Dollar General 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

Certain Covenants and Events of Default. The senior secured credit agreements contain a number

of covenants that, among other things, restrict, subject to certain exceptions, our ability to:

• incur additional indebtedness;

• sell assets;

• pay dividends and distributions or repurchase our capital stock;

• make investments or acquisitions;

• repay or repurchase subordinated indebtedness, including the Senior Subordinated Notes

discussed below;

• amend material agreements governing our subordinated indebtedness, including the Senior

Subordinated Notes discussed below;

• change our lines of business.

The senior secured credit agreements also contain certain customary affirmative covenants and

events of default.

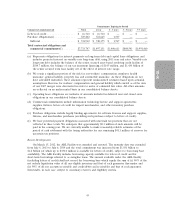

At February 3, 2012, we had the following amounts outstanding under our ABL Facility:

borrowings of $184.7 million; standby letters of credit of $21.7 million; and commercial letters of credit

of $16.7 million.

Senior Notes due 2015 and Senior Subordinated Toggle Notes due 2017

Overview. On April 29, 2011, we repurchased in the open market $25.0 million outstanding

aggregate principal amount of our 10.625% senior notes due 2015 (the ‘‘Senior Notes’’) at a

redemption price of 107.0% of the principal amount, plus accrued and unpaid interest, resulting in a

pretax loss of $2.2 million. On July 15, 2011, we redeemed the remaining $839.3 million outstanding

aggregate principal amount of the Senior Notes (which had been scheduled to mature on July 15, 2015)

at a redemption price of 105.313% of the principal amount, plus accrued and unpaid interest, resulting

in a pretax loss of $58.1 million. The redemption was effected in accordance with the indenture dated

as of July 6, 2007 governing the Senior Notes pursuant to a notice dated May 31, 2011. The pretax

losses on these transactions are reflected in Other (income) expense in our consolidated statement of

income for 2011. We funded the redemption price for the Senior Notes with cash on hand and

borrowings under the ABL Facility. The redemption is a significant factor in the reduction of our cash

balances at February 3, 2012 compared to the prior year end.

As of February 3, 2012, we had $450.7 million aggregate principal amount of 11.875%/12.625%

senior subordinated toggle notes due 2017 (the ‘‘Senior Subordinated Notes’’) outstanding, which

mature on July 15, 2017, pursuant to an indenture dated as of July 6, 2007 (the ‘‘senior subordinated

indenture’’).

Interest on the Senior Subordinated Notes is payable on January 15 and July 15 of each year. Cash

interest on the Senior Subordinated Notes accrues at a rate of 11.875% per annum. An option to pay

interest by increasing the principal amount of the Senior Subordinated Notes or issuing new Senior

Subordinated Notes (‘‘PIK interest’’) instead of paying cash interest expired in 2011. As a result, all

interest on the Senior Subordinated Notes has been paid or will be payable in cash.

The Senior Subordinated Notes are fully and unconditionally guaranteed by each of the existing

and future direct or indirect wholly owned domestic subsidiaries that guarantee the obligations under

our Credit Facilities.

We intend to redeem some or all of the Senior Subordinated Notes near the first scheduled call

date in July 2012. We may redeem some or all of the Senior Subordinated Notes at any time at

39