Dollar General 2011 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued)

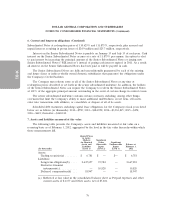

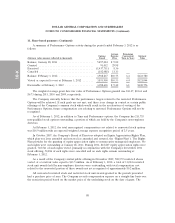

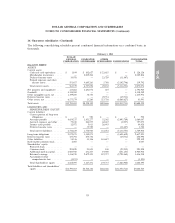

The weighted average for key assumptions used in determining the fair value of all options granted

in the years ended February 3, 2012, January 28, 2011, and January 29, 2010, and a summary of the

methodology applied to develop each assumption, are as follows:

February 3, January 28, January 29,

2012 2011 2010

Expected dividend yield ................... 0% 0% 0%

Expected stock price volatility .............. 38.7% 39.1% 41.2%

Weighted average risk-free interest rate ....... 2.3% 2.8% 2.8%

Expected term of options (years) ............ 6.8 7.0 7.4

Expected dividend yield—This is an estimate of the expected dividend yield on the Company’s

stock. The Company is subject to limitations on the payment of dividends under its Credit Facilities as

further discussed in Note 6. An increase in the dividend yield will decrease compensation expense.

Expected stock price volatility—This is a measure of the amount by which the price of the

Company’s common stock has fluctuated or is expected to fluctuate. For awards issued under the Plan

through October 2011, the expected volatilities were based upon the historical volatilities of a peer

group of four companies. Beginning in November 2011, the expected volatilities for awards are based

on the historical volatility of the Company’s publicly traded common stock. An increase in the expected

volatility will increase compensation expense.

Weighted average risk-free interest rate—This is the U.S. Treasury rate for the week of the grant

having a term approximating the expected life of the option. An increase in the risk-free interest rate

will increase compensation expense.

Expected term of options—This is the period of time over which the options granted are expected

to remain outstanding. Options granted have a maximum term of 10 years. Due to the relatively limited

historical data for grants issued under the Plan, the Company has estimated the expected term as the

mid-point between the vesting date and the contractual term of the option. An increase in the expected

term will increase compensation expense.

Both the Time Options and the Performance Options are subject to various provisions set forth in

a management stockholder’s agreement entered into with each option holder by which the Company

may require the employee, upon termination, to sell to the Company any vested options or shares

received upon exercise of the Time Options or Performance Options at amounts that differ based upon

the reason for the termination. In particular, in the event that the employee resigns ‘‘without good

reason’’ (as defined in the management stockholder’s agreement), then any options whether or not then

exercisable are forfeited and any shares received upon prior exercise of such options are callable at the

Company’s option at an amount equal to the lesser of fair value or the amount paid for the shares

(i.e., the exercise price). In such cases, because the employee would not benefit in any share

appreciation over the exercise price, for accounting purposes such options are not considered vested

until the expiration of the Company’s call option, which is generally five years subsequent to the date

of grant. Accordingly, all references to the vesting provisions or vested status of the options discussed

in this note give effect to the vesting pursuant to these accounting provisions and may differ from

descriptions of the vesting status of the Time Options and Performance Options located elsewhere in

this report or the Company’s other SEC filings. The Company records expense for Time Options on a

straight-line basis over the term of the management stockholder’s agreement.

86