Dollar General 2011 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

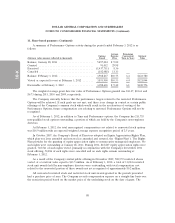

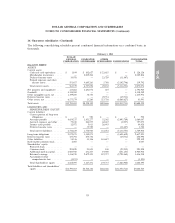

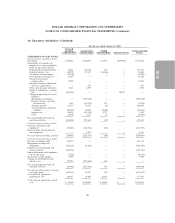

13. Segment reporting

The Company manages its business on the basis of one reportable segment. See Note 1 for a brief

description of the Company’s business. As of February 3, 2012, all of the Company’s operations were

located within the United States with the exception of a Hong Kong subsidiary, and a liaison office in

India, the collective assets and revenues of which are not material. The following net sales data is

presented in accordance with accounting standards related to disclosures about segments of an

enterprise.

(In thousands) 2011 2010 2009

Classes of similar products:

Consumables .................... $10,833,735 $ 9,332,119 $ 8,356,381

Seasonal ........................ 2,051,098 1,887,917 1,711,471

Home products ................... 1,005,219 917,638 869,772

Apparel ........................ 917,136 897,326 858,756

Net sales ...................... $14,807,188 $13,035,000 $11,796,380

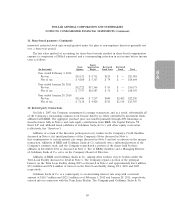

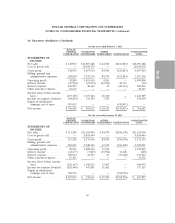

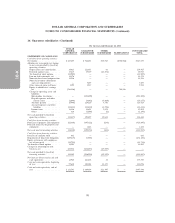

14. Quarterly financial data (unaudited)

The following is selected unaudited quarterly financial data for the fiscal years ended February 3,

2012 and January 28, 2011. Each quarterly period listed below was a 13-week accounting period, with

the exception of the fourth quarter of 2011, which was a 14-week accounting period. The sum of the

four quarters for any given year may not equal annual totals due to rounding.

First Second Third Fourth

(In thousands) Quarter Quarter Quarter Quarter

2011:

Net sales .................. $3,451,697 $3,575,194 $3,595,224 $4,185,073

Gross profit ................ 1,087,397 1,148,342 1,115,802 1,346,369

Operating profit ............. 321,618 350,029 310,917 508,240

Net income ................ 156,969 146,042 171,164 292,510

Basic earnings per share ....... 0.46 0.43 0.50 0.86

Diluted earnings per share ..... 0.45 0.42 0.50 0.85

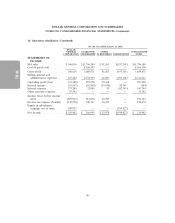

First Second Third Fourth

(In thousands) Quarter Quarter Quarter Quarter

2010:

Net sales .................. $3,111,314 $3,214,155 $3,223,427 $3,486,104

Gross profit ................ 999,756 1,035,979 1,010,668 1,130,153

Operating profit ............. 290,723 300,757 274,334 408,251

Net income ................ 135,996 141,195 128,120 222,546

Basic earnings per share ....... 0.40 0.41 0.38 0.65

Diluted earnings per share ..... 0.39 0.41 0.37 0.64

As discussed in Note 6, in the first quarter of 2011, the Company repurchased $25.0 million

principal amount of its outstanding Senior Notes, resulting in a pretax loss of $2.2 million ($1.3 million

net of tax, or less than $0.01 per diluted share) which is recognized as Other (income) expense.

91