Dollar General 2008 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

company-leased automobile, $7,162 for a pro-rated automobile allowance, and other amounts which individually did not equal the greater

of $25,000 or 10% of total perquisites, including expenses related to Ms. Lanigan’ s and her guests’ attendance at entertainment events, costs

incurred in connection with a medical physical exam, and a holiday gift.

(12) Includes $2,044,598 paid in connection with Mr. Buley’ s employment termination (see “Potential Payments upon Termination or Change-

in-Control” below), $5,834 for our match contributions to the 401(k) Plan, $894 for the reimbursement of taxes related to life and disability

insurance premiums, and $734 for premiums paid under our life and disability insurance programs. Excludes the aggregate incremental cost

of providing certain perquisites to Mr. Buley which totaled less than $10,000.

(13) Includes $1,487,873 paid in connection with Ms. Lowe’ s employment termination (including $1,455,223 in severance and $32,650 which

constituted the fair market value of a company vehicle transferred to Ms. Lowe in connection with her termination. See “Potential

Payments upon Termination or Change-in-Control” below.), $12,895 for the reimbursement of taxes related to life and disability insurance

premiums and the personal use of a company-leased automobile, $9,412 for our match contributions to the 401(k) Plan, $3,747 for our

match contributions to the CDP, $2,929 for premiums paid under our life and disability insurance programs, and $23,980 which represents

the aggregate incremental cost of providing certain perquisites, including $18,260 for personal use of a company-leased automobile and

other amounts which individually did not equal the greater of $25,000 or 10% of total perquisites, including a directed charitable donation

and costs incurred in connection with a medical physical exam.

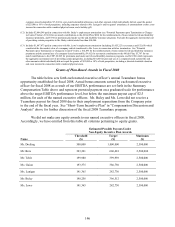

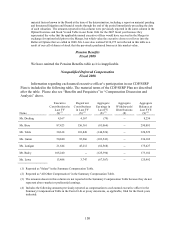

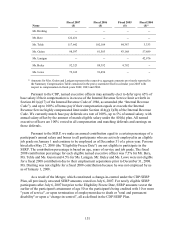

Grants of Plan-Based Awards in Fiscal 2008

The table below sets forth each named executive officer’ s annual Teamshare bonus

opportunity established for fiscal 2008. Actual bonus amounts earned by each named executive

officer for fiscal 2008 as a result of our EBITDA performance are set forth in the Summary

Compensation Table above and represent prorated payment on a graduated scale for performance

above the target EBITDA performance level, but below the maximum payout cap of $2.5

million, for each of the named executive officers. Mr. Buley and Ms. Lowe did not receive a

Teamshare payout for fiscal 2008 due to their employment separations from the Company prior

to the end of the fiscal year. See “Short-Term Incentive Plan” in “Compensation Discussion and

Analysis” above for further discussion of the fiscal 2008 Teamshare program.

We did not make any equity awards to our named executive officers in fiscal 2008.

Accordingly, we have omitted from this table all columns pertaining to equity grants.

Estimated Possible Payouts Under

Non-Equity Incentive Plan Awards

Name

Threshold

($)

Target

($)

Maximum

($)

Mr. Dreiling 500,000 1,000,000 2,500,000

Mr. Bere 303,241 606,481 2,500,000

Mr. Tehle 199,980 399,959 2,500,000

Ms. Guion 193,375 386,750 2,500,000

Ms. Lanigan 141,365 282,730 2,500,000

Mr. Buley 198,256 396,512 2,500,000

Ms. Lowe 141,365 282,730 2,500,000