Dollar General 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.96

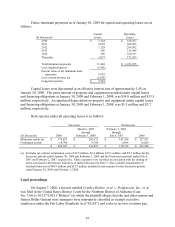

related to the leases during the year ended January 30, 2009. However, the possibility remains

that the ultimate resolution of these matters could require the Company to make a significant

cash investment to purchase these DCs.

In January 1999 and April 1997, the Company sold its DCs located in Ardmore,

Oklahoma and South Boston, Virginia, respectively, for 100% cash consideration. Concurrent

with the sale transactions, the Company leased the properties back for periods of 23 and 25

years, respectively. The transactions were recorded as financing obligations rather than sales as

a result of, among other things, the lessor’ s ability to put the properties back to the Company

under certain circumstances. The property and equipment, along with the related lease

obligations, associated with these transactions were recorded in the consolidated balance sheets.

In August 2007, the Company purchased a secured promissory note (the “Ardmore

Note”) from Principal Life Insurance Company, which had a face value of $34.3 million at the

date of purchase and approximated the remaining financing obligation. The Ardmore Note

represents debt issued by the third party entity from which the Company leases the Ardmore DC.

The Ardmore Note is being accounted for as a “held to maturity” debt security in accordance

with the provisions of SFAS 115, “Accounting for Certain Investments in Debt and Equity

Securities” (see Note 1). However, by acquiring the Ardmore Note, the Company holds the debt

instrument pertaining to its lease financing obligation and, because a legal right of offset exists,

is accounting for the acquired Ardmore Note as a reduction of its outstanding financing

obligations in its consolidated balance sheets as of January 30, 2009 and February 1, 2008 in

accordance with the provisions of FASB Interpretation 39, “Offsetting of Amounts Related to

Certain Contracts – An Interpretation of APB Opinion 10 and FASB Statement 105.”

In May 2003, the Company purchased two secured promissory notes (the “South Boston

Notes”) from Principal Life Insurance Company totaling $49.6 million. The South Boston Notes

represented debt issued by the third party entity from which the Company leased the South

Boston DC. In June 2006, the Company acquired the third party entity, which owned legal title

to the South Boston DC assets and had issued the related debt in connection with the original

financing transaction. There was no material gain or loss recognized as a result of this

transaction. Based on the Company’ s ownership of the third party entity at January 30, 2009, the

financing obligation and South Boston Notes are eliminated in the Company’s consolidated

financial statements.