Dollar General 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

Liquidity and Capital Resources

Current Financial Condition

During the past three years, we have generated an aggregate of approximately $2.55 billion in cash

flows from operating activities. During that period, we expanded the number of stores we operate by

1,575, or approximately 19%, remodeled or relocated 1,529 stores, or approximately 15% of stores we

operated as of February 3, 2012, and incurred approximately $1.19 billion in capital expenditures. We

made certain strategic decisions which slowed our store growth for a period prior to 2009, but we

reaccelerated store growth beginning in 2009 and currently plan to continue that strategy in 2012 and

for the foreseeable future.

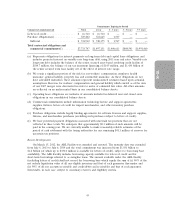

At February 3, 2012, we had total outstanding debt (including the current portion of long-term

obligations) of $2.62 billion, which includes our senior secured asset-based revolving credit facility

(‘‘ABL Facility’’ and, together with the Term Loan Facility, the ‘‘Credit Facilities’’), and senior

subordinated notes, all of which are described in greater detail below. We had $807.9 million available

for borrowing under the ABL Facility at February 3, 2012. Our liquidity needs are significant, primarily

due to our debt service and other obligations. Our substantial debt could adversely affect our ability to

raise additional capital to fund our operations, limit our ability to react to changes in the economy or

our industry or to pursue our growth strategy, expose us to interest rate risk to the extent of our

variable rate debt, and increase the difficulty of our ability to make payments on our outstanding debt

securities.

We believe our cash flow from operations and existing cash balances, combined with availability

under the Credit Facilities (described in greater detail below), will provide sufficient liquidity to fund

our current obligations, projected working capital requirements and capital spending for a period that

includes the next twelve months as well as the next several years.

The ABL Facility was amended and restated on March 15, 2012 as discussed below under ‘‘Recent

Developments.’’

Credit Facilities

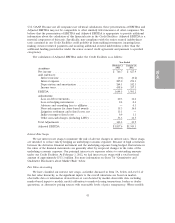

Overview. The Credit Facilities consist of the $1.964 billion Term Loan Facility and the ABL

Facility which was recently amended to a maximum of $1.2 billion (of which up to $350.0 million is

available for letters of credit), subject to borrowing base availability. The ABL Facility includes

borrowing capacity available for letters of credit and for short-term borrowings referred to as swingline

loans.

Interest Rates and Fees. Borrowings under the Credit Facilities bear interest at a rate equal to an

applicable margin plus, at our option, either (a) LIBOR or (b) a base rate (which is usually equal to

the prime rate). The applicable margin for borrowings under the Term Loan Facility is 2.75% for

LIBOR borrowings and 1.75% for base-rate borrowings. The interest rate for borrowings under the

Term Loan Facility was 3.1% (without giving effect to the market rate swaps discussed below) as of

February 3, 2012.

The current interest rate for the amended ABL Facility is described below under ‘‘Recent

Developments.’’ As of February 3, 2012, the applicable margin for borrowings under the ABL Facility

(except for the last out tranche) was 1.50% for LIBOR borrowings and 0.50% for base-rate borrowings,

the applicable margin for the last out borrowings was 2.25% for LIBOR borrowings and 1.25% for

base-rate borrowings and the commitment fee to the lenders for any unutilized commitments was

0.375% per annum. See Item 7A. ‘‘Quantitative and Qualitative Disclosures About Market Risk’’ below

for a discussion of our use of interest rate swaps to manage our interest rate risk.

37