Lexmark 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

Table of contents

-

Page 1

-

Page 2

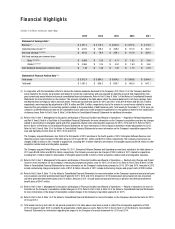

... Statements for more information on the Company's reportable segment Revenue and Operating income (loss) for 2015, 2014 and 2013. The Company acquired Brainware, Isys, Nolij in the ï¬rst quarter of 2012 and Acuo in the fourth quarter of 2012. Enterprise Software Revenue and Operating income...

-

Page 3

... and customer engagement to deliver solutions of superior value. Our offering is unique in the industry, and, in 2015, we further expanded it with the acquisition of Kofax, a leading provider of smart process software applications. The Kofax acquisition nearly doubled the size of Lexmark Enterprise...

-

Page 4

... technology solutions, and making a difference in the communities where we live and work. These values drive all of us at Lexmark, and they are the essence of what makes our company a great partner for our customers. To our shareholders, our customers, our business partners and our employees...

-

Page 5

... a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X] The aggregate market value of the shares of voting common stock held by non-affiliates of the registrant was approximately $2.7 billion based on the closing price for the Class A Common Stock on the last business day of...

-

Page 6

... AND FINANCIAL DISCLOSURE CONTROLS AND PROCEDURES OTHER INFORMATION PART III Item 10. Item 11. Item 12. Item 13. Item 14. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE EXECUTIVE COMPENSATION SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS...

-

Page 7

... above should be considered by investors when reviewing any forward-looking statements contained in this report, in any of the Company's public filings or press releases or in any oral statements made by the Company or any of its officers or other persons acting on its behalf. The important factors...

-

Page 8

... output management ("DOM")/customer communications management ("CCM"), intelligent content capture and data extraction and enterprise search software markets. Lexmark's products include laser printers and multifunction dev ices, dot matrix printers and the associated supplies/solutions/services...

-

Page 9

...to provide service, support and aftermarket supplies for its inkjet installed base. In April 2015, the Company announced a strategic rebranding action to unify and strengthen the market presence of the Company's information technology portfolio of enterprise software, print hardware and MPS. As part...

-

Page 10

... Lexmark's strategy is based on a business model of investing in technology to develop and sell printing and imaging, and content and process management solutions, including printers, multifunction devices and software solutions with the objective of growing an installed base of hardware devices...

-

Page 11

... partners that sell into the Company's target ind ustries.

ï,·

ï,·

Lexmark is focused on driving long-term performance by strategically investing in technology, hardware and software products and solutions to secure high value product installations and capture profitable supplies, and software...

-

Page 12

...

Lexmark has ceased development and manufacturing of inkjet technology. Lexmark will continue to provide service, support, and aftermarket supplies for its inkjet installed base. o Dot Matrix Products

ISS continues to market several dot matrix printer models for customers who print multipart forms...

-

Page 13

...ISS designs, manufactures and distributes a variety of cartridges, service parts and other supplies for use in its installed base of laser, inkjet and dot matrix printers. Revenue and profit growth from the ISS supplies business is directly linked to the ability to increase the installed base of ISS...

-

Page 14

...quality and reliability. As t he installed base of laser and inkjet products matures, the Company expects competitive supplies activity to increase. • Manufacturing and Materials - ISS

ISS operates manufacturing control centers in Lexington, Kentucky; Shenzhen, China; and Geneva, Switzerland; and...

-

Page 15

...providing easy Web-based access via desktop and mobile devices. In May of 2015, Enterprise Software strengthened its position in the enterprise content and process management space with the acquisition of Kofax, a leading provider of smart process applications. The addition of Kofax enhances Lexmark...

-

Page 16

...England; and Singapore, as well as employees co-located within ISS offices around the world. Enterprise Software also offers a channel partner program that allows authorized third-party resellers to market and sell Enterprise Software products and solutions to a distributed market, as well as an OEM...

-

Page 17

... technologically advanced products required to remain competitive. Employees As of December 31, 2015, of the approximately 14,000 Lexmark employees worldwide, 4,300 are located in the U.S. and the remaining 9,700 are located in Europe, Canada, Latin America, Asia Pacific, the Middle East and Africa...

-

Page 18

... Manager, PSSD Worldwide Marketing and Lexmark Services. Mr. Bish has been Vice President of the Company and President of Lexmark Enterprise Software since May 2015, when the Company acquired Kofax Limited. Prior to the acquisition, Mr. Bish served as a Director and Chief Executive Officer of Kofax...

-

Page 19

... is committed to maintaining compliance with all environmental laws applicable to its operations, products and services. Lexmark is also required to have permits from a number of governmental agencies in order to conduct various aspects of its business. Compliance with these laws and regulations has...

-

Page 20

.../or use of mobile devices such as tablets and smart phones by businesses could result in a reduction in printing, which could adversely impact consumption of supplies.

ï,·

If the Company cannot successfully execute on its strategy to become an end-to-end solutions provider, the Company's revenue...

-

Page 21

... number of ECM, BPM and DOM/CCM providers that have significantly greater financial, marketing and/or technological resources than the Company. Enterprise Software could lose market share if its competitors introduce new products and services, add functionality to existing products, or reduce prices...

-

Page 22

... the Company's cloud -based offerings and services and store and process increasingly large amounts of the Company's customers' confidential information and data and host or manage parts of the Company's customers' businesses in cloud -based IT environments, especially in customer sectors involving...

-

Page 23

...develop, manufacture and market products that are reliable, competitive, and meet customers' needs. The markets for laser products and associated supplies and content/process management software are aggressively competitive, especially with respect to pricing and the introduction of new technologies...

-

Page 24

... purchases of existing products in anticipation of new product introductions by the Company or its competitors and market acceptance of new products and pricing programs, any disruption in the supply of new or existing products as well as the costs of any product recall or increased warranty, repair...

-

Page 25

... Company's revenue and gross margins. ï,· Refill, remanufactured, clones, counterfeits and other compatible alternatives for some of the Company's cartridges are available and compete with the Company's supplies business. The Company expects competitive supplies activity to increase. Various legal...

-

Page 26

... 2.

PROPERTIES

Lexmark's corporate headquarters is located in Lexington, Kentucky. At December 31, 2015, the Company owned or leased approximately 5.5 million square feet of administrative, sales, service, research and development, warehouse and manufacturing facilities worldwide. Approximately...

-

Page 27

...November 1-30, 2015 December 1-31, 2015 Total

Total Number of Shares Purchased - - 9,939 9,939

$

$

Average Price Paid per Share - - 33.50 33.50

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs - - - -

(1) Information regarding the Company's share repurchases can...

-

Page 28

.../31/12

12/31/13

12/31/14

12/31/15

Lexmark

S&P MidCap 400 Index

S&P 400 Information Technology Index

Comparison of cumulative total returns Lexmark International, Inc. S&P MidCap 400 Index S&P 400 Information Technology Index Source: Standard & Poor's Capital IQ

$

12/31/10 100 100 100

$

12...

-

Page 29

... 46,000 shares remained outstanding (all of which are in the form of stock options) pursuant to awards made under the Lexmark International, Inc. Broad-Based Employee Stock Incentive Plan (the "Broad-Based Plan"), an equity compensation plan which had not been approved by the Company's stockholders...

-

Page 30

...Financial Statements for more information on the Company's reportable segment Revenue and Operating income (loss) for 2015, 2014 and 2013. The Company acquired Brainware, Isys, Nolij in the first quarter of 2012 and Acuo in the fourth quarter of 2012. Enterprise Software Revenue and Operating income...

-

Page 31

... The Company operates in the office printing and imaging, ECM, BPM, DOM/CCM, intelligent content capture and data extraction and enterprise search software markets. Lexmark's products include laser printers and multifunction devices, dot matrix printers and the associated supplies/solutions/services...

-

Page 32

.../business process management solutions and MPS, the Company acquired Perceptive Software in 2010, Pallas Athena in 2011, Brainware, Nolij, ISYS and Acuo in 2012; Twistage, Access Via, Saperion and PACSGEAR in 2013; ReadSoft and GNAX Health in 2014; and Claron and Kofax in 2015. These acquisitions...

-

Page 33

... 2015, including printing hardware, supplies and related services. This opportunity includes printers and multifunction devices as well as a declining base of copiers and fax machines that are increasingly being integrated into multifunction devices. Based on industry information, Lexmark management...

-

Page 34

...maximize cash flow and profit. The content and process management software and services markets serve business customers. These markets include solutions for capturing all types of unstructured information such as hardcopy documents and forms, photographs, emails, images, video, audio and faxes, and...

-

Page 35

..., multifunction devices and software solutions with the objective of growing an installed base of hardware devices and software installations, which drives recurring printing supplies sales and software subscription, maintenance and services revenue. The Company's management believes that Lexmark...

-

Page 36

... (installation, maintenance, and enhanced warranty services). These arrangements may involve upfront purchase or lease of hardware products with services and supplies provided per contract terms or as needed. Lexmark also enters into multiple element agreements with customers that contain software...

-

Page 37

... company-specific intentions. Warranty Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The amounts accrued for product warranties are based on the quantity of units sold under warranty, estimated product failure rates, and material usage and service...

-

Page 38

... pension plan employs professional investment managers to invest in U.S. equity, global equity, international developed equity, emerging market equity, U.S. fixed income, high yield bonds and emerging market debt. Each investment manager operates under an investment management contract that includes...

-

Page 39

.... In the ordinary course of business there is inherent uncertainty in quantifying our income tax positions. The Company assesses its income tax positions based upon management's evaluation of the facts, circumstances, and informa tion available at the reporting date. For those tax positions where...

-

Page 40

..., brand recognition, the allocation of projected cash flows to identifiable intangible assets and discount rates. The Company also considers market participant assumptions in its valuations of deferred revenue acquired in a business combination, including estimated costs to fulfill the obligation as...

-

Page 41

... multiples developed from prices paid in observed market transactions of comparable companies. For its estimation of the fair value of the Enterprise Software reporting unit, the Company used an equally-weighted measure based on a discounted cash flow analysis and a market based measurement analysis...

-

Page 42

...the execution of its restructuring plans. The Company uses the term "remediation-related charges" for professional fees associated with analysis and remediation of the Company's previously disclosed material weakness in internal controls over income tax accounting. During 2014, total Lexmark revenue...

-

Page 43

... base. Inkjet exit supplies revenue declined 36% YTY due to ongoing and expected declines in the inkjet install base as the Company has exited inkjet technology. During 2015, 2014 and 2013, no one customer accounted for more than 10% of the Company's total revenues. Enterprise Software For the year...

-

Page 44

...partially offset by growth in Enterprise Software revenue. The YTY decline in revenues in other international regions was primarily due to lower laser hardware and supplies revenues in Asia Pacific and lower supplies revenues in Latin America. For 2015, currency exchange rates had an unfavorable YTY...

-

Page 45

... of certain obsolete marketing assets. These factors were partially offset by favorable currency movements and expense reductions in ISS and Enterprise Software due to the Company's restructuring actions and overall expense management. Research and development expenses for the year ended December 31...

-

Page 46

... the decline in inkjet exit supplies revenue was partially offset by increased laser supplies and hardware revenue and a reduction in operating expenses due to the Company's previously announced restructuring and ongoing expense actions. The higher operating losses in Enterprise Software were driven...

-

Page 47

... placed in service during 2015, 2016 and 2017; 40% for 2018; and 30% for 2019. Accounting and financial reporting effects of tax law changes are recognized in the period in which the legislation was enacted, which means when the President signed the Act into law on December 18, 2015. Companies are...

-

Page 48

... designed to incr ease profitability and operational efficiency. These Company-wide restructuring actions are broad-based but primarily capture the anticipated cost and expense synergies from the Kofax and ReadSoft acquisitions. Additionally, as the strong U.S. dollar continues to negatively impact...

-

Page 49

... and resources on higher usage business platforms, t he Company announced various restructuring actions ( "Other Restructuring Actions") over the past several years. The Other Restructuring Actions primarily include exiting the development and manufacturing of the Company's remaining inkjet hardware...

-

Page 50

For the year ended December 31, 2015, restructuring charges and project costs were incurred in the Company's segments as follows:

(Dollars in millions) ISS All other Enterprise Software Total restructuring charges and project costs 2016 Actions 40.4 - - $ 40.4 $ 2015 Actions 11.8 3.8 20.9 $ 36.5 $ ...

-

Page 51

... Company's restructuring plans as follows:

Other Actions Restructuring Charges (Reversals) (Note 5) $ 11.1 15.8 11.1 (0.2) - $ 37.8

(Dollars in millions) Accelerated depreciation charges Excess components and other inventory-related charges Employee termination benefit charges Contract termination...

-

Page 52

... presented on the balance sheet of the acquired company. These intangible assets consist primarily of purchased technology, customer relationships, trade names, in-process research and development and non-compete agreements. Subsequent to the acquisition date, some of these intangible assets begin...

-

Page 53

...acquire Kofax and Claron of $1,006.6 million. This was partially offset by $362.7 million in proceeds from debt, net of repayments, used to fund the acquisition activities. The Company also repurchased shares in the amount of $30.3 million and made cash dividend payments of $88.6 million during 2015...

-

Page 54

...credit facilities or access to the private and public debt markets. The Company may choose to use these sources of liquidity from time to time to fund strategic acquisitions and dividends. As of December 31, 2015, the Company held $158.3 million in Cash and cash equivalents. The Company's ability to...

-

Page 55

... provided higher cash flow for operating activities in 2014 of $60.6 million. This $30.7 million fluctuation year over year is driven by the timing of revenue later in the last quarter of 2015 versus 2014 in combination with higher mix of Enterprise Software revenue which typically pays slower...

-

Page 56

... devices to smart multifunction products ("MFPs"). During 2015, the Company also acquired substantially all of the assets of Claron for $30.3 million. Claron is a leading provider of medical image viewing, distribution, sharing and collaboration software technology, and its solutions help healthcare...

-

Page 57

... selectively repurchase its stock from time to time in the open m arket or in privately negotiated transactions depending upon market price and other factors. During 2015, the Company paused its share repurchases in order to pay down debt associated with the Kofax acquisition. Refer to Part II, Item...

-

Page 58

.... These sources can be accessed domestically if the Company is unable to satisfy its cash needs in the United States with cash flows provided by operations and existing cash and cash equivalents. Trade Receivables Facility In the U.S., the Company, Lexmark Enterprise Software, LLC ("LESL") and Kofax...

-

Page 59

...reported in the table above include agreements to purchase goods or services that are enforceable and legally binding on the Company and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing...

-

Page 60

... Company's business. In an effort to minimize the impact on earnings of an y such increases, the Company must continually manage its product and service costs and its manufacturing and development processes. Additionally, monetary assets such as cash and cash equivalents lose purchasing power during...

-

Page 61

... 2015 the fair value of the Company's senior notes was estimated at $ 735.6 million, based on the prices the bonds have recently traded in the market as well as the overall market conditions on the date of valuation, stated coupon rates, the number of coupon payments each year and the maturity dates...

-

Page 62

... Per Share Amounts) 2015 Revenue: Product Service Total Revenue Cost of revenue: Product Service Restructuring-related costs Total Cost of revenue Gross profit Research and development Selling, general and administrative Gain on sale of inkjet-related technology and assets Restructuring and related...

-

Page 63

... in 2013) Recognition of pension and other postretirement benefit plans prior service credit, net of (amortization) (net of tax benefit (liability) of $0.3 in 2015, $0.1 in 2014, and $(0.8) in 2013) Net unrealized loss on OTTI* marketable securities (net of tax (liability) benefit of $0.0 in 2014...

-

Page 64

Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION As of December 31, 2015 and 2014 (In Millions, Except Par Value) 2015 ASSETS Current assets: Cash and cash equivalents Marketable securities Trade receivables, net of allowances of $24.4 in 2015 and $22.2 in ...

-

Page 65

... of cash dividend Purchase of treasury stock Proceeds from employee stock plans Other Net cash flows provided by (used for) financing activities Effect of exchange rate changes on cash Net change in cash and cash equivalents Cash and cash equivalents - beginning of year Cash and cash equivalents...

-

Page 66

... of options Tax benefit (shortfall) related to stock plans Stock-based compensation Purchase of shares from noncontrolling interest Dividends declared on Class A common stock, $1.44 per share (3) Treasury shares purchased Balance at December 31, 2015

63.9

$

1.0

$ 900.6

$ 1,252.2 259.1

$ (844...

-

Page 67

... and enterprise search software markets. Lexmark's products include laser printers and multifunction devices, dot matrix printers and the associated supplies/solution s/services, as well as ECM, BPM, DOM, intelligent data capture, search and web-based document imaging and workflow software solutions...

-

Page 68

...

Provision for income taxes Net earnings Net earnings per share: Basic Diluted Consolidated Statements of Comprehensive Earnings

$ $

$ $

$ $

4.16 4.08

$ $

(0.05) (0.04)

$ $

4.11 4.04

December 31, 2014 As Previously Reported $ 79.1 (71.2) (56.4) 22.7 Adjustment 0.8 0.8 0.8 1.6 As Revised 79...

-

Page 69

... per share practical expedient. Refer to Note 4 of the Notes to Consolidated Financial Statements for information regarding the second quarter 2015 measurement period adjustments applied retrospectively to the Consolidated Statements of Financial Position related to the acquisition of ReadSoft in...

-

Page 70

.... On an ongoing basis, the Company evaluates its estimates, including those related to customer programs and incentives, product returns, doubtful accounts, inventories, stock-based compensation, goodwill, intangible assets, income taxes, warranty obligations, restructurings, pension and other...

-

Page 71

... developed from prices paid in observed market transactions of comparable companies. In estimating the fair value of its Enterprise Software reporting unit, the Company used an equally-weighted measure based on a discounted cash flow analysis and certain market-based measurements. In estimating...

-

Page 72

... multifunction products as well as a wide range of supplies and services covering its printing products and technology solutions. Enterprise Software offers an integrated suite of ECM, BPM, DOM/CCM that includes case management, electronic signature, process analytics, information and application...

-

Page 73

... model is a multiple element arrangement that includes a perpetual software license, professional services, and maintenance and support. Provided that all other recognition criteria have been met, license revenue is recognized when the customer either takes possession of the software via a download...

-

Page 74

... Element Revenue Arrangements General: Lexmark enters into agreements with customers that contain multiple elements, such as the provisions of hardware, supplies, separately priced extended warranty and product maintenance services, and other professional services (such as installation, maintenance...

-

Page 75

.... Research and Development Costs: Lexmark engages in the design and development of new products and enhancements to its existing products. The Company's research and development activity is focused on laser devices and associated supplies, features and related technologies as well as software. Refer...

-

Page 76

... estimated future service period of active plan participants. Stock-Based Compensation: Equity Classified Share-based payments to employees, including grants of stock options, are recognized in the financial statements based on their grant date fair value. The fair value of the Company's stock-based...

-

Page 77

... the communication date and recognizes the expense and liability ratably over the future service period. For contract termination costs, which primarily includes leases, Lexmark records a liability for costs to terminate a contract before the end of its term when the Company terminates the agreement...

-

Page 78

...is based on the core principle that revenue be recognized in a manner that depicts the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Under the new standard, a good or service...

-

Page 79

...Standards Update No. 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date to provide a one year delay in the effective date of ASU 2014-09. The effective date of the new guidance for the Company is now January 1, 2018; however, early application is permitted for...

-

Page 80

... the Company has the ability to access at the measurement date; Level 2 -- Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly; and Level 3 -- Unobservable inputs used in valuations in which there is little market activity...

-

Page 81

the Company's policy regarding cash equivalents. Fair value of these instruments is readily determinable using the methods de scribed below for money market funds. The Company liquidated its marketable securities portfolio entirely in 2015 in order to partially fund the acquisition of Kofax Limited ...

-

Page 82

... future cash flows are converted to a single discounted amount. Marketable Securities - Valuation Process The Company uses third-party pricing information to report the fair values of the securities in which it is invested, though the responsibility of valuation remains with the Company's management...

-

Page 83

... that the price can be transacted upon in the market at the reporting date. Money Market Funds The money market funds in which the Company is invested are considered cash equivalents and are generally highly liquid investments. Money market funds are valued at the per share (unit) published as the...

-

Page 84

... of Kofax will enhance the Company's industry-leading enterprise content management ("ECM") and business process management ("BPM") offerings and strengthen the Company's portfolio of capture solutions in the market, ranging from Web portals and mobile devices to smart multifunction products ("MFPs...

-

Page 85

...-Average Useful Life (years)

Cash and cash equivalents Trade receivables Inventories Prepaid expenses and other current assets Property, plant and equipment Identifiable intangible assets: Developed technology Customer relationships Trade names Non-compete agreements In-process technology (1) Other...

-

Page 86

... of this immaterial error. The Company's consolidated results of operations include the results of the acquired Kofax businesses from the acquisition date, including, revenue of $160.6 million and operating income (loss) of $(52.1) million for the year ended December 31, 2015. The unaudited pro...

-

Page 87

..., distribution, sharing and collaboration software technology, Claron helps healthcare delivery organizations provide universal access to patient imaging studies and other content across and between healthcare enterprises. Of the $33.0 million cash payment, $30.3 million was paid to acquire the net...

-

Page 88

... revenue and net earnings disclosures have been omitted. 2014 ReadSoft AB In the second quarter of 2014, the Company commenced a public cash tender offer for all of the outstanding shares of ReadSoft AB ("ReadSoft"). ReadSoft is a leading global provider of software solutions that automate business...

-

Page 89

...Company considered the timing of the public announcement of this offer price as well as the market response to the announcement in making this determination. The purchase of ReadSoft is included in Purchase of businesses, net of cash acquired in the Consolidated Statements of Cash Flows for the year...

-

Page 90

... of GNAX Holdings, LLC. GNAX Health is a provider of image exchange software technology for exchanging medical content between medical facilities. 2013 During the year ended December 31, 2013, the Company completed the following acquisitions: Total purchase price, net of cash acquired $ 65.7 52.3 28...

-

Page 91

... actions (the "2015 Restructuring Actions") designed to increase profita bility and operational efficiency. These Company-wide restructuring actions are broad-based but primarily capture the anticipated cost and expense synergies from the Kofax and ReadSoft acquisitions. Additionally, as...

-

Page 92

... over the past several years. The Other Restructuring Actions primarily include exiting the development and manufacturing of the Company's remaining inkjet hardware, with reductions primarily in the areas of inkjet-related manufacturing, research and development, supply chain, marketing and sales as...

-

Page 93

... 11.1 (0.2) 37.8

$

$

$

$

$

For the years ended December 31, 2015, 2014, and 2013, the Company incurred restructuring charges in connection with the Other Restructuring Actions in the Company's segments as follows: 2015 ISS All other Enterprise Software Total charges $ 1.4 0.6 0.2 2.2 $ 2014 15...

-

Page 94

... for the cash-based long-term incentive awards and is included in pre-tax stock-based compensation expense. The following table presents a breakout of the stock-based compensation expense recognized for the years ended December 31: 2015 Cost of revenue Research and development Selling, general and...

-

Page 95

... of achievement was services and software revenue. The performance period for the awards is 1 year ending on December 31, 2015. The expense for these awards was recognized at maximum achievement level. During 2014, a certain number of executive officers of the Company were also granted additional...

-

Page 96

... unrecognized compensation expense, net of estimated forfeitures, related to RSUs and DSUs that will be recognized over the weighted average period of 1.6 years.

7.

MARKETABLE SECURITIES

The Company liquidated its marketable securities portfolio entirely in the second quarter of 2015 in order to...

-

Page 97

... Statements of Earnings. The amount in 2014 includes a gain of $1.3 million on the Company's previously held investment in shares of ReadSoft, which were purchased in 2014 and marked to fair value on the acquisition date. Refer to Note 4 of the Notes to Consolidated Financial Statements for...

-

Page 98

....3 million in 2015, 2014 and 2013, respectively. Leased products refers to hardware leased by Lexmark to certain customers as part of the Company's ISS operations. The cost of the hardware is amortized over the life of the contracts, which have been classified as operating leases based on the terms...

-

Page 99

... gross carrying amounts and accumulated amortization of the Company's intangible assets. December 31, 2015 Accum Gross Amort Intangible assets subject to amortization: Customer relationships Non-compete agreements Technology and patents Trade names and trademarks Total Intangible assets not subject...

-

Page 100

...on the rebranding. The Company's expected use of its acquired trade names and trademarks could change in future periods as the Company considers alternatives for going to market with its acquired software and solutions products. The Company accounts for its internal-use software, an intangible asset...

-

Page 101

... 31 $ 2015 180.3 79.9 (89.1) 171.1 72.7 98.4 171.1 $ 2014 179.9 93.8 (93.4) 180.3 77.5 102.8 180.3

$

$

$

$

The table above includes separately priced extended warranty and product maintenance contracts. It does not include software and other elements of the Company's deferred revenue. The short...

-

Page 102

... million, respectively, for the year ended December 31, 2013. Trade Receivables Facility In the U.S., the Company, Lexmark Enterprise Software, LLC ("LESL") and Kofax, Inc. transfer a majority of their receivables to a wholly-owned subsidiary, Lexmark Receivables Corporation ("LRC"), which then may...

-

Page 103

... used the remaining net proceeds for general corporate purposes, including to fund share repurchases, fund dividends, finance acquisitions, finance capital expenditures and operating expenses, and invest in subsidiaries. Other During the second quarter of 2015, the Company entered into an agreement...

-

Page 104

... Form 10-K, the Company identified errors related to the income tax provision and related to current tax, deferred tax and unrecognized tax benefits accounts that impacted the Company's previously issued interim and annual consolidated financial statements. Specifically, identified errors related...

-

Page 105

... the effective tax rate from 2014 to 2015 was due to the following factors: current year losses being recognized in higher tax jurisdictions in 2015, primarily the US; the increased relative impact of the research and development credit on the 2015 rate versus 2014, statutory impairments of foreign...

-

Page 106

... Credit carryforwards Inventories Restructuring Pension and postretirement benefits Warranty Equity compensation Other compensation Foreign exchange Deferred revenue Other Deferred tax liabilities: Property, plant and equipment Intangible assets Foreign exchange Valuation allowances * Net...

-

Page 107

... examination of the Company's US income tax returns for 2012 and 2013 in the fourth quarter of 2015; however, the IRS has not yet proposed any adjustments. The Company's US income tax returns prior to 2012 are no longer subject to IRS examination. In Switzerland, tax years 2011 and after are subject...

-

Page 108

....2 million. The increase was primarily driven by $41.5 million recognized for share-based compensation awards and $20.0 million recognized for the fair value of Lexmark replacement stock options and RSUs related to pre-combination services resulting from the Company's acquisition of Kofax . Refer to...

-

Page 109

... provided in the preceding paragraphs. There were no outstanding ASR Agreements as of December 31, 2015. Under the terms of the ASR agreement, the Company paid an agreed upon amount targeting a certain number of shares based on the closing price of the Company's Class A Common Stock on the date...

-

Page 110

...

(80.3) (165.0)

Changes in the Company's foreign currency translation adjustments were due to a number of factors as the Company operates in various currencies throughout the world. The primary drivers of the unfavorable change in 2015 were decreases in the exchange rate values of approximately 33...

-

Page 111

... Amortization of prior service credit

Affected Line Item in the Statements of Earnings Note 17. Employee Pension and Postretirement Plans Tax benefit (liability) Net of tax

$ $

1.7 (0.2) 1.5

Other expense (income), net Tax benefit (liability) Net of tax

Unrealized gain on cash flow hedges $ 73...

-

Page 112

... of the basic and diluted EPS calculations for the years ended December 31: 2015 Numerator: Net (loss) earnings Denominator: Weighted average shares used to compute basic EPS Effect of dilutive securities Employee stock plans Weighted average shares used to compute diluted EPS Basic net EPS Diluted...

-

Page 113

...- (26.2)

$

$

The change in Benefit Obligation and Plan Assets due to Acquisitions relates to the purchase of Kofax. Refer to Note 4 for more information. The actuarial gain for the year ended December 31, 2015 was primarily due to increases in discount rate assumptions. The actuarial loss for the...

-

Page 114

... 582.1 582.1 $ Benefit Obligation 880.7 867.2 $ 2014 Plan Assets 711.8 711.8

2015 Net Periodic Benefit Cost: Service cost Interest cost Expected return on plan assets Amortization of prior service cost (credit) Immediate recognition of net loss (gain) Net periodic benefit cost $ 6.5 $ 30.6 (45...

-

Page 115

... parties to report the fair values of its plan assets. The Company tested the fair value of the portfolio and default level assumptions provided by the third parties as of December 31, 2015 and December 31, 2014 using the following procedures: ï,· assessment of trading activity and other market data...

-

Page 116

...Valued at quoted prices, broker dealer quotations, or other methods by which all significant inputs are generally observable, either directly or indirectly. If significant inputs are unobservable, the security is classified as Level 3. Cash equivalent: Valued at the per share (unit) published as the...

-

Page 117

... to Lexmark's acquisition of the Information Products Corporation from IBM in 1991, IBM agreed to pay for its pro rata share (currently estimated at $9.6 million) of future postretirement benefits for all the Company's U.S. employees based on prorated years of service with IBM and the Company. Cash...

-

Page 118

...or where applicable, quoted market prices. On the date the derivative contract is entered into, the Company designates the derivative as a fair value hedge or a cash flow hedge, based upon the nature of the underlying hedged item. Changes in the fair value of a derivative that is highly effective as...

-

Page 119

...are recognized ...Exchange Contracts Underlying Total

2015 3.0 2.6 $ 5.6 $

* Gains and losses recorded in Cost of revenue are included in Product on the Consolidated Statements of Earnings Cash Flow Hedges The Company's cash flow hedging contracts are not subject to master netting agreements...

-

Page 120

... circumstances. In addition, the Company uses credit insurance for specific obligors to limit the impact of nonperformance. Lexmark sells a large portion of its products through third-party distributors and resellers and original equipment manufacturer ("OEM") customers. If the financial condition...

-

Page 121

...guarantee is remote. In most transactions with customers of the Company's products, software, services or solutions, including resellers, the Comp any enters into contractual arrangements under which the Company may agree to indemnify the customer from certain events as defined within the particular...

-

Page 122

... In the second quarter of 2013, as part of the Company's sale of inkjet -related technology and assets, 100% of the shares of the legal entity owning the inkjet manufacturing facility in Cebu, Philippines were sold. The Philippines internal revenue bureau ("BIR") subsequently assessed approximately...

-

Page 123

... related to single function printers and multifunctional devices sold in Germany. Reprobel, a collection society with the authority to collect and distribute the remuneration for reprography to Belgian copyright holders, commenced legal proceedings against Lexmark Belgium in March of 2010 before the...

-

Page 124

... the office imaging and enterprise content and business process management markets. In April 2015, the Company announced a strategic rebranding action to unify and strengthen the market presence of the Company's information technology portfolio of enterprise software, print hardware and MPS. As part...

-

Page 125

... plan asset and actuarial net gain of $83.0 million. During 2015, 2014 and 2013, no one customer accounted for more than 10% of the Company's total revenues. The following is revenue by geographic area for the year ended December 31: 2015 Revenue: United States EMEA (Europe, the Middle East & Africa...

-

Page 126

...Stock prices: High Low

Dividend declared per share $

46.29 34.40

The Company acquired ReadSoft in August of 2014, GNAX Health in October of 2014, Claron in January of 2015 and Kofax in May of 2015. The consolidated financial results include the results of these acquisitions subsequent to the date...

-

Page 127

...ed Financial Statements for a discussion of a tax error correction related to transaction costs included in integration costs associated with the Company's acquisitions. Net loss for the third quarter of 2015 included $0.9 million of pre-tax restructuring charges and project costs in connection with...

-

Page 128

... on Internal Control over Financial Reporting, management has excluded Kofax Limited and i ts subsidiaries ("Kofax") and Claron from its assessment of internal control over financial reporting as of December 31, 2015 because they were acquired by the Company in business acquisitions during 2015. We...

-

Page 129

...sed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission and, as such, is accumulated and communicated to the Company's management, including our Chairman and Chief Executive Officer ("CEO") and Vice President and Chief Financial...

-

Page 130

...31, 2015, based on criteria described in Internal Control - Integrated Framework (2013) issued by COSO. The Company's management has excluded Kofax and Claron from its assessment of internal control over financial reporting as of December 31, 2015, because they were acquired in business acquisitions...

-

Page 131

... and procedures or the Company's internal control over financial reporting will prevent or detect all error and all fraud. A control system, regardless of how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system will be met...

-

Page 132

... by Paul A. Rooke, Chairman and Chief Executive Officer, and David Reeder, Vice President and Chief Financial Officer, of the Company and are included as Exhibits 31.1 and 31.2 to this Annual Report on Form 10-K.

Item 11.

EXECUTIVE COMPENSATION

Information required by Part III, Item 11 of this...

-

Page 133

...Related Person Transactions," "Executive Compensation" and "Director Compensation."

Item 14.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Information required by Part III, Item 14 of this Form 10-K is incorporated by reference from the Company's definitive Proxy Statement for its 2016 Annual Meeting of...

-

Page 134

... Statement Schedule: Report of Independent Registered Public Accounting Firm included in Part II, Item 8 For the years ended December 31, 2013, 2014 and 2015: Schedule II - Valuation and Qualifying Accounts 124 131

All other schedules are omitted as the required information is inapplicable or...

-

Page 135

LEXMARK INTERNATIONAL, INC. AND SUBSIDIARIES SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS For the Years Ended December 31, 2013, 2014 and 2015 (In Millions)

(A) (B) Balance at Beginning of Period (C) Additions Charged to Costs Charged to and Other Expenses Accounts (D) (E) Balance at End of ...

-

Page 136

...has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Lexington, Commonwealth of Kentucky, on February 29, 2016. LEXMARK INTERNATIONAL, INC. /s/ Paul A. Rooke Name: Paul A. Rooke Title: Chairman and Chief Executive Officer Pursuant to the...

-

Page 137

..., by and between Lexmark International, Inc. (the "Company") and Lexmark International Group, Inc. 2.2 Agreement and Plan of Merger by and among, Lexmark International Technology, S.A., Ariel Investment Company, Ltd., the Company and Kofax Limited, dated as of March 24, 2015. Restated Certificate of...

-

Page 138

.... 4 to Second Amended and Restated Purchase Agreement, dated as of October 20, 2015. Master Inkjet Sale Agreement by and among the Company, Lexmark International Technology, S.A., and Funai Electric Company, Ltd., dated April 1, 2013. Company Stock Incentive Plan, as Amended and Restated, effective...

-

Page 139

... Director Stock Plan.+ Company Senior Executive Incentive Compensation Plan, as Amended and Restated, effective January 1, 2009.+ Form of Executive Severance Agreement for Executive Officers.+ Form of Executive Change in Control Agreement for the Chief Executive Officer and Executive Vice Presidents...

-

Page 140

... Martin S. Canning, executive vice president and president of Imaging Solutions and Services Reynolds C. Bish, vice president and president of Enterprise Software Ronaldo M. Foresti, vice president of Asia Paciï¬c and Latin America Jeri L. Isbell, vice president of human resources Robert J. Patton...

-

Page 141