Lexmark 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

the Company’s policy regarding cash equivalents. Fair value of these instruments is readily determinable using the methods described

below for money market funds.

The Company liquidated its marketable securities portfolio entirely in 2015 in order to partially fund the acquisition of Kofax Limited

(“Kofax”). Refer to Note 4 of the Notes to Consolidated Financial Statements for more information on the acquisition of Kofax.

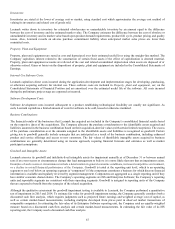

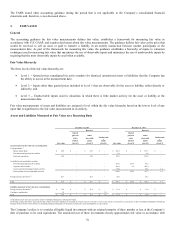

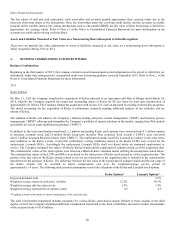

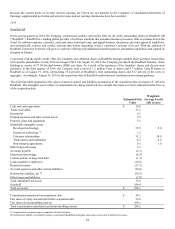

The following table presents additional information about Level 3 assets measured at fair value on a recurring basis for the year ended

December 31, 2015:

Available-for-sale marketable securities

Twelve Months Ended December 31, 2015

Total Level 3

AB and MB

securities

securities

Balance, beginning of period

$

1.4

$

1.4

Realized and unrealized gains/(losses) included in earnings (1)

0.3

0.3

Unrealized gains/(losses) included in OCI - All other

(0.3)

(0.3)

Sales

(1.3)

(1.3)

Paydowns

(0.1)

(0.1)

Balance, end of period

$

–

$

–

OCI = Other comprehensive income

AB = Asset-backed

MB = Mortgage-backed

(1) Included in Other expense (income), net on the Consolidated Statements of Earnings

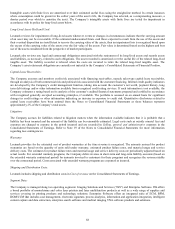

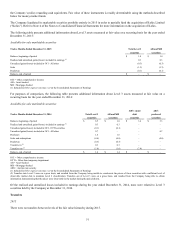

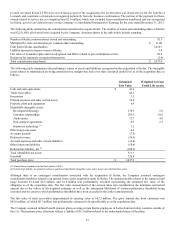

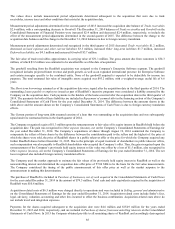

For purposes of comparison, the following table presents additional information about Level 3 assets measured at fair value on a

recurring basis for the year ended December 31, 2014:

Available-for-sale marketable securities

ARS - muni

ARS -

Twelve Months Ended December 31, 2014

Total Level 3

AB and MB

debt

preferred

securities

securities

securities

securities

Balance, beginning of period

$

8.5

$

1.8

$

3.4

$

3.3

Realized and unrealized gains/(losses) included in earnings (1)

0.3

0.3

–

–

Unrealized gains/(losses) included in OCI - OTTI securities

(0.1)

(0.1)

–

–

Unrealized gains/(losses) included in OCI - All other

0.7

–

–

0.7

Purchases

1.6

1.6

–

–

Sales and redemptions

(4.6)

(0.6)

–

(4.0)

Paydowns

(0.3)

(0.3)

–

–

Transfers in (2)

0.3

0.3

–

–

Transfers out (2)

(5.0)

(1.6)

(3.4)

–

Balance, end of period

$

1.4

$

1.4

$

–

$

–

OCI = Other comprehensive income

OTTI = Other than temporary impairment

AB = Asset-backed

MB = Mortgage-backed

ARS = Auction rate security

(1) Included in Other expense (income), net on the Consolidated Statements of Earnings

(2) Transfers into Level 3 were on a gross basis, and resulted from the Company being unable to corroborate the prices of these securities with a sufficient level of

observable market data to maintain Level 2 classification. Transfers out of Level 3 were on a gross basis, and resulted from the Company being able to obtain

information demonstrating that the prices were observable in the market during the period shown.

Of the realized and unrealized losses included in earnings during the year ended December 31, 2014, none were related to Level 3

securities held by the Company at December 31, 2014.

Transfers

2015

There were no transfers between levels of the fair value hierarchy during 2015.