Dollar General 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

PROPOSAL 2:

VOTE REGARDING THE AMENDED AND RESTATED 2007 STOCK INCENTIVE

PLAN

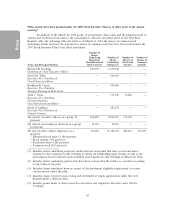

What are shareholders being asked to approve?

Our Board of Directors is asking you to approve our Amended and Restated 2007 Stock

Incentive Plan, along with the material terms of the performance-based compensation under the plan

for purposes of compensation deductibility under Internal Revenue Code Section 162(m). In this proxy

statement, we sometimes refer to this amended and restated plan as the ‘‘2007 Stock Incentive Plan.’’

On November 30, 2011, upon the recommendation of our Compensation Committee, our Board of

Directors approved the plan described in this proposal, subject to shareholder approval at the annual

meeting. The plan will not become effective unless and until it is approved by shareholders. A copy of

the proposed 2007 Stock Incentive Plan is attached as Appendix A to this proxy statement.

Why are shareholders being asked to approve the 2007 Stock Incentive Plan?

NYSE rules generally require companies to submit material revisions of equity-compensation

plans to shareholders for approval. Among other changes, the 2007 Stock Incentive Plan extends the

term of the plan to the tenth anniversary of the date of shareholder approval, which is considered a

material revision of the plan under NYSE rules.

Why are shareholders being asked to approve the material terms of the performance-based

compensation under the 2007 Stock Incentive Plan?

Section 162(m) of the Internal Revenue Code limits our ability to deduct from our U.S. federal

corporate income taxes compensation in excess of $1 million per year paid to ‘‘covered employees’’

unless the compensation qualifies as ‘‘performance-based.’’ Compensation cannot qualify as

‘‘performance-based’’ unless the plan under which it is paid is approved by shareholders. ‘‘Covered

employees’’ generally include each of the persons who are our Chief Executive Officer or one of the

other named executive officers (other than our Chief Financial Officer).

The 2007 Stock Incentive Plan is designed to permit Dollar General to grant awards that

qualify as performance-based compensation for purposes of satisfying the requirements of

Section 162(m). The Section 162(m) deduction limit does not apply for certain grants made during any

period during which our securities are not publicly-traded and during a transition reliance period after

our securities become publicly-traded. Our Section 162(m) transition reliance period ends in 2013.

Thus, in order for us to continue to have flexibility to pay performance-based compensation that meets

the requirements for deductibility under Section 162(m), we need to obtain shareholder approval of the

2007 Stock Incentive Plan no later than the 2013 annual meeting of shareholders. We decided to

submit the plan to our shareholders in 2012 because (1) we wanted to determine the availability of

making deductible awards in 2013 before the 2013 annual meeting of shareholders; and (2) an Internal

Revenue Service proposed regulation could eliminate the deductibility of all or a portion of the March

2012 performance share unit awards absent approval of the plan by our shareholders at the 2012

annual meeting.

Why should shareholders approve this proposal?

We believe the 2007 Stock Incentive Plan is important to our continued growth and success.

The purpose of the plan is to attract and retain management and other personnel and key service

providers, to motivate management personnel by means of growth-related incentives to achieve

long-range goals, and to further align the interests of plan participants with those of our shareholders.

54