Lexmark 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

matrix printers and options. The term “small workgroup” includes small workgroup lasers and personal lasers, which are attached to

small workgroup networks and/or personal computers. The Company uses the term “inkjet exit” to include consumer and business

inkjet hardware and supplies.

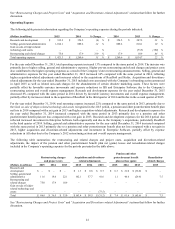

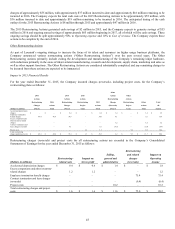

Supplies revenue for the year ended December 31, 2015 was down 13% compared to the same period in 2014, reflecting unfavorable

currency and inkjet exit impacts of 5% and 5%, respectively. Laser supplies revenue decreased 9% YTY primarily due to unfavorable

currency impact of 6% and unfavorable revenue per page impact of 9%. These factors were partially offset by continued YTY growth

in MPS laser supplies revenue. Inkjet exit supplies revenue of $142.3 million declined 45% YTY due to ongoing and expected

declines in the inkjet installed base as the Company has exited inkjet technology.

For the year ended December 31, 2014, ISS revenue declined 1% compared to prior year, which reflected an unfavorable inkjet exit

impact of approximately 4% and an unfavorable currency impact of 1% compared to the prior year. Laser hardware revenue increased

2% YTY. Large workgroup laser hardware revenue, which represented about 84% of total hardware revenue for the year ended

December 31, 2014 increased 3% YTY with 7% increase in units partially offset by a 4% decline in average unit revenue (“AUR”).

Unit growth, particularly for color units, reflected growth in the segment’s MPS business. The AUR decline reflected competitive

pricing pressures early in the year as well as unfavorable currency impacts, particularly in the fourth quarter. Small workgroup laser

hardware revenue, which for the year ended December 31, 2014 represented 16% of total hardware revenue, declined 1% YTY driven

by an 8% decline in AUR mostly offset by a 7% increase in units. The decline in AUR was driven by competitive pricing pressures

and a higher relative proportion of revenue for mono devices, as well as unfavorable currency impacts, particularly in the fourth

quarter. There was no inkjet exit hardware revenue for the year ended December 31, 2014.

Supplies revenue for the year ended December 31, 2014 was down 2% compared to the same period in 2013. Laser supplies revenue

increased 5% YTY primarily due to strong end-user demand, attributed to growth in the segment’s MPS business and the large

workgroup installed base. Inkjet exit supplies revenue declined 36% YTY due to ongoing and expected declines in the inkjet install

base as the Company has exited inkjet technology.

During 2015, 2014 and 2013, no one customer accounted for more than 10% of the Company’s total revenues.

Enterprise Software

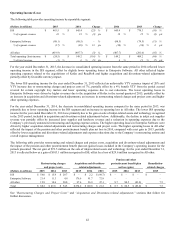

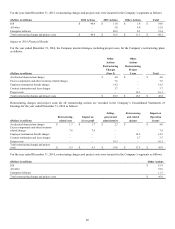

For the year ended December 31, 2015, revenue for Enterprise Software increased 81% compared to the same period in 2014. The

YTY increases in maintenance and support, license, professional services and subscription revenue of approximately 54% were

primarily due to the impact of the Kofax acquisition, in the second quarter of 2015, as well as the full year benefit of the ReadSoft

acquisition, in the third quarter of 2014. This was partially offset by an unfavorable currency impact of 8% and unfavorable impact on

perpetual license revenue from the selection of a subscription model by certain customers during the year, consistent with an overall

shift in market trends.

For the year ended December 31, 2014, revenue for Enterprise Software increased 32% compared to the same period in 2013. The

YTY increases are due to the acquisition of ReadSoft in 2014 as well as the acquisitions of Saperion and PACSGEAR in the third and

fourth quarters of 2013, respectively, partially offset by organic decline of 3%. This decline was driven by lower YTY perpetual

license revenue, particularly in the U.S., attributed to timing for closing of customer contracts as well as selection of a subscription

model by certain customers during the year, consistent with an overall shift in market trends. The 2015 and 2014 financial results for

the Enterprise Software reportable segment include only the activity occurring after the dates of acquisition.

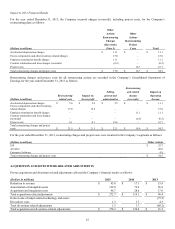

Reductions in revenue result from business combination accounting rules when deferred revenue balances assumed as part of

acquisitions are adjusted down to fair value. Fair value approximates the cost of fulfilling the service obligation, plus a reasonable

profit margin. Subsequent to acquisitions, the Company analyzes the amount of amortized revenue that would have been recognized

had the acquired company remained independent and had the deferred revenue balances not been adjusted to fair value.

See “Acquisition and Divestiture-related Adjustments” section that follows for further discussion.