Dollar General 2011 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

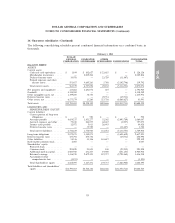

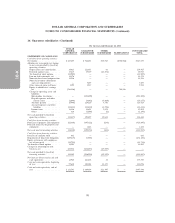

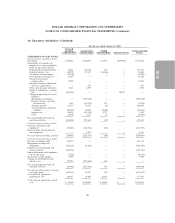

11. Share-based payments (Continued)

nonvested restricted stock unit awards granted under the plan to non-employee directors generally vest

over a three-year period.

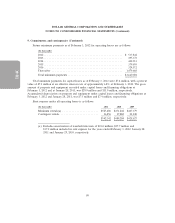

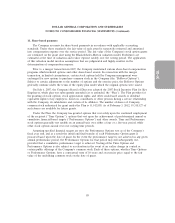

The fair value method of accounting for share-based awards resulted in share-based compensation

expense (a component of SG&A expenses) and a corresponding reduction in net income before income

taxes as follows:

Equity

Stock Appreciation Restricted Restricted

(In thousands) Options Rights Stock Units Stock Total

Year ended February 3, 2012

Pre-tax ............... $15,121 $ 8,731 $129 $ — $23,981

Net of tax ............ $ 9,208 $ 5,317 $ 79 $ — $14,604

Year ended January 28, 2011

Pre-tax ............... $12,722 $17,366 $ 83 $ — $30,171

Net of tax ............ $ 7,755 $10,587 $ 51 $ — $18,393

Year ended January 29, 2010

Pre-tax ............... $11,686 $ 7,237 $840 $2,482 $22,245

Net of tax ............ $ 7,138 $ 4,420 $513 $1,516 $13,587

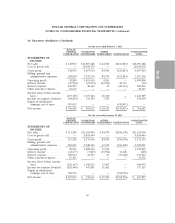

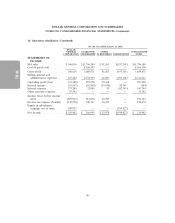

12. Related party transactions

On July 6, 2007, the Company consummated a merger transaction, and as a result, substantially all

of the Company’s outstanding common stock became held by an entity controlled by investment funds

affiliated with KKR. The aggregate purchase price was funded primarily through debt financings as

described more fully in Note 6 and cash equity contributions from KKR, GS Capital Partners VI

Fund, L.P. and affiliated funds (affiliates of Goldman, Sachs & Co.), and other equity co-investors

(collectively, the ‘‘Investors’’).

Affiliates of certain of the Investors participated as (i) lenders in the Company’s Credit Facilities

discussed in Note 6; (ii) initial purchasers of the Company’s Notes discussed in Note 6;

(iii) counterparties to certain interest rate swaps discussed in Note 8 and (iv) as advisors in the merger

transaction. Affiliates of KKR and Goldman, Sachs & Co. indirectly own a substantial portion of the

Company’s common stock, and the Company repurchased a portion of the shares held by these

affiliates in December 2011 as discussed in Note 2. Two of KKR’s members and a Managing Director

of Goldman, Sachs & Co. serve on the Company’s Board of Directors.

Affiliates of KKR and Goldman, Sachs & Co. (among other entities) may be lenders under the

Term Loan Facility discussed in detail in Note 6. The Company repaid a portion of the principal

balance on the Term Loan Facility during 2009 as discussed in Note 6 and approximately $66.4 million,

$53.4 million and $74.8 million of interest on the Term Loan Facility during 2011, 2010 and 2009,

respectively.

Goldman, Sachs & Co. is a counterparty to an amortizing interest rate swap with a notional

amount of $116.7 million and $323.3 million as of February 3, 2012 and January 28, 2011, respectively,

entered into in connection with the Term Loan Facility. The Company paid Goldman, Sachs & Co.

89