Dollar General 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

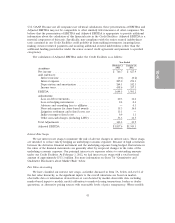

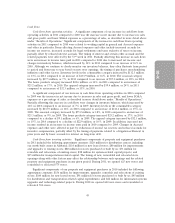

Commitments Expiring by Period

Commercial commitments(d) Total 1 year 1 - 3 years 3 - 5 years 5+ years

Letters of credit .................. $ 16,710 $ 16,710 $ — $ — $ —

Purchase obligations(e) ............. 725,202 723,665 1,537 — —

Subtotal ...................... $ 741,912 $ 740,375 $ 1,537 $ — $ —

Total contractual obligations and

commercial commitments(f) ....... $7,733,747 $1,497,131 $3,400,613 $844,543 $1,991,460

(a) Represents obligations for interest payments on long-term debt and capital lease obligations, and

includes projected interest on variable rate long-term debt, using 2011 year end rates. Variable rate

long-term debt includes the balance of the senior secured asset-based revolving credit facility of

$184.7 million, the balance of our tax increment financing of $14.5 million, and $1.430 billion of

the senior secured term loan facility net of the effect of interest rate swaps.

(b) We retain a significant portion of the risk for our workers’ compensation, employee health

insurance, general liability, property loss and automobile insurance. As these obligations do not

have scheduled maturities, these amounts represent undiscounted estimates based upon actuarial

assumptions. Reserves for workers’ compensation and general liability which existed as of the date

of our 2007 merger were discounted in order to arrive at estimated fair value. All other amounts

are reflected on an undiscounted basis in our consolidated balance sheets.

(c) Operating lease obligations are inclusive of amounts included in deferred rent and closed store

obligations in our consolidated balance sheets.

(d) Commercial commitments include information technology license and support agreements,

supplies, fixtures, letters of credit for import merchandise, and other inventory purchase

obligations.

(e) Purchase obligations include legally binding agreements for software licenses and support, supplies,

fixtures, and merchandise purchases (excluding such purchases subject to letters of credit).

(f) We have potential payment obligations associated with uncertain tax positions that are not

reflected in these totals. We anticipate that approximately $0.3 million of such amounts will be

paid in the coming year. We are currently unable to make reasonably reliable estimates of the

period of cash settlement with the taxing authorities for our remaining $41.1 million of reserves for

uncertain tax positions.

Recent Developments

On March 15, 2012, the ABL Facility was amended and restated. The maturity date was extended

from July 6, 2013 to July 6, 2014 and the total commitment was increased from $1.031 billion to

$1.2 billion (of which up to $350.0 million is available for letters of credit), subject to borrowing base

availability. The ABL Facility includes borrowing capacity available for letters of credit and for

short-term borrowings referred to as swingline loans. The amount available under the ABL Facility

(including letters of credit) shall not exceed the borrowing base which equals the sum of (i) 90% of the

net orderly liquidation value of all our eligible inventory and that of each guarantor thereunder and

(ii) 90% of all our accounts receivable and credit/debit card receivables and that of each guarantor

thereunder, in each case, subject to customary reserves and eligibility criteria.

43