Dollar General 2011 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

Management estimates

The preparation of financial statements and related disclosures in conformity with accounting

principles generally accepted in the United States requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the consolidated financial statements and the reported amounts of

revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Accounting standards

In June 2011, the FASB issued an accounting standards update which revises the manner in which

entities present comprehensive income in their financial statements. The new standard removes the

presentation options in current guidance and requires entities to report components of comprehensive

income in either a continuous statement of comprehensive income or separate but consecutive

statements. The new standard does not change the items that must be reported in other comprehensive

income. In addition, in December 2011, the FASB issued a related amendment which defers the

requirement to present components of reclassifications of other comprehensive income on the face of

the income statement. For public entities, the amendments are effective for fiscal years, and interim

periods within those years, beginning after December 15, 2011. The Company will adopt this guidance

in the first quarter of 2012, and does not expect such adoption to have a material effect on its

consolidated financial statements.

Reclassifications

Certain reclassifications of the 2010 and 2009 amounts have been made to conform to the 2011

presentation.

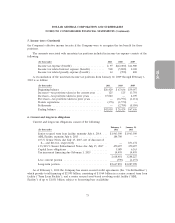

2. Common stock transactions

On November 30, 2011, the Company’s Board of Directors authorized a $500 million common

stock repurchase program. Under the program, shares of the Company’s common stock may be

repurchased from time to time in open market transactions or in privately negotiated purchases, which

could include repurchases from the Company’s controlling shareholder, Buck Holdings, L.P. (which is

controlled by affiliates of Kohlberg Kravis Roberts & Co., L.P. (‘‘KKR’’) and Goldman Sachs & Co), or

other related parties if appropriate. The timing and actual number of shares purchased will depend on

a variety of factors, such as price, market conditions and other factors. Repurchases under the program

may be funded from available cash or borrowings under the Company’s revolving credit facility. The

repurchase authorization has no expiration date. In connection with the repurchase program, on

December 12, 2011, the Company repurchased 4,915,637 shares from Buck Holdings, L.P. for

$185 million.

On November 18, 2009, the Company completed an initial public offering of common stock. The

Company issued 22,700,000 shares in the offering, and Buck Holdings, L.P. sold an additional

16,515,000 outstanding shares. Net proceeds to the Company from the offering of $446.0 million were

used to redeem outstanding debt, as discussed in more detail in Note 6 below. The Company paid

certain fees to KKR and Goldman, Sachs & Co. in connection with the offering, including fees paid to

terminate an advisory agreement with these parties as discussed in more detail in Note 12 below. The

67