Dollar General 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

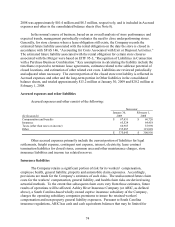

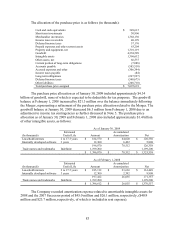

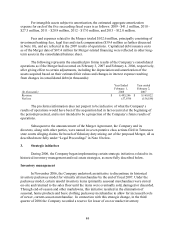

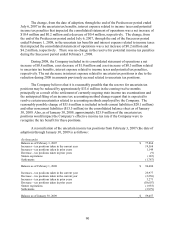

The allocation of the purchase price is as follows (in thousands):

Cash and cash equivalents

$

349,615

Short-term investments

30,906

Merchandise inventories

1,368,130

Income taxes receivable

40,199

Deferred income taxes

57,176

Prepaid expenses and other current assets

63,204

Property and equipment, net

1,301,119

Goodwill

4,338,589

Intangible assets

1,396,612

Other assets, net

66,537

Current portion of long-term obligations

(7,088)

Accounts payable

(585,518)

Accrued expenses and other

(306,394)

Income taxes payable

(84)

Long-term obligations

(267,927)

Deferred income taxes

(540,675)

Other liabilities

(208,710)

Total purchase price assigned

$

7,095,691

The purchase price allocation as of January 30, 2009 included approximately $4.34

billion of goodwill, none of which is expected to be deductible for tax purposes. The goodwill

balance at February 1, 2008 increased by $21.3 million over the balance immediately following

the Merger, representing a refinement of the purchase price allocation related to the Merger. The

goodwill balance at January 30, 2009 decreased $6.3 million from February 1, 2008 due to an

adjustment to income tax contingencies as further discussed in Note 5. The purchase price

allocation as of January 30, 2009 and February 1, 2008 also included approximately $1.4 billion

of other intangible assets, as follows:

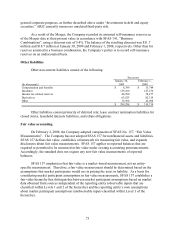

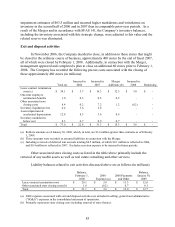

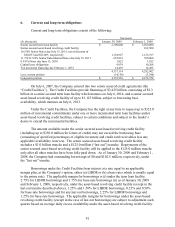

As of January 30, 2009

(In thousands)

Estimated

Useful Life Amount

Accumulated

Amortization Net

Leasehold interests

2 to 17.5 years

$

184,570

$

64,020

$

120,550

Internally developed software

3 years

12,300

6,492

5,808

196,870

70,512

126,358

Trade names and trademarks

Indefinite

1,199,200

-

1,199,200

$

1,396,070

$

70,512

$

1,325,558

As of February 1, 2008

(In thousands)

Estimated

Useful Life

Amount

Accumulated

Amortization

Net

Leasehold interests

2 to 17.5 years

$

185,112

$

23,663

$

161,449

Internally developed software

3 years

12,300

2,392

9,908

197,412

26,055

171,357

Trade names and trademarks

Indefinite

1,199,200

-

1,199,200

$

1,396,612

$

26,055

$

1,370,557

The Company recorded amortization expense related to amortizable intangible assets for

2008 and the 2007 Successor period of $45.0 million and $26.1 million, respectively, ($40.9

million and $23.7 million, respectively, of which is included in rent expense).