Dollar General 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

optimization of our category management processes, further improvement in store standards, and an

increase in sales prices resulting primarily from passing through certain cost increases and increased

utilization of square footage in our stores. Increases in sales of consumables outpaced our

non-consumables, with sales of packaged foods, snacks, beverages and perishables, contributing the

majority of the increase throughout the year.

The net sales increase in 2010 reflects a same-store sales increase of 4.9% compared to 2009. For

2010, there were 8,712 same-stores which accounted for sales of $12.23 billion. The remainder of the

increase in sales in 2010 was attributable to new stores, partially offset by sales from closed stores. The

increase in sales reflects the refinement of our merchandise offerings, improvements in our category

management processes and store standards, and increased utilization of square footage in our stores.

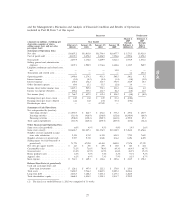

Of our four major merchandise categories, the consumables category, which generally has a lower

gross profit rate than the other three categories, has grown most significantly over the past several

years. Because of the impact of sales mix on gross profit, we continually review our merchandise mix

and strive to adjust it when appropriate. Maintaining an appropriate sales mix is an integral part of

achieving our gross profit and sales goals. Both the number of customer transactions and average

transaction amount increased in 2011 and 2010, and we believe that our stores have benefited to some

degree from attracting new customers who are seeking value as a result of the challenging

macroeconomic environment in recent years.

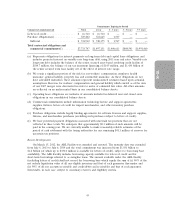

Gross Profit. The gross profit rate as a percentage of sales was 31.7% in 2011 compared to 32.0%

in 2010, a decline of 31 basis points. Consumables, which generally have lower markups than

non-consumables, represented a greater percentage of sales in 2011 than in 2010. Our purchase costs

increased primarily due to increased commodity costs. In addition, we incurred higher markdowns and

our transportation costs were impacted by higher fuel rates in 2011. Our LIFO provision increased to

$47.7 million in 2011 compared to $5.3 million in 2010. In 2011, our mix of home and apparel

merchandise decreased as percentage of sales and the gross profit rate within these categories

decreased due, in part, to higher markdowns. Although we saw improvement in the home category in

the latter part of 2011, we believe the economic environment continues to impede our ability to grow

sales in discretionary areas such as this. Factors positively affecting gross profit include the selective

price increases noted above as well as lower inventory shrinkage and distribution center costs, as a

percentage of sales.

The gross profit rate as a percentage of sales was 32.0% in 2010 compared to 31.3% in 2009.

Factors contributing to the increase in the 2010 gross profit rate include increased markups resulting

primarily from higher purchase markups, partially offset by increased markdowns, as well as our

category management efforts and increased sales volumes which have contributed to our ability to

reduce purchase costs from our vendors. Our merchandising team continues to work closely with our

vendors to provide quality merchandise at value prices to meet our customers’ demands. In 2010 we

recorded a LIFO provision of $5.3 million, reflecting an increase in certain merchandise costs, the most

significant of which occurred in the 2010 fourth quarter, compared to a LIFO benefit of $2.5 million in

2009.

SG&A Expense. SG&A expense was 21.7% as a percentage of sales in 2011 compared to 22.3%

in 2010, an improvement of 61 basis points reflecting the favorable impact of the 13.6% increase in

sales. In addition, retail labor expense increased at a rate lower than our increase in sales, partially due

to the rollout of our workforce management system. A decrease in incentive compensation driven by

more aggressive bonus targets, and various cost reduction efforts affecting rent, benefits, electricity and

other power costs, among other expenses, also contributed to the overall decrease in SG&A as a

percentage of sales. Costs that increased at a rate higher than our increase in sales included those

associated with our high speed store data network discussed above, depreciation and amortization

expense and fees associated with the increased use of debit cards. Depreciation and amortization

34