Dollar General 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

successor rule), ‘‘independent directors’’ within the meaning of NYSE listing standards, and ‘‘outside

directors’’ within the meaning of Section 162(m) (or any successor section). If at any time Dollar

General has not appointed such a committee, the Board itself may administer the plan. We refer to the

individuals administering the plan as the ‘‘Committee.’’ Subject to the terms of the plan, the Committee

may select participants to receive awards, determine the types, terms and conditions of awards, adopt

rules for the plan’s administration, and interpret plan provisions.

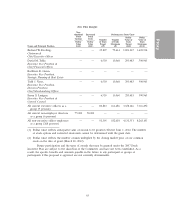

Shares of Common Stock Reserved for Issuance under the Plan. This proposal does not increase

the number of shares available for issuance under the plan. Subject to adjustment in connection with

certain significant corporate events, the maximum number of shares that may be issued under the plan

is 31,142,858. As of March 23, 2012, awards relating to 13,763,730 shares have been issued or are

subject to outstanding awards granted under the plan, and 17,379,128 shares remain available for

awards under the plan. As of March 23, 2012, the closing price per share of our common stock as

reported on the NYSE was $47.13.

The common stock issued or to be issued under the plan consists of authorized but unissued

shares or issued shares that we have reacquired. The issuance of shares or the payment of cash in

consideration of the substitution, cancellation or termination of an award will reduce the total number

of shares available under the plan to the extent of the number of shares subject to such substituted,

cancelled or terminated award, provided that shares subject to awards that are either repurchased by

Dollar General or withheld or tendered to satisfy tax withholding obligations, the exercise price of a

stock option or the purchase price for any other award will immediately become available for new

awards to be granted under the plan. In addition, if any shares covered by an award under the plan are

forfeited, or if an award expires unexercised, then the number of shares relating to such forfeited or

expired awards will, to the extent of any such forfeiture or expiration, immediately become available for

new awards to be granted under the plan.

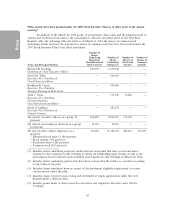

Eligibility. Awards may be made under the plan to any of our employees, non-employee

members of our Board of Directors, any consultant or other person having a service relationship with

Dollar General and any of our subsidiaries and affiliates. On March 23, 2012, there were 9 executive

officers, 6 non-employee members of our Board of Directors, 1,473 employees and no consultants or

other service providers eligible to participate in the plan.

Stock Options and Stock Appreciation Rights. The plan permits the grant of stock options

intended to qualify as incentive stock options under the Internal Revenue Code as well as stock options

that do not qualify as incentive stock options.

The per share exercise price of a stock option may not be less than 100% of the fair market

value of one share of our common stock on the date of grant. The fair market value is generally

determined as the closing price of our common stock on the date of grant. In the case of shareholders

who own 10% or more of our outstanding common stock and who receive incentive stock options, the

per share exercise price may not be less than 110% of the fair market value of one share of our

common stock on the date of grant.

The Committee determines the term of each stock option, which may not exceed ten years

from the date of grant. If the grantee is a shareholder who owns 10% or more of our outstanding

common stock, a stock option intended to be an incentive stock option must expire five years following

the grant date. Subject to these limitations, the Committee determines the time or times each stock

option may be exercised, vesting requirements, and such other terms, conditions or restrictions on the

grant or exercise of the option as the Committee deems appropriate, including whether a participant

will receive dividend equivalent rights on vested stock options.

In general, a participant may pay the exercise price of a stock option in cash, through the

withholding of shares underlying the option, or, with the Committee’s consent, by delivering shares that

the participant has held for at least six months, or by a combination of these methods that complies

56