Dollar General 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

such participant at the end of the restriction period or, if later, the payment date. If Dollar General

complies with applicable reporting requirements and with the restrictions of Section 162(m), Dollar

General will be entitled to a business expense deduction in the same amount and generally at the same

time as the participant recognizes ordinary income.

Performance Share Units. There are no immediate tax consequences of receiving an award of

performance share units under the plan. A participant who is awarded performance share units will be

required to recognize ordinary income in an amount equal to the fair market value of shares issued to

such participant on the payment date. If Dollar General complies with applicable reporting

requirements and with the restrictions of Section 162(m), Dollar General will be entitled to a business

expense deduction in the same amount and generally at the same time as the participant recognizes

ordinary income.

Dividend Equivalent Rights. A participant generally will not recognize taxable income when a

dividend equivalent right is granted. The participant, however, will generally recognize ordinary income

upon receiving payment of cash and/or shares for the dividend equivalent right. The amount included

in the participant’s income will equal the amount of cash and the fair market value of the shares

received. Dollar General generally will be entitled to a corresponding tax deduction at the time the

participant recognizes ordinary income with respect to a dividend equivalent right.

Section 280(G). To the extent payments that are contingent on a change in control are

determined to exceed certain Internal Revenue Code limitations, they may be subject to a 20%

nondeductible excise tax, and Dollar General’s deduction with respect to the associated compensation

expense may be disallowed in whole or in part.

Section 409A. The plan is intended to comply with Section 409A of the Internal Revenue

Code to the extent that such section would apply to any award under the plan. Section 409A governs

the taxation of deferred compensation. Any participant granted an award that is deemed to be deferred

compensation, such as a grant of restricted stock units, that does not qualify for an exemption from

Section 409A, and does not comply with Section 409A, could be subject to immediate taxation on the

award as soon as the award is no longer subject to a substantial risk of forfeiture (even if the award is

not exercisable) and an additional 20% tax (and a further additional tax based upon an amount of

interest determined under Section 409A) on the value of the award.

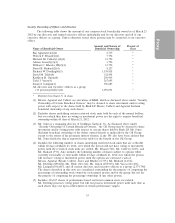

Have any awards been granted under the amended and restated terms of the 2007 Stock Incentive

Plan prior to the annual meeting?

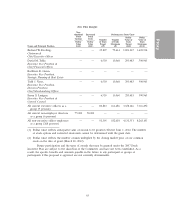

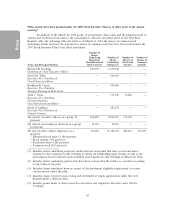

On March 20, 2012, the Committee approved awards of performance share units to certain

employees, subject to shareholder approval of the 2007 Stock Incentive Plan. If this proposal is not

approved at the annual meeting, these performance share units will be automatically forfeited.

Additionally, in connection with the annual meeting, we anticipate awarding stock options and

restricted stock units to the non-employee directors under the 2007 Stock Incentive Plan. If this

proposal is not approved at the annual meeting, these stock options and restricted stock units will still

be granted, but they will be granted pursuant to the 2007 Stock Incentive Plan as in effect prior to the

annual meeting. Information regarding the March 20, 2012 grants of performance share units and the

planned award of options and restricted stock units to the non-employee directors is set forth in the

table below.

62