Dollar General 2011 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

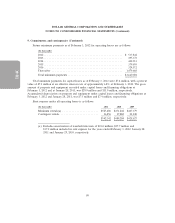

9. Commitments and contingencies (Continued)

governing the swap, giving the Company the right to terminate. The Company subsequently settled the

swap in November 2008 for approximately $7.6 million, including interest accrued to the date of

termination. On May 14, 2010, the Company received a demand from the counterparty for an

additional payment of approximately $19 million plus interest, claiming that the valuation used to

calculate the $7.6 million was commercially unreasonable, and seeking to invoke the alternative dispute

resolution procedures established by the bankruptcy court. The Company participated in the alternative

dispute resolution procedures as it believed a reasonable settlement would be in the best interest of the

Company to avoid the substantial risk and costs of litigation. In April of 2011, the Company reached a

settlement with the counterparty under which the Company paid an additional $9.85 million in

exchange for a full release. The Company accrued the settlement amount along with additional

expected fees and costs related thereto in the first quarter of 2011. The settlement was finalized and

the payment was made in May 2011.

From time to time, the Company is a party to various other legal actions involving claims

incidental to the conduct of its business, including actions by employees, consumers, suppliers,

government agencies, or others through private actions, class actions, administrative proceedings,

regulatory actions or other litigation, including without limitation under federal and state employment

laws and wage and hour laws. The Company believes, based upon information currently available, that

such other litigation and claims, both individually and in the aggregate, will be resolved without a

material adverse effect on the Company’s financial statements as a whole. However, litigation involves

an element of uncertainty. Future developments could cause these actions or claims to have a material

adverse effect on the Company’s results of operations, cash flows, or financial position. In addition,

certain of these lawsuits, if decided adversely to the Company or settled by the Company, may result in

liability material to the Company’s financial position or may negatively affect operating results if

changes to the Company’s business operation are required.

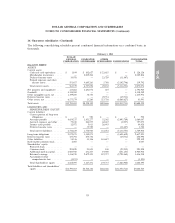

10. Benefit plans

The Dollar General Corporation 401(k) Savings and Retirement Plan, which became effective on

January 1, 1998, is a safe harbor defined contribution plan and is subject to the Employee Retirement

and Income Security Act (‘‘ERISA’’).

A participant’s right to claim a distribution of his or her account balance is dependent on the plan,

ERISA guidelines and Internal Revenue Service regulations. All active participants are fully vested in

all contributions to the 401(k) plan. During 2011, 2010 and 2009, the Company expensed approximately

$10.9 million, $9.5 million and $8.4 million, respectively, for matching contributions.

The Company also has a nonqualified supplemental retirement plan (‘‘SERP’’) and compensation

deferral plan (‘‘CDP’’), known as the Dollar General Corporation CDP/SERP Plan, for a select group

of management and other key employees. The Company incurred compensation expense for these plans

of approximately $1.7 million, $1.7 million and $1.9 million in 2011, 2010 and 2009, respectively.

The CDP/SERP Plan assets are invested in accounts selected by the Company’s Compensation

Committee or its delegate. These investments are classified as trading securities and the associated

deferred compensation liability is reflected in the consolidated balance sheets as further discussed in

Note 7.

84