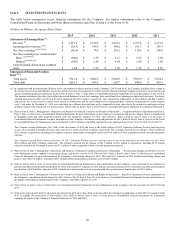

Lexmark 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

customers to bridge the paper and digital worlds and the unstructured and structured content/process worlds. Lexmark provides

comprehensive capabilities to allow customers to manage their print and MFP environment, including MPS. The Company also

continues to build its capabilities to help customers capture, manage and access unstructured content, in any form, through both

organic investment and acquisitions.

The Company continues a strategic focus on growing its MPS offerings and the placement of high-end hardware. The Company also

continues the strategic focus on expansion in solutions and software capabilities, to both strengthen its MPS offerings and grow its

non-printing related software solutions business focused in the ECM, BPM and DOM/CCM markets. These strategic focus areas are

intended to increase our penetration in the business segment. The business segment tends to have higher page generating and more

software intensive application requirements, which drive increasing levels of supplies and software maintenance and support revenue.

In order to support these strategic focus areas, and to allow Lexmark to participate in the growing market to manage unstructured data

and processes, and to further strengthen the Company’s products, content/business process management solutions and MPS, the

Company acquired Perceptive Software in 2010, Pallas Athena in 2011, Brainware, Nolij, ISYS and Acuo in 2012; Twistage, Access

Via, Saperion and PACSGEAR in 2013; ReadSoft and GNAX Health in 2014; and Claron and Kofax in 2015. These acquisitions are

included in the Enterprise Software segment.

While focusing on core strategic initiatives, Lexmark has taken actions over the last few years to improve its cost and expense

structure. As a result of restructuring initiatives, significant changes have been implemented, from the consolidation and reduction of

the manufacturing and support infrastructure and the increased use of shared service centers in low-cost countries, to the exit of inkjet

technology. In the second quarter of 2013, the Company and Funai entered into a Master Inkjet Sale Agreement of the Company’s

inkjet-related technology and assets to Funai for total cash consideration of $100 million. Included in the sale were one of the

Company’s subsidiaries, certain intellectual property and other assets of the Company. The Company will continue to provide service,

support and aftermarket supplies for its current inkjet installed base. The sale closed in the second quarter of 2013. With this

announcement, Lexmark has focused its printing and MFP development activities solely in laser-based technologies.

The Company remains committed on its stated capital allocation framework of returning, on average, more than 50 percent of free

cash flow to its shareholders through dividends and share repurchases while pursuing acquisitions and organic investments that

support the strengthening and growth of the Company. During 2015, the Company paused its share repurchases in order to pay down

debt associated with the Kofax acquisition.

Lexmark’s 2015 revenue was down 4% YTY, primarily due to an unfavorable YTY currency impact of 6% and an unfavorable impact

of approximately 3% due to the Company’s exit of inkjet technology. The change in YTY revenues reflected a positive impact of 6%

for growth in Enterprise Software revenue, primarily due to the acquisitions of Kofax in the second quarter of 2015 and ReadSoft in

the third quarter of 2014. Additionally, the Company benefited from continued growth in MPS supplies revenue. Operating income

decreased 116% YTY primarily driven by the revenue impacts discussed above and higher operating expenses primarily due to the

acquisition of Kofax and recently announced 2016 and 2015 restructuring plans.

As in 2015, the Company is focused in 2016 on revenue and profit growth from the strategic imaging and software segments of the

business, particularly MPS offerings and Enterprise Software. This growth is expected to be dampened by the continued unfavorable

effects from continued YTY currency impact and continued YTY decreases in inkjet supplies revenue as a result of the Inkjet Exit,

although this headwind is expected to decline over time.

In October 2015, the Company announced that its Board of Directors has authorized the exploration of strategic alternatives to

enhance shareholder value. No decision has been made with regard to any alternatives, and there is no assurance that the Board’s

exploration of strategic alternatives will result in any transaction being entered into or consummated.

Refer to the section entitled “RESULTS OF OPERATIONS” that follows for a further discussion of the Company’s results of

operations.

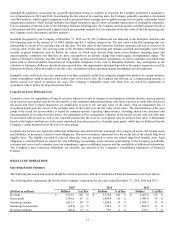

Trends and Opportunities

Lexmark serves both the distributed printing and imaging and content and process management markets with a focus on business

customers. Lexmark’s enterprise content and process management software platform supports traditional business content as well as

rich media and industry-specific content like medical image content and includes enterprise search, intelligent content capture and data

extraction, DOM/CCM, business process and case management. Lexmark’s healthcare offering includes an industry leading, standards

based and highly secure, content repository and VNA that integrates all patient unstructured information across the enterprise to

enable easy access including access via an EMR system. This healthcare content and process management offering also includes

workflow automation and medical information and imaging study sharing within and between facilities and organizations.

Lexmark management believes the total relevant market opportunity of these markets combined in 2015 was approximately $80

billion. Lexmark management believes that the total relevant distributed laser printing and imaging market opportunity was