Dollar General 2011 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

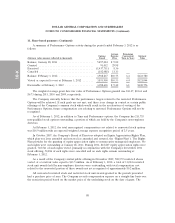

8. Derivative financial instruments (Continued)

Credit-risk-related contingent features

The Company has agreements with all of its interest rate swap counterparties that contain a

provision providing that the Company could be declared in default on its derivative obligations if

repayment of the underlying indebtedness is accelerated by the lender due to the Company’s default on

such indebtedness.

As of February 3, 2012, the fair value of interest rate swaps in a net liability position, which

includes accrued interest but excludes any adjustment for nonperformance risk related to these

agreements, was $11.1 million. If the Company had breached any of these provisions at February 3,

2012, it could have been required to post full collateral or settle its obligations under the agreements at

an estimated termination value of $11.1 million. As of February 3, 2012, the Company had not

breached any of these provisions or posted any collateral related to these agreements.

9. Commitments and contingencies

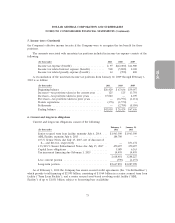

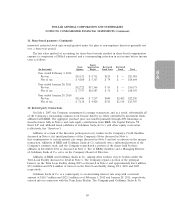

Leases

As of February 3, 2012, the Company was committed under operating lease agreements for most

of its retail stores. Many of the Company’s stores are subject to build-to-suit arrangements with

landlords which typically carry a primary lease term of 10-15 years with multiple renewal options. The

Company also has stores subject to shorter-term leases and many of these leases have renewal options.

Approximately 26% of the leased stores have provisions for contingent rentals based upon a specified

percentage of defined sales volume.

The land and buildings of the Company’s DCs in Fulton, Missouri and Indianola, Mississippi are

subject to operating lease agreements and the leased Ardmore, Oklahoma DC is subject to a financing

arrangement. The entities involved in the ownership structure underlying these leases meet the

accounting definition of a Variable Interest Entity (‘‘VIE’’). The Company is not the primary

beneficiary of these VIEs and, accordingly, has not included these entities in its consolidated financial

statements. Certain leases contain restrictive covenants. As of February 3, 2012, the Company is not

aware of any material violations of such covenants.

In January 1999, the Company sold its DC located in Ardmore, Oklahoma for cash and concurrent

with the sale transaction, the Company leased the property back for a period of 23 years. The

transaction is accounted for as a financing obligation rather than a sale as a result of, among other

things, the lessor’s ability to put the property back to the Company under certain circumstances. The

property and equipment, along with the related lease obligation associated with this transaction are

recorded in the consolidated balance sheets. In August 2007, the Company purchased a secured

promissory note (the ‘‘Ardmore Note’’) from an unrelated third party with a face value of $34.3 million

at the date of purchase which approximated the remaining financing obligation. The Ardmore Note

represents debt issued by the third party entity from which the Company leases the Ardmore DC and

therefore the Company holds the debt instrument pertaining to its lease financing obligation. Because a

legal right of offset exists, the Company is accounting for the Ardmore Note as a reduction of its

outstanding financing obligation in its consolidated balance sheets.

79