Dollar General 2011 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

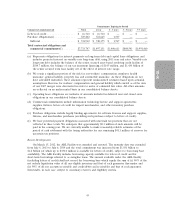

Significant components of our property and equipment purchases in 2009 included the following

approximate amounts: $114 million for improvements, upgrades, remodels and relocations of existing

stores; $69 million for new leased stores; $28 million for distribution and transportation-related capital

expenditures; $24 million for various administrative capital costs; and $11 million for information

systems upgrades and technology-related projects. During 2009 we opened 500 new stores and

remodeled or relocated 450 stores.

Capital expenditures during 2012 are projected to be in the range of $600-$650 million. We

anticipate funding 2012 capital requirements with cash flows from operations, and if necessary, we also

have significant availability under our ABL Facility. Approximately 65 percent of projected capital

spending is for investment in store growth and development for approximately 625 new stores and for

approximately 550 stores to be remodeled or relocated. Capital expenditures are anticipated for the

construction of new stores; costs related to new leased stores such as leasehold improvements, fixtures

and equipment; the purchase of existing stores; and continued investment in our existing store base.

Approximately 15 percent of projected capital spending is for transportation, distribution and special

projects; and the remaining 20 percent is for routine and ongoing capital requirements.

Included in our 2012 new store growth plans are 40 new Dollar General Market stores, some of

which we will introduce in new markets, including California and Nevada. We also intend to test a

larger format traditional store with additional coolers and freezers in several markets. The Market and

larger format traditional stores require higher investments than our traditional stores which can vary

depending on numbers of coolers, square feet, type of construction and layout. Because we are testing

several different formats, the costs of rolling out these concepts in larger quantities, should we decide

to do so, are uncertain at the present time. We plan to undertake these expenditures as part of our

efforts to improve our infrastructure and increase our cash generated from operating activities.

Cash flows from financing activities. On July 15, 2011, we redeemed $839.3 million aggregate

principal amount of our outstanding Senior Notes at total cost of $883.9 million including associated

premiums, and on April 29, 2011, we repurchased in the open market $25.0 million aggregate principal

amount of Senior Notes at a total cost of $26.8 million including associated premiums. A portion of the

July 2011 redemption of Senior Notes was financed by borrowings under the ABL Facility. Net

borrowings under the ABL Facility were $184.7 million during 2011. In December 2011, we

repurchased 4.9 million outstanding shares from our principal shareholder at a total cost of

$185.0 million.

During 2010, we repurchased $115.0 million outstanding principal amount of our outstanding

Senior Notes at a total cost of $127.5 million including associated premiums. We had no borrowings or

repayments under the ABL Facility in 2010.

In 2009, we had cash inflows from the issuance of equity of $443.8 million primarily due to our

initial public offering of 22.7 million shares of common stock. We used the proceeds from the offering

to redeem outstanding Notes with a total principal amount of $400.9 million at a premium, and used

cash generated from operations to repay $336.5 million outstanding principal amount on our Term

Loan Facility. We had no borrowings or repayments under the ABL Facility in 2009. In addition, we

paid a dividend and related amounts totaling $239.7 million using cash generated from operations.

Critical Accounting Policies and Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to

make estimates and assumptions that affect reported amounts and related disclosures. In addition to

the estimates presented below, there are other items within our financial statements that require

estimation, but are not deemed critical as defined below. We believe these estimates are reasonable and

appropriate. However, if actual experience differs from the assumptions and other considerations used,

the resulting changes could have a material effect on the financial statements taken as a whole.

46