Dollar General 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

decision to purchase certain of our leased stores and continued to purchase some stores in 2011. We

believe that the current environment in the real estate markets provides an opportunity to make these

investments at levels which are expected to result in favorable returns and positively impact our

operating results.

In 2012, we plan to continue to focus on our four key operating priorities. We will continue to

refine and improve our store standards in order to increase sales, focusing on achieving a consistent

look and feel across the chain. Continued progress on improving our merchandise in-stock position is

an important element in improving overall customer service and increasing sales. As part of our

category management program, we plan to expand our refrigerated food offerings, further expand our

private brand consumables and increase the number of $1.00 price point items in our stores. With

regard to non-consumables, we plan to further improve the quality and appeal of our seasonal, home

and apparel merchandise, and to continue to offer the items our customers want and need most

frequently. We will continue our focused shrink reduction efforts by employing our exception reporting

tools and enhanced shrink optimization processes. We will also continue to pursue global opportunities

to directly source a larger portion of our products, with the potential for significant savings to current

costs.

With regard to leveraging information technology and process improvements to reduce costs, we

will continue to focus on making improvements that benefit our merchandising and operations efforts,

including further implementation of a new supply chain/procurement system which we anticipate will

produce benefits in 2013 and beyond, as well as enhanced pricing and markdown capabilities,

merchandise selection and allocation procedures. We expect to gain further efficiencies with additional

utilization of our workforce management systems and high speed data transmission capabilities.

Finally, we are pleased with the performance of our 2011 new stores, remodels and relocations,

and in 2012 we plan to open 625 new stores and remodel or relocate an additional 550 stores. Included

in our 2012 new store growth plans are 40 new Dollar General Market stores and we also intend to

continue tests of a larger format traditional store with additional coolers and freezers in several

markets.

In the first half of 2011, we utilized cash flow from operations and borrowings under our revolving

credit agreement to repurchase the $864 million remaining balance of our outstanding 10.625% Senior

Notes, reducing our interest expense and strengthening our financial position. Then, in December 2011,

we repurchased approximately 4.9 million shares of our outstanding common stock for $185 million. In

2012, we plan to refinance the remaining $451 million of our 11.875%/12.625% outstanding Senior

Subordinated Notes further reducing interest expense. In addition, we plan to repurchase additional

shares of our common stock under our current authorization with a remaining balance of $315 million.

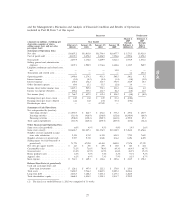

Key Financial Metrics. We have identified the following as our most critical financial metrics for

2011:

• Same-store sales growth;

• Sales per square foot;

• Gross profit, as a percentage of sales;

• Selling, general and administrative expenses, as a percentage of sales;

• Operating profit;

• Inventory turnover;

• Cash flow;

• Net income;

31