Dollar General 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

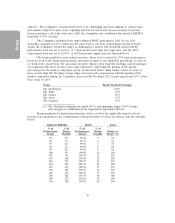

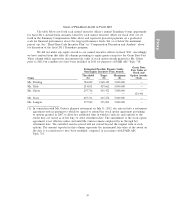

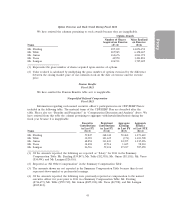

Outstanding Equity Awards at 2011 Fiscal Year-End

The table below sets forth information regarding awards granted under our 2007 Stock

Incentive Plan and held by our named executive officers as of the end of fiscal 2011. We have omitted

the columns pertaining to stock awards because they are inapplicable. The exercise prices set forth in

the table below reflect an adjustment made in connection with a special dividend paid to our

shareholders in September 2009 to reflect the effects of such dividend on such options, as required by

the terms of such options. In October 2009, we completed a reverse split of 1 share for each 1.75

shares of common stock outstanding. The exercise prices of, and number of shares outstanding under,

our equity awards existing at the time of the reverse stock split were retroactively adjusted to reflect

the reverse stock split and are reflected in the table below.

Option Awards

Equity Incentive

Plan Awards:

Number of Number of Number of

Securities Securities Securities

Underlying Underlying Underlying

Unexercised Unexercised Unexercised Option

Options Options Unearned Exercise Option

(#) (#) Options Price Expiration

Name Exercisable Unexercisable (#) ($) Date

Mr. Dreiling 362,033(1) 142,857(1) — 7.9975 07/06/2017

428,571(2) — — 7.9975 07/06/2017

100,000(3) — — 29.38 04/23/2020

Mr. Tehle 134,743(1) 62,857(1) — 7.9975 07/06/2017

188,571(2) — — 7.9975 07/06/2017

Ms. Guion 100,965(1) 50,000(1) — 7.9975 07/06/2017

150,000(2) — — 7.9975 07/06/2017

Mr. Vasos 113,383(1) 100,000(1) — 7.9975 12/19/2018

150,000(4) — 91,667(4) 7.9975 12/19/2018

Ms. Lanigan 80,972(1) 38,571(1) — 7.9975 07/06/2017

115,713(2) — — 7.9975 07/06/2017

(1) These options are part of a grant of time-based options scheduled to vest 20% per year on each of the

first five anniversaries of (a) July 6, 2007 (in the case of all listed officers other than Mr. Vasos) or

(b) December 1, 2008 (in the case of Mr. Vasos); in each case subject to certain accelerated vesting

provisions as described in ‘‘Potential Payments upon Termination or Change in Control’’ below.

(2) These options are part of a grant of performance-based options scheduled to vest 20% per year on each

of February 1, 2008, January 30, 2009, January 29, 2010, January 28, 2011 and February 3, 2012 if we

achieve specific annual adjusted EBITDA-based targets for the applicable fiscal year, all of which have

been achieved.

(3) These options vested on April 23, 2011.

(4) These options are part of a grant of performance-based options scheduled to vest (a) as to 8,333 shares

on January 30, 2009, 50,000 shares on each of January 29, 2010, January 28, 2011, February 3, 2012 and

February 1, 2013, and 41,667 shares on January 31, 2014, if we achieve specific annual adjusted

EBITDA-based targets for the applicable fiscal year; or (b) on a ‘‘catch up’’ basis if an applicable

cumulative adjusted EBITDA-based target is achieved at the end of fiscal year 2012, 2013 or 2014.

These options are subject to certain accelerated vesting provisions as described in ‘‘Potential Payments

upon Termination or Change in Control’’ below. We achieved the annual financial targets for each of

the 2009, 2010 and 2011 fiscal years, and a portion (417 shares) of the options reported as exercisable

vested on an accelerated basis on December 14, 2010.

40