Lexmark 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

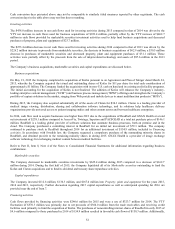

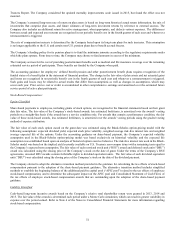

62

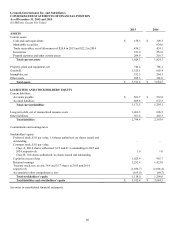

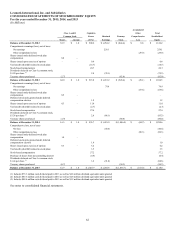

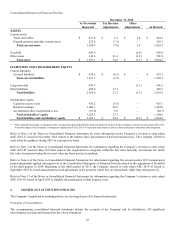

Lexmark International, Inc. and Subsidiaries

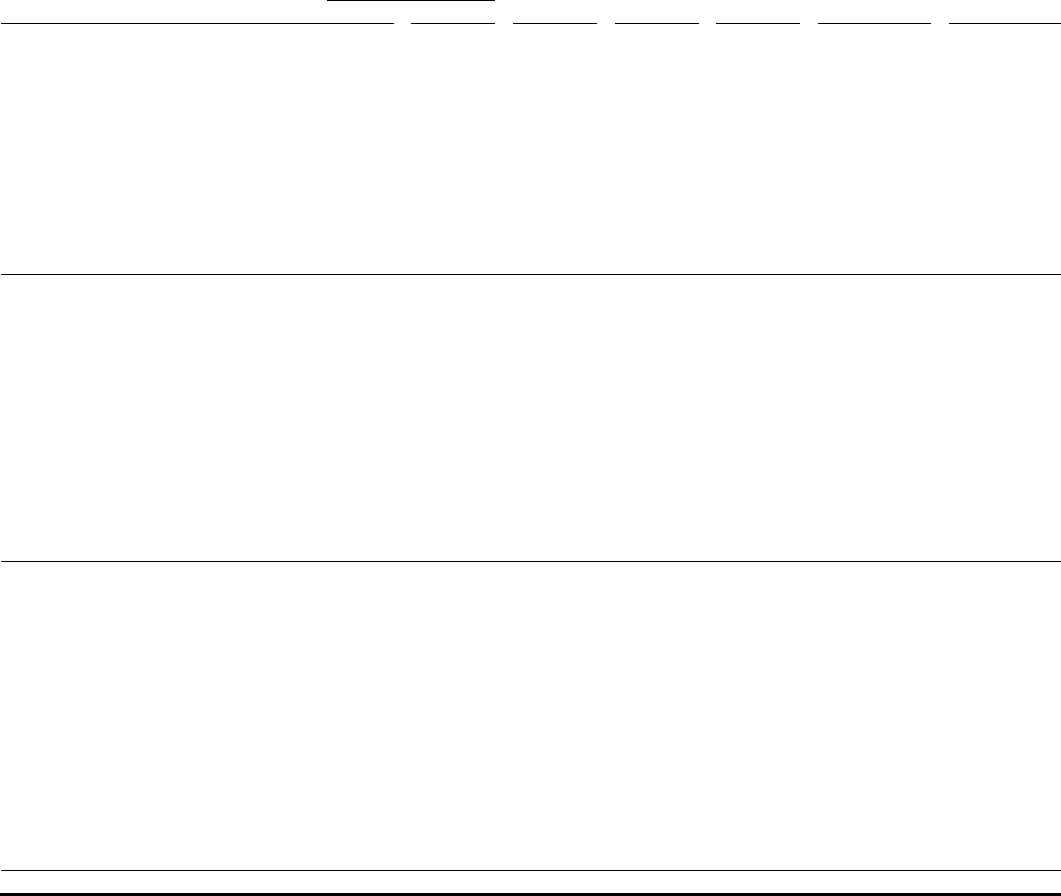

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the years ended December 31, 2015, 2014, and 2013

(In Millions)

Accumulated

Class A and B

Capital in

Other

Total

Common Stock

Excess

Retained

Treasury

Comprehensive

Stockholders'

Shares

Amount

of Par

Earnings

Stock

Loss

Equity

Balance at December 31, 2012

63.9

$

1.0

$

900.6

$

1,252.2

$

(844.4)

$

0.8

$

1,310.2

Comprehensive earnings (loss), net of taxes

Net earnings

259.1

259.1

Other comprehensive loss

(29.9)

(29.9)

Shares issued under deferred stock plan

compensation

0.8

–

–

Shares issued upon exercise of options

–

–

0.4

0.4

Tax benefit (shortfall) related to stock plans

(14.7)

(14.7)

Stock-based compensation

26.7

26.7

Dividends declared on Class A common stock,

$1.20 per share (1)

2.8

(78.1)

(75.3)

Treasury shares purchased

(2.7)

(82.0)

(82.0)

Balance at December 31, 2013

62.0

$

1.0

$

915.8

$

1,433.2

$

(926.4)

$

(29.1)

$

1,394.5

Comprehensive earnings (loss), net of taxes

Net earnings

79.9

79.9

Other comprehensive loss

(55.6)

(55.6)

Shares issued under deferred stock plan

compensation

0.9

–

–

Deferred stock units granted under deferred

compensation election

1.2

1.2

Shares issued upon exercise of options

0.3

–

11.0

11.0

Tax benefit (shortfall) related to stock plans

(2.7)

(2.7)

Stock-based compensation

27.6

27.6

Dividends declared on Class A common stock,

$1.38 per share (2)

2.8

(88.1)

(85.3)

Treasury shares purchased

(1.9)

(80.0)

(80.0)

Balance at December 31, 2014

61.3

$

1.0

$

955.7

$

1,425.0

$

(1,006.4)

$

(84.7)

$

1,290.6

Comprehensive loss, net of taxes

Net loss

(40.4)

(40.4)

Other comprehensive loss

(80.3)

(80.3)

Shares issued under deferred stock plan

compensation

1.0

–

–

Deferred stock units granted under deferred

compensation election

1.0

1.0

Shares issued upon exercise of options

0.3

–

6.2

6.2

Tax benefit (shortfall) related to stock plans

3.5

3.5

Stock-based compensation

57.2

57.2

Purchase of shares from noncontrolling interest

(0.9)

(0.9)

Dividends declared on Class A common stock,

$1.44 per share (3)

3.2

(91.8)

(88.6)

Treasury shares purchased

(0.7)

(30.3)

(30.3)

Balance at December 31, 2015

61.9

$

1.0

$

1,025.9

$

1,292.8

$

(1,036.7)

$

(165.0)

$

1,118.0

(1) Includes $75.3 million cash dividend paid in 2013 as well as $2.8 million dividend equivalent units granted

(2) Includes $85.3 million cash dividend paid in 2014 as well as $2.8 million dividend equivalent units granted

(3) Includes $88.6 million cash dividend paid in 2015 as well as $3.2 million dividend equivalent units granted

See notes to consolidated financial statements.