Dollar General 2011 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued)

Each of the Company’s management-owned shares, Rollover Options, and vested Time and

Performance options include certain provisions by which the holder of such shares, Rollover Options,

or vested Time and Performance options may require the Company to repurchase such instruments in

limited circumstances. Specifically, each such instrument is subject to a put right for a period of

365 days after termination due to the death or disability of the holder of the instrument that occurs

generally within five years from the date of grant. In such circumstances, the holder of such instruments

may require the Company to repurchase any shares at the fair market value of such shares and any

Rollover Options or vested Time and Performance options at a price equal to the intrinsic value of

such Rollover or vested Time and Performance options. Because the Company does not have control

over the circumstances in which it may be required to repurchase the outstanding shares or Rollover

Options, such shares and Rollover Options have been classified as Redeemable common stock in the

accompanying consolidated balance sheets as of these dates. The values of these equity instruments are

based upon the fair value and intrinsic value, respectively, of the underlying stock and Rollover Options

at the date of issuance. Because redemption of such shares is uncertain, such shares are not subject to

re-measurement until their redemption becomes probable.

At February 3, 2012, 5,382 Rollover Options were outstanding, all of which were exercisable. The

aggregate intrinsic value of these outstanding Rollover Options was $0.2 million with a weighted

average remaining contractual term of 2.2 years, and a weighted average exercise price of $2.1875.

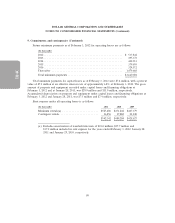

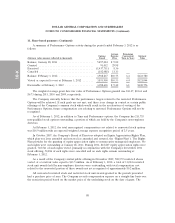

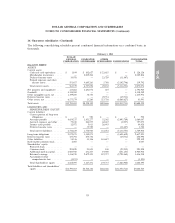

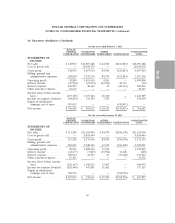

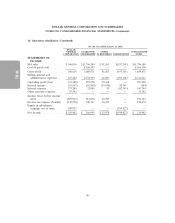

A summary of Time Options activity during the period ended February 3, 2012 is as follows:

Average Remaining

Options Exercise Contractual Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Price Term in Years Value

Balance, January 28, 2011 ...................... 5,778,131 $ 9.73

Granted ................................... 91,012 29.98

Exercised .................................. (1,427,179) 8.41

Canceled ................................... (183,383) 11.09

Balance, February 3, 2012 ...................... 4,258,581 $10.55 6.3 $133,691

Vested or expected to vest at February 3, 2012 ....... 4,159,595 $10.36 6.3 $131,357

Exercisable at February 3, 2012 .................. 2,486,048 $ 9.08 6.1 $ 81,692

The weighted average grant date fair value of Time Options granted during 2011, 2010 and 2009

was $13.47, $12.61 and $6.73, respectively.

87