Dollar General 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138

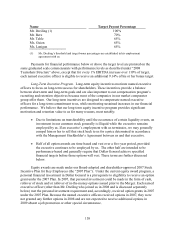

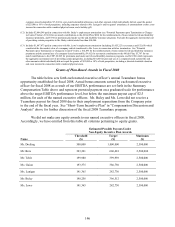

Name

Target Payout Percentage

Mr. Dreiling (1)

100%

Mr. Bere

70%

Mr. Tehle

65%

Ms. Guion

65%

Ms. Lanigan

65%

(1) Mr. Dreiling’ s threshold and target bonus percentages are established in his employment

agreement with us.

Payments for financial performance below or above the target level are prorated on the

same graduated scale commensurate with performance levels as described under “2008

Teamshare Structure” above, except that for every 1% EBITDA increase over 110% of target,

each named executive officer is eligible to receive an additional 9.14% of his or her bonus target.

Long-Term Incentive Program. Long-term equity incentives motivate named executive

officers to focus on long-term success for shareholders. These incentives provide a balance

between short-term and long-term goals and are also important to our compensation program’ s

recruiting and retention objectives because most of the companies in our market comparator

group offer them. Our long-term incentives are designed to compensate named executive

officers for a long-term commitment to us, while motivating sustained increases in our financial

performance. We believe that our long-term equity incentive program provides significant

motivation and retention value to us for many reasons, most notably:

• Due to limitations on transferability until the occurrence of certain liquidity events, an

investment in our common stock generally is illiquid while the executive remains

employed by us. If an executive’ s employment with us terminates, we may generally

compel him or her to sell that stock back to us for a price determined in accordance

with the Management Stockholder’ s Agreement between us and that executive.

• Half of all option awards are time-based and vest over a five-year period, provided

the executive continues to be employed by us. The other half are intended to be

performance-based and generally require that Dollar General achieve specified

financial targets before those options will vest. These terms are further discussed

below.

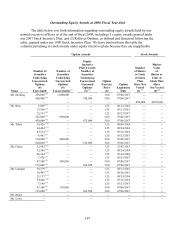

Equity awards are made under our Board-adopted and shareholder-approved 2007 Stock

Incentive Plan for Key Employees (the “2007 Plan”). Under the current equity award program, a

personal financial investment in Dollar General is a prerequisite to eligibility to receive an option

grant under the 2007 Plan. In 2007, that personal investment could be made in the form of cash,

rollover of stock and/or rollover of in-the-money options issued prior to the Merger. Each named

executive officer (other than Mr. Dreiling who joined us in 2008 and is discussed separately

below) met the personal investment requirement and, accordingly, received option grants in 2007

under the 2007 Plan. Because the named executive officers received options in 2007, they were

not granted any further options in 2008 and are not expected to receive additional options in

2009 absent a job promotion or other special circumstance.