Lexmark 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

Because the current levels of revenue and net earnings for Claron are not material to the Company’s Consolidated Statements of

Earnings, supplemental pro forma and actual revenue and net earnings disclosures have been omitted.

2014

ReadSoft AB

In the second quarter of 2014, the Company commenced a public cash tender offer for all of the outstanding shares of ReadSoft AB

(“ReadSoft”). ReadSoft is a leading global provider of software solutions that automate business processes, both on premise and in the

cloud. Its software captures, classifies, sorts and routes both hard copy and digital business documents, provides approval workflows,

and automatically extracts and verifies relevant data before depositing it into a customer’s systems of record. With the addition of

ReadSoft, Enterprise Software will grow its software offering with additional document process automation capabilities and expand its

footprint in Europe.

Concurrent with the public tender offer, the Company also obtained shares in ReadSoft through multiple share purchase transactions

with specific shareholders in July 2014 and August 2014. On August 19, 2014, the Company purchased the ReadSoft founders’ share

holdings at a price of 57.00 Swedish kronor (SEK) per share. As a result of the purchases of the founders’ shares and the previous

purchases in the third quarter of 2014, the Company held a total of 1.2 million Class A shares and 9.7 million Class B shares in

ReadSoft as of August 19, 2014, representing 35.4 percent of ReadSoft’s total outstanding shares and 52.2 percent of the votes in

aggregate. Accordingly, August 19, 2014 is the acquisition date of ReadSoft under business combination accounting guidance.

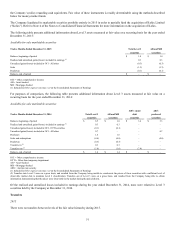

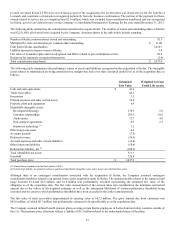

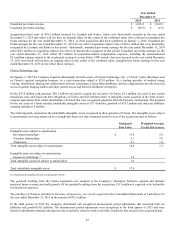

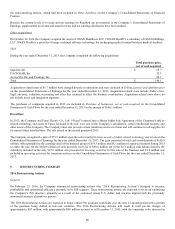

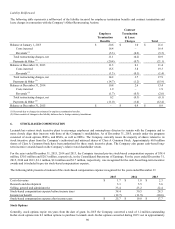

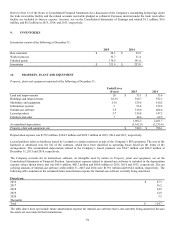

The following table summarizes the values of assets acquired and liabilities assumed as of the acquisition date of August 19, 2014 for

ReadSoft. The intangible assets subject to amortization are being amortized on a straight-line basis over their estimated useful lives as

of the acquisition date:

Estimated Fair

Value

Weighted-

Average Useful

Life (years)

Cash and cash equivalents

$

10.8

Trade receivables

31.1

Inventories

0.1

Prepaid expenses and other current assets

9.7

Property, plant and equipment

3.5

Identifiable intangible assets:

Developed technology

52.5

5.0

In-process technology (1)

1.2

Customer relationships

31.2

10.0

Trade names and trademarks

8.2

4.0

Non-compete agreements

0.1

1.0

Other long-term assets

2.3

Accounts payable

(2.1)

Short-term borrowings

(4.3)

Current portion of long-term debt

(1.3)

Loans payable to employees

(10.6)

Deferred revenue

(17.5)

Accrued expenses and other current liabilities

(18.0)

Deferred tax liability, net (2)

(20.3)

Other long-term liabilities

(2.8)

Total identifiable net assets

73.8

Goodwill

180.4

Total net assets

$

254.2

Consideration transferred on acquisition date

$

58.1

Fair value of equity interest held before acquisition date

32.0

Fair value of noncontrolling interest

164.1

Total consideration transferred and noncontrolling interest

$

254.2

(1) Amortization commenced upon completion of related projects.

(2) Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.