Dollar General 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

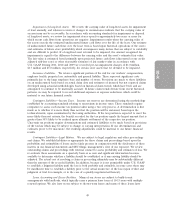

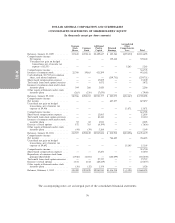

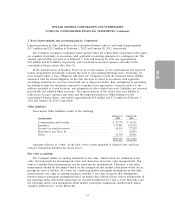

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands except per share amounts)

Accumulated

Common Additional Other

Stock Common Paid-in Retained Comprehensive

Shares Stock Capital Earnings Loss Total

Balances, January 30, 2009 ......... 317,845 $278,114 $2,489,647 $ 103,364 $(39,430) $2,831,695

Comprehensive income:

Net income .................. — — — 339,442 — 339,442

Unrealized net gain on hedged

transactions, net of income tax

expense of $2,553 ............ — — — — 5,263 5,263

Comprehensive income ............ 344,705

Issuance of common stock .......... 22,700 19,863 421,299 — — 441,162

Cash dividends, $0.7525 per common

share, and related amounts ........ — — — (239,731) — (239,731)

Share-based compensation expense .... — — 15,009 — — 15,009

Tax benefit from stock option exercises . — — 3,072 — — 3,072

Issuance of common stock under stock

incentive plans ................ 304 266 2,020 — — 2,286

Other equity settlements under stock

incentive plans ................ (263) (230) (7,670) — — (7,900)

Balances, January 29, 2010 ......... 340,586 $298,013 $2,923,377 $ 203,075 $(34,167) $3,390,298

Comprehensive income:

Net income ................... — — — 627,857 — 627,857

Unrealized net gain on hedged

transactions, net of income tax

expense of $9,406 .............. — — — — 13,871 13,871

Comprehensive income ............ 641,728

Share-based compensation expense .... — — 12,805 — — 12,805

Tax benefit from stock option exercises . — — 10,110 — — 10,110

Issuance of common stock under stock

incentive plans ................ 93 82 1,943 — — 2,025

Exercise of stock options .......... 872 763 (8,399) — — (7,636)

Other equity settlements under stock

incentive plans ................ (44) (39) 5,188 — — 5,149

Balances, January 28, 2011 ......... 341,507 $298,819 $2,945,024 $ 830,932 $(20,296) $4,054,479

Comprehensive income:

Net income ................... — — — 766,685 — 766,685

Unrealized net gain on hedged

transactions, net of income tax

expense of $9,692 .............. — — — — 15,105 15,105

Comprehensive income ............ 781,790

Share-based compensation expense .... — — 15,250 — — 15,250

Repurchase of common stock from

principal shareholder ............ (4,916) (4,301) — (180,699) — (185,000)

Tax benefit from stock option exercises . — — 27,727 — — 27,727

Exercise of stock options .......... 1,534 1,342 (28,419) — — (27,077)

Other equity settlements under stock

incentive plans ................ (36) (32) 1,358 — — 1,326

Balances, February 3, 2012 ......... 338,089 $295,828 $2,960,940 $1,416,918 $ (5,191) $4,668,495

The accompanying notes are an integral part of the consolidated financial statements.

56