Dollar General 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

observable data or information derived from or corroborated by market-observable data,

including market-based inputs to models, model calibration to market-clearing transactions,

broker or dealer quotations, or alternative pricing sources with reasonable levels of price

transparency. Where models are used, the selection of a particular model to value a derivative

depends upon the contractual terms of, and specific risks inherent in, the instrument as well as

the availability of pricing information in the market. We use similar models to value similar

instruments. Valuation models require a variety of inputs, including contractual terms, market

prices, yield curves, credit curves, measures of volatility, and correlations of such inputs. For

our derivatives, all of which trade in liquid markets, model inputs can generally be verified and

model selection does not involve significant management judgment.

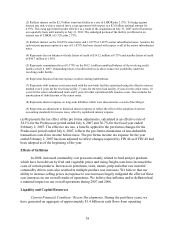

To comply with the provisions of SFAS 157, we incorporate credit valuation adjustments

to appropriately reflect both our own nonperformance risk and the respective counterparty’ s

nonperformance risk in the fair value measurements of our derivatives. The credit valuation

adjustments are calculated by determining the total expected exposure of the derivatives (which

incorporates both the current and potential future exposure) and then applying each

counterparty’ s credit spread to the applicable exposure. For derivatives with two-way exposure,

such as interest rate swaps, the counterparty’ s credit spread is applied to our exposure to the

counterparty, and our own credit spread is applied to the counterparty’ s exposure to us, and the

net credit valuation adjustment is reflected in our derivative valuations. The total expected

exposure of a derivative is derived using market-observable inputs, such as yield curves and

volatilities. The inputs utilized for our own credit spread are based on implied spreads from our

publicly-traded debt. For counterparties with publicly available credit information, the credit

spreads over LIBOR used in the calculations represent implied credit default swap spreads

obtained from a third party credit data provider. In adjusting the fair value of our derivative

contracts for the effect of nonperformance risk, we have considered the impact of netting and any

applicable credit enhancements, such as collateral postings, thresholds, mutual puts, and

guarantees. Additionally, we actively monitor counterparty credit ratings for any significant

changes.

As of January 30, 2009, the net credit valuation adjustments reduced the settlement

values of our derivative liabilities by $8.5 million. Various factors impact changes in the credit

valuation adjustments over time, including changes in the credit spreads of the parties to the

contracts, as well as changes in market rates and volatilities, which affect the total expected

exposure of the derivative instruments. When appropriate, valuations are also adjusted for

various factors such as liquidity and bid/offer spreads, which factors we deemed to be immaterial

as of January 30, 2009.

Other Considerations

Our inventory balance represented approximately 44% of our total assets exclusive of

goodwill and other intangible assets as of January 30, 2009. Our proficiency in managing our

inventory balances can have a significant impact on our cash flows from operations during a

given fiscal year. As a result, efficient inventory management has been and continues to be an

area of focus for us.