Dollar General 2011 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

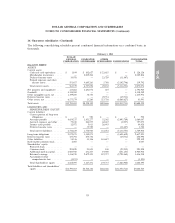

11. Share-based payments (Continued)

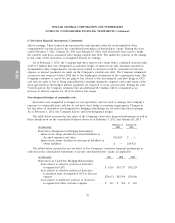

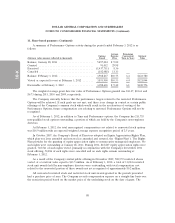

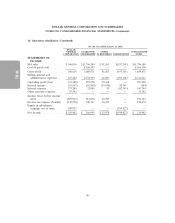

A summary of Performance Options activity during the period ended February 3, 2012 is as

follows:

Average Remaining

Options Exercise Contractual Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Price Term in Years Value

Balance, January 28, 2011 ...................... 5,497,024 $ 9.82

Granted ................................... 91,012 29.98

Exercised .................................. (1,437,711) 8.36

Canceled ................................... (182,088) 11.13

Balance, February 3, 2012 ...................... 3,968,237 $10.75 6.4 $123,780

Vested or expected to vest at February 3, 2012 ....... 3,853,900 $10.53 6.4 $121,044

Exercisable at February 3, 2012 .................. 3,098,603 $ 9.42 6.1 $100,756

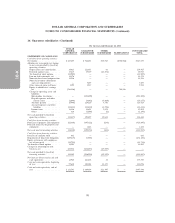

The weighted average grant date fair value of Performance Options granted was $13.47, $12.61 and

$6.73 during 2011, 2010 and 2009, respectively.

The Company currently believes that the performance targets related to the unvested Performance

Options will be achieved. If such goals are not met, and there is no change in control or certain public

offerings of the Company’s common stock which would result in the acceleration of vesting of the

Performance Options, future compensation cost relating to unvested Performance Options will not be

recognized.

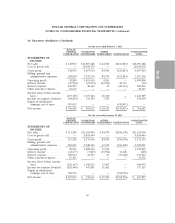

As of February 3, 2012, in addition to Time and Performance options, the Company has 211,755

non-qualified stock options outstanding, a portion of which are held by the Company’s non-employee

directors.

At February 3, 2012, the total unrecognized compensation cost related to nonvested stock options

was $16.9 million with an expected weighted average expense recognition period of 2.5 years.

In October 2007, the Company’s Board of Directors adopted an Equity Appreciation Rights Plan,

which plan was later amended and restated (as amended and restated, the ‘‘Rights Plan’’). The Rights

Plan provides for the granting of equity appreciation rights to nonexecutive managerial employees. No

such rights were outstanding at January 28, 2011. During 2011, 818,847 equity appreciation rights were

granted, 768,561 of such rights vested, primarily in conjunction with the Company’s December 2011

stock offering, 50,286 of such rights were cancelled and no such rights remain outstanding at

February 3, 2012.

As a result of the Company’s initial public offering in November 2009, 508,572 restricted shares

vested, at a total fair value equal to $11.5 million. As of February 3, 2012, a total of 13,024 restricted

stock unit awards held by non-employee directors were outstanding, with total compensation cost

related to the nonvested portion of these awards not yet recognized of approximately $0.2 million.

All nonvested restricted stock and restricted stock unit awards granted in the periods presented

had a purchase price of zero. The Company records compensation expense on a straight-line basis over

the restriction period based on the market price of the underlying stock on the date of grant. The

88