Dollar General 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

long-term portion in Other liabilities in the consolidated balance sheets, and totaled approximately

$31.3 million and $23.2 million at February 3, 2012 and January 28, 2011, respectively.

The Company recognizes contingent rental expense when the achievement of specified sales targets

are considered probable, in accordance with applicable accounting standards for contingent rent. The

amount expensed but not paid as of February 3, 2012 and January 28, 2011 was approximately

$9.4 million and $9.2 million, respectively, and is included in Accrued expenses and other in the

consolidated balance sheets (See Note 9).

In the normal course of business, based on an overall analysis of store performance and expected

trends, management periodically evaluates the need to close underperforming stores. Generally, for

store closures where a lease obligation still exists, the Company records the estimated future liability

associated with the rental obligation on the date the store is closed in accordance with applicable

accounting standards for costs associated with exit or disposal activities. Key assumptions in calculating

the liability include the timeframe expected to terminate lease agreements, estimates related to the

sublease potential of closed locations, and estimation of other related exit costs. Liabilities are reviewed

periodically and adjusted when necessary. The current portion of the closed store rent liability is

reflected in Accrued expenses and other and the long-term portion in Other liabilities in the

consolidated balance sheets, and totaled approximately $4.9 million and $7.0 million at February 3,

2012 and January 28, 2011, respectively.

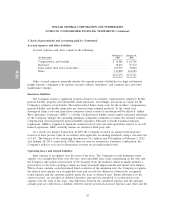

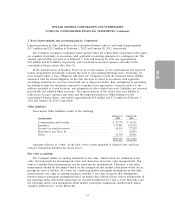

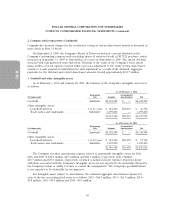

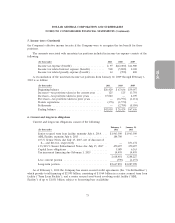

Other liabilities

Non-current Other liabilities consist of the following:

February 3, January 28,

(In thousands) 2012 2011

Compensation and benefits ......................... $ 17,570 $ 14,531

Insurance ...................................... 137,891 131,912

Income tax related reserves ......................... 41,130 27,255

Derivatives (see Note 8) ........................... — 34,923

Other ......................................... 32,558 22,961

$229,149 $231,582

Amounts reflected as ‘‘other’’ in the table above consist primarily of deferred rent and lease

contract termination liabilities for closed stores.

Fair value accounting

The Company utilizes accounting standards for fair value, which include the definition of fair

value, the framework for measuring fair value, and disclosures about fair value measurements. Fair

value is a market-based measurement, not an entity-specific measurement. Therefore, a fair value

measurement should be determined based on the assumptions that market participants would use in

pricing the asset or liability. As a basis for considering market participant assumptions in fair value

measurements, fair value accounting standards establish a fair value hierarchy that distinguishes

between market participant assumptions based on market data obtained from sources independent of

the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and

the reporting entity’s own assumptions about market participant assumptions (unobservable inputs

classified within Level 3 of the hierarchy).

63