Dollar General 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

A significant percentage of our outstanding common stock is held by Buck Holdings, L.P., a

Delaware limited partnership controlled by investment funds affiliated with Kohlberg Kravis

Roberts & Co. L.P. (collectively, ‘‘KKR’’). The membership interests of Buck Holdings, L.P. and Buck

Holdings, LLC, the general partner of Buck LP, are held by a private investor group, including affiliates

of each of KKR and Goldman, Sachs & Co. and other equity investors (collectively, the ‘‘Investors’’).

The customers we serve are value-conscious, and Dollar General has always been intensely focused

on helping our customers make the most of their spending dollars. We believe our convenient store

format and broad selection of high quality products at compelling values have driven our substantial

growth and financial success over the years. Like other companies, we have been operating in an

environment with heightened economic challenges and uncertainties. Consumers are facing high rates

of unemployment, fluctuating food, gasoline and energy costs, rising medical costs, and a continued

weakness in housing and consumer credit markets, and the timetable and strength of any economic

recovery is uncertain. Nonetheless, as a result of our long-term mission of serving the value-conscious

customer, coupled with a vigorous focus on improving our operating and financial performance, our

2011 and 2010 financial results were strong, and we remain optimistic with regard to executing our

operating priorities in 2012.

At the beginning of 2008, we defined four operating priorities, which we remain keenly focused on

executing. These priorities are: 1) drive productive sales growth, 2) increase our gross margins,

3) leverage process improvements and information technology to reduce costs, and 4) strengthen and

expand Dollar General’s culture of serving others.

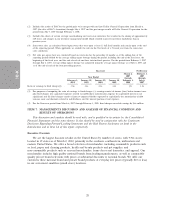

Our first priority is driving productive sales growth by increasing shopper frequency and

transaction amount and maximizing sales per square foot. In 2011, sales in same-stores increased by

6.0%, due to increases in traffic and average transaction, and, to a lesser extent, the impact of inflation.

Sales in same-stores were aided by continued enhancements to our category management processes

which help us determine the most productive merchandise offerings for our customers. Specific sales

growth initiatives in 2011 included: improvement in merchandise in-stock levels; the completion of the

final phase of raising the shelf height in our stores to 78 inches, which impacted health and beauty aids;

further emphasis on the $1.00 price point; the expansion of the number of coolers in approximately

500 existing stores; and the impact of 575 remodeled and relocated stores during the year. In addition

to same-store sales growth, we opened 625 new stores in 2011. Our small box stores offer consumable

items, including packaged and refrigerated foods, to communities that might not otherwise have

convenient access at value prices. To further expand this opportunity, we opened 12 new Dollar

General Market stores in 2011.

Our second priority is to increase gross profit through effective category management, the

expansion of private brand offerings, increased foreign sourcing, shrink reduction, distribution

efficiencies and improvements to our pricing and markdown model, while remaining committed to our

everyday low price strategy. We constantly review our pricing strategy and work diligently to minimize

product cost increases as we focus on providing our customers quality merchandise at great values. In

our consumables category, we strive to offer the optimal balance of the most popular nationally

advertised brands and our own private brands, which generally have higher gross profit rates than

national brands. Throughout 2011, we experienced increased product costs, primarily as the result of

increases in the costs of certain commodities which were passed through to us. These increased product

costs negatively affected gross profit and resulted in an increased LIFO provision. In addition, elevated

costs of diesel fuel affected our overall merchandise costs in 2011. Our shrink reduction efforts were

successful in 2011 and we believe we have additional opportunities to reduce shrink in our stores.

Our third priority is leveraging process improvements and information technology to reduce costs.

We are committed as an organization to extract costs that do not affect the customer experience. In

2011, much of our focus was on decreasing our store labor costs while improving our store standards

29