Lexmark 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

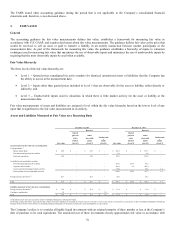

Revenue Recognition:

General

Lexmark recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or

determinable and collectability is reasonably assured. Revenue as reported in the Company’s Consolidated Statements of Earnings is

reported net of any taxes (e.g., sales, use, value added) assessed by a governmental entity that are directly imposed on a revenue-

producing transaction between a seller and a customer. Product revenue includes all hardware, parts, supplies and software license

revenue. Service revenue includes professional services performed under MPS arrangements and extended warranties, as well as

software as a service, subscriptions, maintenance and support, and other software-related services.

The Company typically records revenue on a gross basis in those instances when revenue is derived from the sale of products or

services provided by third-party vendors, such as the Company’s use of subcontractors or the sale of third-party software licenses.

The Company records revenue on a gross basis when it is the principal to the transaction and net of costs when it is acting as an agent

between the customer and the vendor. The Company considers several factors in determining whether it is acting as principal or agent

such as whether the Company is the primary obligor to the customer, has control over the pricing, and has inventory and credit risks.

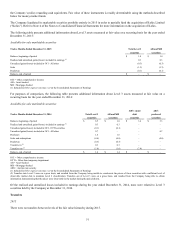

Printing Products and Services

Revenue from product sales, including sales to distributors and resellers, is recognized when title and risk of loss transfer to the

customer, generally when the product is shipped to the customer provided all other revenue recognition criteria are met. Lexmark

customers include distributors, resellers and end-users of Lexmark products. When other significant obligations or uncertainties

remain after products are delivered, such as contractual requirements pertaining to customer acceptance, revenue is recognized only

after such obligations are fulfilled or uncertainties resolved. At the time revenue is recognized, the Company provides for the

estimated cost of post-sales support, principally product warranty, and reduces revenue for estimated product returns and customer

programs and incentive offerings.

Lexmark records reductions to revenue for customer programs and incentive offerings including special pricing agreements,

promotions and other volume-based incentives at the later of the date of revenue recognition or the date the sales incentive is offered.

Estimated reductions in revenue are based upon historical trends and other known factors at the time of sale. Lexmark also records

estimated reductions to revenue for price protection, which it provides to substantially all of its distributors and reseller customers.

The Company records estimated reductions to revenue (and cost of revenue) at the time of sale related to its customer’s right to return

product based upon historical trends of actual product returns as well as the Company’s assessment of its products in the channel.

Provisions for specific returns from large customers are also recorded as necessary.

Printing products may also be leased to the customer under certain arrangements. Revenue from sales-type leases is recognized on the

commencement date of the lease. Revenue from operating leases is recognized as earned over the lease term, which is generally on a

straight-line basis.

Revenue from support or maintenance contracts, including extended warranty programs, is recognized ratably over the contractual

period, which is generally one to three years, and the costs associated with the contracts are recognized as incurred. Amounts invoiced

to customers in excess of revenue recognized on support or maintenance contracts are recorded as deferred revenue until the

appropriate revenue recognition criteria are met. For time and material contracts, revenue is recognized as the services are performed

and costs are recognized as incurred.

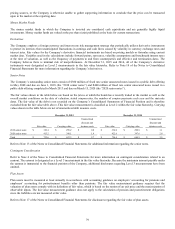

Software Licenses and Services

Lexmark enters into software agreements with customers through the sale of licenses, software as a service and subscription services.

The predominant model is a multiple element arrangement that includes a perpetual software license, professional services, and

maintenance and support. Provided that all other recognition criteria have been met, license revenue is recognized when the customer

either takes possession of the software via a download, or has been provided with access codes that allow immediate possession of the

software as the Company generally has vendor specific objective evidence (“VSOE”) of fair value of the undelivered elements. When

products are sold through channel partners, risk of loss generally passes upon delivery and revenue is recognized at this time (sell-in

model) provided all other recognition criteria have been met.

Software related services are not considered essential to the functionality of the software and are described in the contract such that the

total price of the arrangement is expected to vary as a result of the inclusion or exclusion of these services and, thus, do not affect the

timing of the software license recognition. Revenue from professional services related to software is recognized as the services are

performed for time and material contracts or on a proportional performance basis for fixed fee contracts. Proportional performance

fixed fee contracts are not significant relative to the Company’s total revenue. Proportional performance is generally determined by

comparing the labor hours incurred to date to the estimated total labor hours required to complete the project. The Company considers