Dollar General 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

The CNG Committee’s charter and our Corporate Governance Guidelines require the CNG

Committee to consider candidates submitted by our shareholders in accordance with the notice

provisions of our Bylaws (see ‘‘Can shareholders nominate directors?’’ below) and to apply the same

criteria to the evaluation of those candidates as it applies to other director candidates. The CNG

Committee may also use a variety of other methods to identify potential director candidates, such as

recommendations by our directors, management, or third party search firms. In January 2012, the

Board instructed the CNG Committee to initiate a search for additional director candidates. The CNG

Committee has retained a third-party search firm to assist in identifying potential future Board

candidates who meet our qualification and experience requirements, as well as compiling and

evaluating information regarding the candidates’ qualifications, experience and independence.

Four of our directors, Messrs. Agrawal, Calbert, Dreiling and Jones, are managers of Buck

Holdings, LLC, which serves as the general partner of Buck Holdings, L.P. The limited liability

company agreement of Buck Holdings, LLC generally requires Buck Holdings, LLC to cause shares of

our common stock held by Buck Holdings, L.P. to be voted in favor of any person designated to be a

member of our Board pursuant to our shareholders’ agreement with Buck Holdings, L.P.

Pursuant to our shareholders’ agreement with Buck Holdings, L.P. and the sponsor

shareholders identified in that agreement, certain of our shareholders have the right to designate

nominees to our Board, subject to their election by our shareholders at the annual meeting.

Specifically, KKR 2006 Fund L.P., KKR PEI Investments, L.P., KKR Partners III, L.P., 8 North America

Investor LP, and their respective permitted transferees (collectively, the ‘‘KKR Shareholders’’) have the

right to designate the following percentage of the number of total directors comprising our Board as

long as Buck Holdings, L.P. beneficially owns the following specified amount of the then outstanding

shares of our common stock:

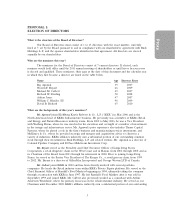

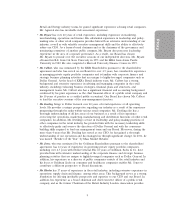

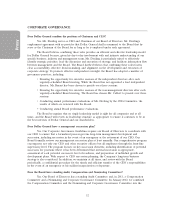

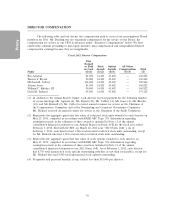

Beneficial Ownership of Dollar General

% of Directors KKR may Designate Common Stock by Buck Holdings, L.P.

Up to a majority >50%

Up to 40% >40% but < or equal to 50%

Up to 30% >30% but < or equal to 40%

Up to 20% >20% but < or equal to 30%

Up to 10% At least 5%

Any fractional amount that results from determining the percentage of the total number of

directors will be rounded up to the next whole number. In the event that the KKR Shareholders have

the right to designate only one director, they also have the right to designate one person to serve as a

non-voting Board observer.

In addition, pursuant to the shareholders’ agreement, GS Capital Partners VI Fund, L.P.,

GS Capital Partners VI Parallel, L.P., GS Capital Partners VI GmbH & Co. KG, GS Capital

Partners VI Offshore Fund, L.P., GSUIG, L.L.C., Goldman Sachs DGC Investors, L.P. and Goldman

Sachs DGC Investors Offshore Holdings, L.P., and their permitted transferees (collectively, the

‘‘Goldman Shareholders’’) have the right, as long as they beneficially own at least 5% of the then

outstanding shares of our common stock, to designate one director and one non-voting Board observer.

Each of the KKR Shareholders and the Goldman Shareholders have the right to remove and

replace their director-designees at any time and for any reason and to fill any vacancies otherwise

resulting in such positions.

Pursuant to the shareholders’ agreement, the KKR Shareholders have nominated

Messrs. Calbert and Agrawal, and the Goldman Shareholders have nominated Mr. Jones. These

nominees, like all of our director nominees, are subject to election by our shareholders at the annual

meeting.

7