Lexmark 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

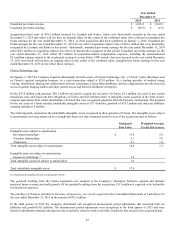

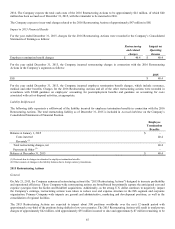

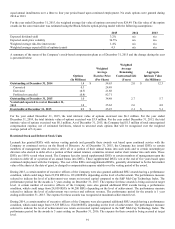

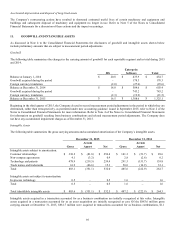

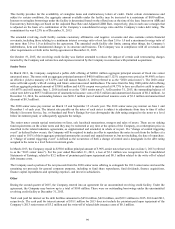

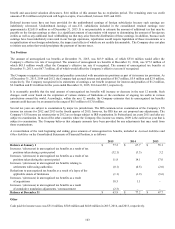

The contractual maturities of the Company’s available-for-sale marketable securities noted above are shown below. Expected

maturities may differ from final contractual maturities for certain securities that allow for call or prepayment provisions. Proceeds

from calls and prepayments are included in Proceeds from maturities of marketable securities on the Consolidated Statements of Cash

Flows.

2014

Amortized

Estimated Fair

Cost

Value

Due in less than one year

$

109.0

$

109.0

Due in one to five years

510.9

510.7

Due after five years

11.5

11.8

Total available-for-sale marketable securities

$

631.4

$

631.5

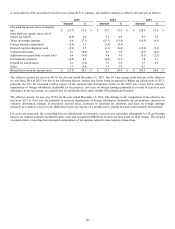

For the years ended December 31, 2015, 2014, and 2013, the Company recognized $1.7 million, $2.9 million, and $1.3 million,

respectively, in net gains on its marketable securities, included in Other expense (income), net on the Consolidated Statements of

Earnings. The amount in 2014 includes a gain of $1.3 million on the Company’s previously held investment in shares of ReadSoft,

which were purchased in 2014 and marked to fair value on the acquisition date. Refer to Note 4 of the Notes to Consolidated Financial

Statements for information. Other amounts recognized in all periods represent realized gains due to sales and maturities. The

Company uses the specific identification method when accounting for the costs of its available-for-sale marketable securities sold.

Impairment

The FASB guidance on the recognition and presentation of OTTI requires that credit-related OTTI on debt securities be recognized in

earnings while noncredit-related OTTI of debt securities not expected to be sold be recognized in other comprehensive income. For

the years ended December 31, 2015, 2014, and 2013, the Company incurred no OTTI on its debt securities. Amounts related to credit

losses for which a portion of total OTTI was recognized in other comprehensive income were immaterial for disclosure in 2015 and

2014.

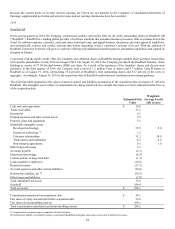

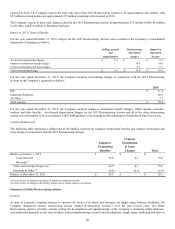

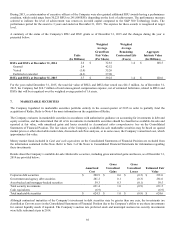

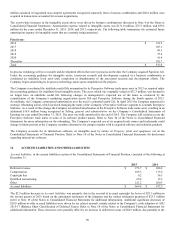

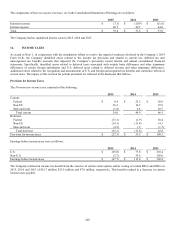

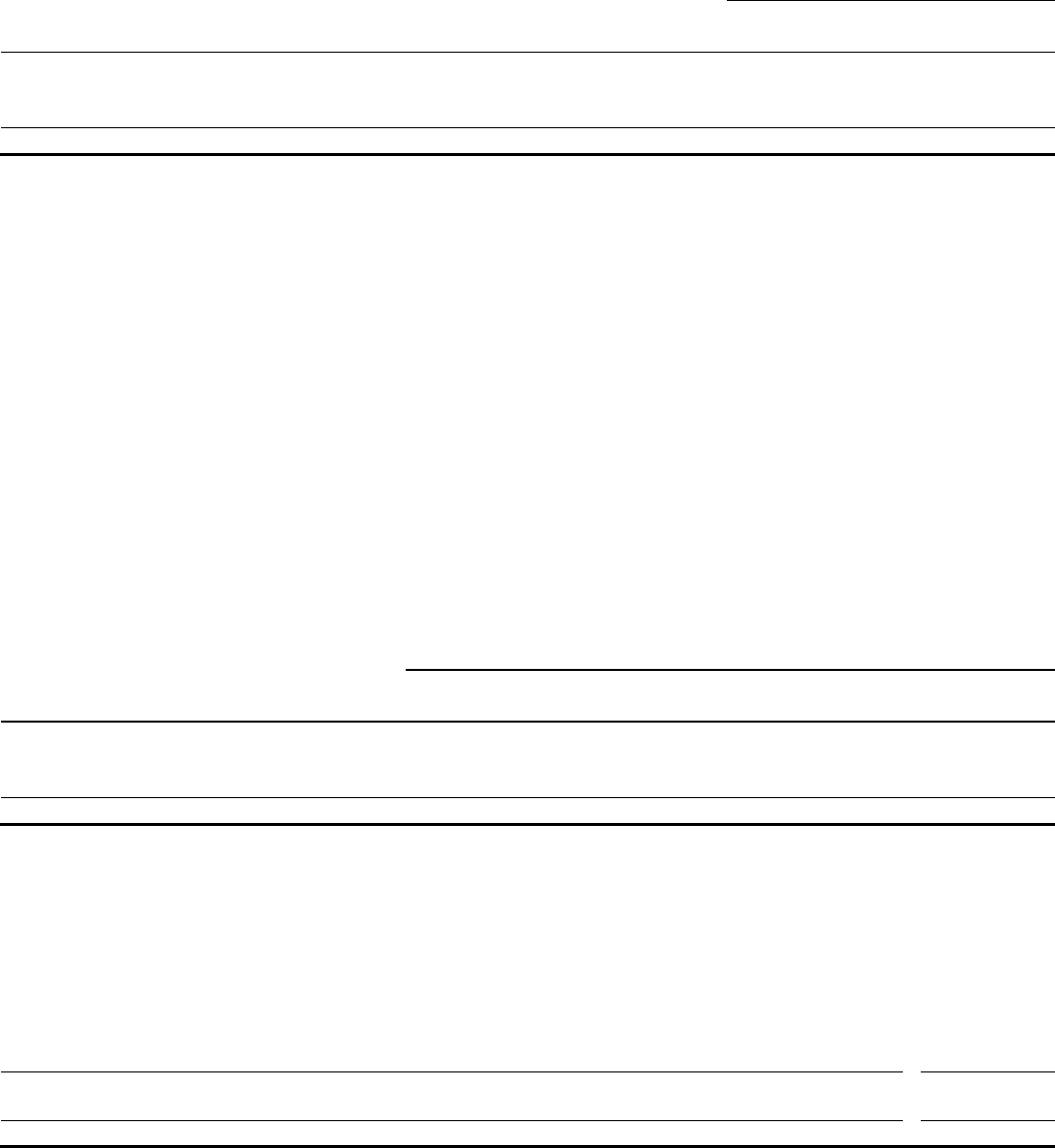

The following tables provide information about the Company’s marketable securities with gross unrealized losses for which no other-

than-temporary impairment has been incurred and the length of time that individual securities have been in a continuous unrealized

loss position. The pre-tax gross unrealized losses below are recognized in Accumulated other comprehensive loss:

December 31, 2014

Less than 12 Months

12 Months or More

Total

Fair

Unrealized

Fair

Unrealized

Fair

Unrealized

Value

Loss

Value

Loss

Value

Loss

Corporate debt securities

$

154.9

$

(0.5)

$

–

$

–

$

154.9

$

(0.5)

Asset-backed and mortgage-backed securities

44.2

(0.1)

0.7

–

44.9

(0.1)

Government and agency debt securities

184.6

(0.3)

–

–

184.6

(0.3)

Total

$

383.7

$

(0.9)

$

0.7

$

–

$

384.4

$

(0.9)

As of December 31, 2014, none of the Company’s marketable securities for which OTTI has been incurred were in an unrealized loss

position.

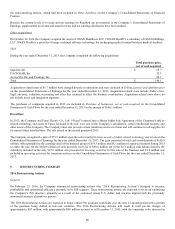

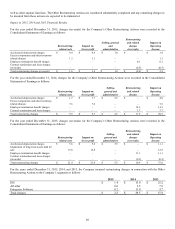

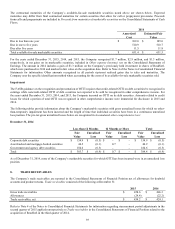

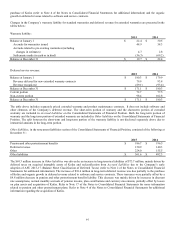

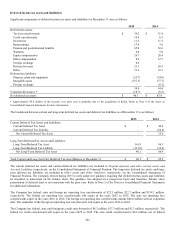

8. TRADE RECEIVABLES

The Company’s trade receivables are reported in the Consolidated Statements of Financial Position net of allowances for doubtful

accounts and product returns. Trade receivables consisted of the following at December 31:

2015

2014

Gross trade receivables

$

458.6

$

446.3

Allowances

(24.4)

(22.2)

Trade receivables, net

$

434.2

$

424.1

Refer to Note 4 of the Notes to Consolidated Financial Statements for information regarding measurement period adjustments in the

second quarter of 2015 applied retrospectively to Trade receivables in the Consolidated Statements of Financial Position related to the

acquisition of ReadSoft in the third quarter of 2014.