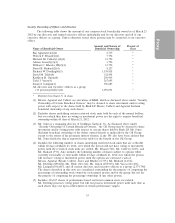

Dollar General 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

Approval of the 2007 Stock Incentive Plan will, among other things, extend the term of the

plan to the tenth anniversary of the date of shareholder approval, which will preserve what we believe

is an essential tool to provide an incentive for management and other personnel and key service

providers to contribute to our future growth and success. If this proposal is not approved at the annual

meeting, the plan will expire by its terms on July 6, 2017.

In addition, if this proposal is not approved at the annual meeting:

• any future awards of stock options, stock appreciation rights and restricted stock granted

under the plan to our covered employees after the end of our transition reliance period, and

any future awards of other types of equity-based compensation granted under the plan to our

covered employees which are paid or settled after the end of our transition reliance period

will not qualify as performance-based compensation and will count against the $1 million

deductible compensation limit otherwise imposed by Section 162(m); and

• the performance share units granted on March 20, 2012 under the plan will be automatically

forfeited.

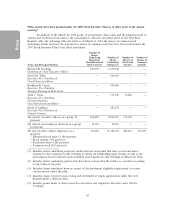

How does the 2007 Stock Incentive Plan compare to compensation best practices?

The 2007 Stock Incentive Plan includes a number of important provisions, summarized below,

that are designed to protect our shareholders’ interests and that reflect our commitment to best

practices and effective management of equity compensation:

•Plan Limits and Additional Shares. A fixed number of shares is authorized under the plan,

and shareholder approval would be required to increase that share limit. The plan does not

contain an evergreen provision or other feature which would periodically add new shares for

grant under the plan. Subject to adjustment in connection with certain significant corporate

events, the maximum number of shares that can be awarded in the form of stock options and

stock appreciation rights to any plan participant is 4.5 million per fiscal year, and the

maximum number of shares that can be awarded in the form of other stock-based awards to

any plan participant is 1.5 million per fiscal year.

•No Discount Stock Options or Stock Appreciation Rights. All stock options and stock

appreciation rights must have an exercise price that is equal to or greater than the fair

market value of one share of our common stock on the date of grant.

•No Repricing. Repricing of stock options and stock appreciation rights (including reduction

in the exercise price of stock options or replacement of an award with cash or another award

type) is prohibited without shareholder approval.

•Limitation on Amendments. No material amendments that would increase the aggregate

number of shares that may be issued under the plan can be made without shareholder

approval.

•Section 162(m) Eligibility. The committee administering the plan maintains the flexibility to

approve equity and cash awards eligible for treatment as performance-based compensation

under Section 162(m).

How does the 2007 Stock Incentive Plan work?

A description of the plan’s provisions is set forth below. This summary is qualified in its

entirety by reference to the 2007 Stock Incentive Plan attached as Appendix A.

Administration. The plan is administered by the CNG Committee, which may delegate some

or all of its authority to a subcommittee consisting solely of at least two directors who qualify as

‘‘non-employee directors’’ for purposes of Rule 16b-3 of the Securities Exchange Act of 1934 (or any

55