Lexmark 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73

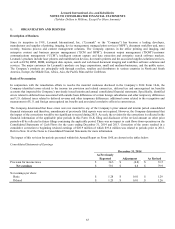

Restructuring:

Lexmark records a liability for a cost associated with an exit or disposal activity at its fair value in the period in which the liability is

incurred, except for liabilities for certain employee termination benefit charges that are accrued over time. Employee termination

benefits associated with an exit or disposal activity are accrued when the obligation is probable and estimable as a postemployment

benefit obligation when local statutory requirements stipulate minimum involuntary termination benefits or when a mutual

understanding of termination benefits has been established through written policies or past practice. Specifically for termination

benefits under a one-time benefit arrangement, the timing of recognition and related measurement of a liability depends on whether

employees are required to render service until they are terminated in order to receive the termination benefits and, if so, whether

employees will be retained to render service beyond a minimum retention period. For employees who are not required to render

service until they are terminated in order to receive the termination benefits or employees who will not provide service beyond the

minimum retention period, the Company records a liability for the termination benefits at the communication date. If employees are

required to render service until they are terminated in order to receive the termination benefits and will be retained to render service

beyond the minimum retention period, the Company measures the liability for termination benefits at the communication date and

recognizes the expense and liability ratably over the future service period. For contract termination costs, which primarily includes

leases, Lexmark records a liability for costs to terminate a contract before the end of its term when the Company terminates the

agreement in accordance with the contract terms or when the Company ceases using the rights conveyed by the contract. The

Company records a liability for other costs associated with an exit or disposal activity in the period in which the liability is incurred.

Income Taxes:

The provision for income taxes is determined based on pre-tax income included in the Consolidated Statement of Earnings and current

tax laws in the jurisdictions in which the Company operates. Deferred tax assets and liabilities are determined under the liability

method based on the differences between the financial statement carrying amounts and tax bases of assets and liabilities measured by

enacted tax rates in effect for the years in which the differences are expected to reverse. A valuation allowance is established to offset

any deferred tax assets if, based upon the available evidence, it is more likely than not that some or all of the deferred tax assets will

not be realized. The Company considers historical profitability, future market growth, future taxable income, the expected timing of

the reversals of existing temporary differences and tax planning strategies in determining the need for a deferred tax valuation

allowance.

The evaluation of tax positions in accordance with the accounting guidance for uncertainty in income taxes is a two-step process. The

first step is recognition, whereby the Company determines whether it is more likely than not, based solely on the technical merits of

the position, that such position will be sustained upon examination, including resolution of any litigation. A tax position that meets the

more likely than not recognition threshold is measured in the second step to determine the amount of benefit to recognize in the

financial statements. The tax position is measured at the largest amount of benefit that is greater than 50 percent likely of being

realized upon ultimate resolution. The Company recognizes interest and penalties on unrecognized tax benefits as part of its income

tax provision.

Derivatives:

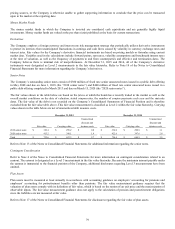

All derivatives, including foreign currency exchange contracts, are recognized in the Statements of Financial Position at fair value. For

those agreements subject to master netting agreements or similar arrangements, the Company nets the fair values of its derivative

assets and liabilities for presentation purposes as permitted under the accounting guidance for offsetting. Derivatives that are not

hedges must be recorded at fair value through earnings. If a derivative is a hedge, depending on the nature of the hedge, changes in the

fair value of the derivative are either offset against the change in fair value of underlying assets or liabilities through earnings or

recognized in Accumulated other comprehensive loss until the underlying hedged item is recognized in earnings. Any ineffective

portion of a derivative’s change in fair value is immediately recognized in earnings. Derivatives qualifying as hedges are included in

the same section of the Consolidated Statements of Cash Flows as the underlying assets and liabilities being hedged. Changes in the

fair value of the derivatives for fair value hedges are offset against the changes in fair value of the underlying assets or liabilities

through earnings. Changes in the fair value of cash flow hedges are recorded in Accumulated other comprehensive loss, until earnings

are affected by the variability of cash flows of the hedged transaction.

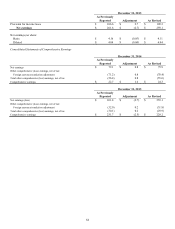

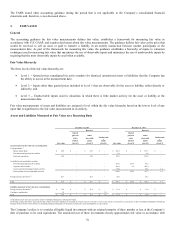

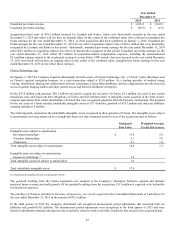

Net (Loss) Earnings Per Share:

Basic net (loss) earnings per share is calculated by dividing net (loss) income by the weighted average number of shares outstanding

during the reported period. The calculation of diluted net (loss) earnings per share is similar to basic, except that the weighted average

number of shares outstanding includes the additional dilution from potential common stock such as stock options, restricted stock

units, and dividend equivalents.