Dollar General 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Common stock transactions (Continued)

Company also incurred charges for the accelerated vesting of certain share-based awards as discussed in

more detail in Note 11 below.

On September 8, 2009, the Company’s Board of Directors declared a special dividend on the

Company’s outstanding common stock (including shares of restricted stock) of $0.7525 per share, which

was paid on September 11, 2009 to shareholders of record on September 8, 2009. The special dividend

was paid with cash generated from operations. Pursuant to the terms of the Company’s stock option

plans, holders of stock options received either a pro-rata adjustment to the terms of their share-based

awards or a cash payment in substitution for such adjustment as a result of the dividend. Aggregate

payments for the dividend and related share-based amounts totaled approximately $239.7 million.

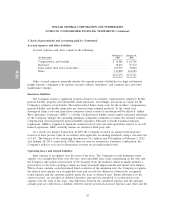

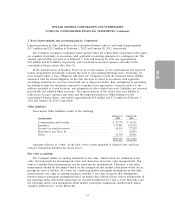

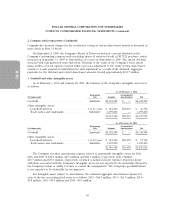

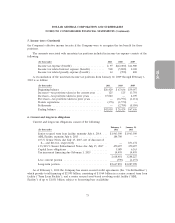

3. Goodwill and other intangible assets

As of February 3, 2012 and January 28, 2011, the balances of the Company’s intangible assets were

as follows:

As of February 3, 2012

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill ............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests .................... 1 to 11 years $ 122,169 $85,415 $ 36,754

Trade names and trademarks ............. Indefinite 1,199,200 — 1,199,200

$1,321,369 $85,415 $1,235,954

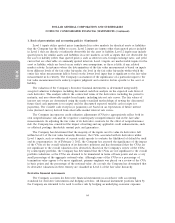

As of January 28, 2011

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill ............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests .................... 1 to 12 years $ 141,180 $83,458 $ 57,722

Trade names and trademarks ............. Indefinite 1,199,200 — 1,199,200

$1,340,380 $83,458 $1,256,922

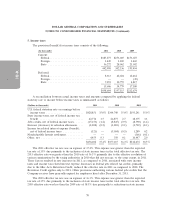

The Company recorded amortization expense related to amortizable intangible assets for 2011,

2010 and 2009 of $21.0 million, $27.4 million and $41.3 million, respectively, ($21.0 million,

$25.7 million and $37.2 million, respectively, of which is included in rent expense). Expected future

cash flows associated with the Company’s intangible assets are not expected to be materially affected by

the Company’s intent or ability to renew or extend the arrangements. The Company’s goodwill balance

is not expected to be deductible for tax purposes.

For intangible assets subject to amortization, the estimated aggregate amortization expense for

each of the five succeeding fiscal years is as follows: 2012—$16.9 million, 2013—$11.9 million, 2014—

$5.8 million, 2015—$0.9 million and 2016—$0.3 million.

68