Dollar General 2011 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

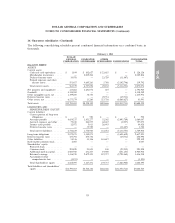

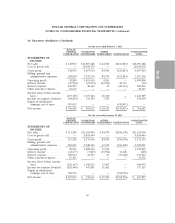

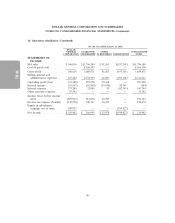

14. Quarterly financial data (unaudited) (Continued)

As discussed in Note 6, in the second quarter of 2011, the Company repurchased $839.3 million

principal amount of its outstanding Senior Notes, resulting in a pretax loss of $58.1 million

($35.4 million net of tax, or $0.10 per diluted share) which is recognized as Other (income) expense.

As discussed in Note 11, in the fourth quarter of 2011 the Company incurred share-based

compensation expenses of $8.6 million ($5.3 million net of tax, or $0.02 per diluted share) for the

accelerated vesting of certain share-based awards in conjunction with a secondary offering of the

Company’s common stock which is included in SG&A expenses.

As discussed in Note 11, in the first quarter of 2010 the Company incurred share-based

compensation expenses of $13.3 million ($8.1 million net of tax, or $0.02 per diluted share) for the

accelerated vesting of certain share-based awards in conjunction with a secondary offering of the

Company’s common stock which is included in SG&A expenses.

As discussed in Note 6, in the second quarter of 2010, the Company repurchased $50.0 million

principal amount of its outstanding Senior Notes, resulting in a pretax loss of $6.5 million ($4.0 million

net of tax, or $0.01 per diluted share) which is recognized as Other (income) expense.

As discussed in Note 6, in the third quarter of 2010, the Company repurchased $65.0 million

principal amount of its outstanding Senior Notes, resulting in a pretax loss of $8.2 million ($5.0 million

net of tax, or $0.01 per diluted share) which is recognized as Other (income) expense.

As discussed in Note 11, in the fourth quarter of 2010 the Company incurred share-based

compensation expenses of $3.8 million ($2.3 million net of tax, or $0.01 per diluted share) for the

accelerated vesting of certain share-based awards in conjunction with a secondary offering of the

Company’s common stock which is included in SG&A expenses.

15. Subsequent Event

On March 15, 2012, the ABL Facility discussed in Note 6 was amended and restated. The maturity

date was extended from July 6, 2013 to July 6, 2014 and the total commitment was increased from

$1.031 billion to $1.2 billion (of which up to $350.0 million is available for letters of credit), subject to

borrowing base availability. The initial applicable margin for borrowings under the ABL Facility is

1.75% for LIBOR borrowings and 0.75% for base-rate borrowings. The commitment fee for any

unutilized commitments has been initially established at a rate of 0.375% per annum. An affiliate of

Goldman, Sachs & Co. is a lender under the amended and restated ABL Facility.

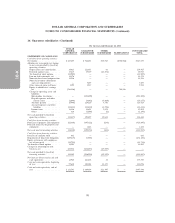

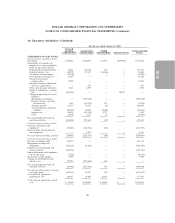

16. Guarantor subsidiaries

Certain of the Company’s subsidiaries (the ‘‘Guarantors’’) have fully and unconditionally

guaranteed on a joint and several basis the Company’s obligations under certain outstanding debt

obligations. Each of the Guarantors is a direct or indirect wholly-owned subsidiary of the Company.

92