Dollar General 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

The initial applicable margin for all borrowings under the ABL Facility is 1.75% for LIBOR

borrowings and 0.75% for base-rate borrowings. We are also required to pay a commitment fee to the

lenders under the ABL Facility for any unutilized commitments, initially at a rate of 0.375% per

annum. The applicable margins for borrowings and the commitment fees under the ABL Facility are

subject to adjustment each quarter based on average daily excess availability under the ABL Facility.

We also must pay customary letter of credit fees.

The entire principal amounts (if any) outstanding under the ABL Facility are due and payable in

full at maturity, on July 6, 2014, on which day the commitments thereunder will terminate. All

obligations and related guarantees under the ABL Facility are secured by the Revolving Facility

Collateral, subject to certain exceptions.

In addition, we recently commenced efforts to amend our Term Loan Facility to extend the

maturity of a portion of the Term Loan Facility from 2014 to 2017. There can be no assurance that we

will be able to amend the Term Loan Facility on these terms, or at all.

Share Repurchase Program

On November 30, 2011, our Board of Directors approved a share repurchase program of up to

$500 million of outstanding shares of our common stock. Under the authorization, purchases may be

made in the open market or in privately negotiated transactions from time to time subject to market

conditions. This repurchase authorization has no expiration date. As part of this repurchase program,

pursuant to a Share Repurchase Agreement between Dollar General and Buck Holdings L.P., dated

December 4, 2011, concurrent with the closing of a secondary offering in December 2011, Dollar

General purchased 4,915,637 shares of Common Stock from Buck Holdings, L.P. for an aggregate

purchase price of $185 million.

Other Considerations

We have no current plans to pay any cash dividends on our common stock and instead may retain

earnings, if any, for future operation and expansion, common stock repurchases and debt repayment.

Any decision to declare and pay dividends in the future will be made at the discretion of our Board of

Directors, subject to certain limitations found in covenants in our Credit Facilities and in the indenture

governing the Senior Subordinated Notes as discussed in more detail above, and will depend on, among

other things, our results of operations, cash requirements, financial condition, contractual restrictions

and other factors that our Board of Directors may deem relevant.

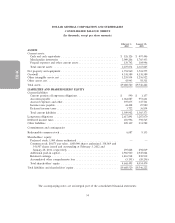

Our inventory balance represented approximately 49% of our total assets exclusive of goodwill and

other intangible assets as of February 3, 2012. Our proficiency in managing our inventory balances can

have a significant impact on our cash flows from operations during a given fiscal year. As a result,

efficient inventory management has been and continues to be an area of focus for us.

As described in Note 9 to the Consolidated Financial Statements, we are involved in a number of

legal actions and claims, some of which could potentially result in material cash payments. Adverse

developments in those actions could materially and adversely affect our liquidity. As discussed in

Note 5 to the Consolidated Financial Statements, we also have certain income tax-related

contingencies. Future negative developments could have a material adverse effect on our liquidity.

In July 2011, Standard & Poor’s upgraded our corporate rating to BB+ with a stable outlook, and

Moody’s raised our corporate rating to Ba2 with a stable outlook. Our current credit ratings, as well as

future rating agency actions, could (i) impact our ability to obtain financings to finance our operations

on satisfactory terms; (ii) affect our financing costs; and (iii) affect our insurance premiums and

collateral requirements necessary for our self-insured programs. There can be no assurance that we will

be able to maintain or improve our current credit ratings.

44