Dollar General 2011 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

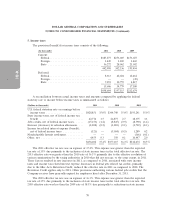

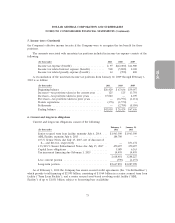

6. Current and long-term obligations (Continued)

All obligations and guarantees of those obligations under the Term Loan Facility are secured by,

subject to certain exceptions, a second-priority security interest in all existing and after-acquired

inventory and accounts receivable; a first priority security interest in substantially all of the Company’s

and the guarantors’ tangible and intangible assets (other than the inventory and accounts receivable

collateral); and a first-priority pledge of the capital stock held by the Company. All obligations under

the ABL Facility are secured by all existing and after-acquired inventory and accounts receivable,

subject to certain exceptions.

The Credit Facilities contain certain covenants, including, among other things, covenants that limit

the Company’s ability to incur additional indebtedness, sell assets, incur additional liens, pay dividends,

make investments or acquisitions, or repay certain indebtedness.

For the years ended February 3, 2012, the Company had borrowings of $1.16 billion and

repayments of $0.97 billion under the ABL Facility. For the years ended January 28, 2011 and

January 29, 2010, the Company had no borrowings or repayments under the ABL Facility. As of

February 3, 2012 and January 28, 2011, the respective letter of credit amounts related to the ABL

Facility included $21.7 million and $52.7 million of standby letters of credit, and $16.7 million and

$19.1 million of commercial letters of credit, and borrowing availability under the ABL Facility was

$807.9 million and $959.3 million, respectively.

On July 6, 2007, the Company issued $1.175 billion aggregate principal amount of 10.625% senior

notes due 2015 (the ‘‘Senior Notes’’) which were issued net of a discount of $23.2 million, and

$725 million aggregate principal amount of 11.875%/12.625% senior subordinated toggle notes due

2017 (the ‘‘Senior Subordinated Notes’’). The Senior Notes were scheduled to mature on July 15, 2015

pursuant to an indenture, dated as of July 6, 2007 (the ‘‘senior indenture’’), and the Senior

Subordinated Notes are scheduled to mature on July 15, 2017, pursuant to an indenture, dated as of

July 6, 2007 (the ‘‘senior subordinated indenture’’). The Senior Notes and the Senior Subordinated

Notes are collectively referred to herein as the ‘‘Notes’’. The senior indenture and the senior

subordinated indenture are collectively referred to herein as the ‘‘indentures.’’

In July 2011, the Company redeemed all $839.3 million outstanding aggregate principal amount of

the Senior Notes at a redemption price of 105.313% of the principal amount, plus accrued and unpaid

interest. The redemption was effected in accordance with the terms of the senior indenture. The

Company funded the redemption price for the Senior Notes with cash on hand and borrowings under

the ABL Facility. In April 2011, the Company repurchased in the open market $25.0 million aggregate

principal amount of Senior Notes at a price of 107.0% plus accrued and unpaid interest. The 2011

redemption and repurchase resulted in pretax losses totaling $60.3 million. Pretax gains and losses

associated with the redemption of the Senior Notes are reflected in Other (income) expense in the

consolidated statements of income for the respective years.

In May 2010, the Company repurchased in the open market $50.0 million aggregate principal

amount of the Senior Notes at a price of 111.0% plus accrued and unpaid interest. In September 2010,

the Company repurchased in the open market $65.0 million aggregate principal amount of the Senior

Notes at a price of 110.75% plus accrued and unpaid interest. The 2010 repurchases resulted in pretax

losses totaling $14.7 million.

In connection with the Company’s November 2009 initial public offering, as further discussed in

Note 2, the Company repurchased $195.7 million of the Senior Notes and $205.2 million of the Senior

75