Dollar General 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

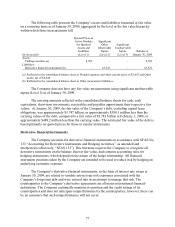

Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or

liabilities that the Company has the ability to access. Level 2 inputs are inputs other than quoted

prices included in Level 1 that are directly or indirectly observable for the asset or liability. Level

2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as

inputs that are observable for the asset or liability (other than quoted prices), such as interest

rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals.

Level 3 inputs are unobservable inputs for the asset or liability, which are based on an entity’ s

own assumptions, as there is little, if any, related market activity. In instances where the

determination of the fair value measurement is based on inputs from different levels of the fair

value hierarchy, the level in the fair value hierarchy within which the entire fair value

measurement falls is based on the lowest level input that is significant to the fair value

measurement in its entirety. The Company’ s assessment of the significance of a particular input

to the fair value measurement in its entirety requires judgment and considers factors specific to

the asset or liability.

The valuation of the Company’ s derivative financial instruments is determined using

widely accepted valuation techniques, including discounted cash flow analysis on the expected

cash flows of each derivative. This analysis reflects the contractual terms of the derivatives,

including the period to maturity, and uses observable market-based inputs, including interest rate

curves. The fair values of interest rate swaps are determined using the market standard

methodology of netting the discounted future fixed cash payments (or receipts) and the

discounted expected variable cash receipts (or payments). The variable cash receipts (or

payments) are based on an expectation of future interest rates (forward curves) derived from

observable market interest rate curves.

To comply with the provisions of SFAS 157, the Company incorporates credit valuation

adjustments (CVAs) to appropriately reflect both its own nonperformance risk and the respective

counterparty’ s nonperformance risk in the fair value measurements. In adjusting the fair value of

its derivative contracts for the effect of nonperformance risk, the Company has considered the

impact of netting and any applicable credit enhancements, such as collateral postings, thresholds,

mutual puts, and guarantees.

Although the Company has determined that the majority of the inputs used to value its

derivatives fall within Level 2 of the fair value hierarchy, the CVAs associated with its

derivatives utilize Level 3 inputs, such as estimates of current credit spreads to evaluate the

likelihood of default by itself and its counterparties. However, as of January 30, 2009, the

Company has assessed the significance of the impact of the CVAs on the overall valuation of its

derivative positions and has determined that the CVAs are not significant to the overall valuation

of its derivatives. Based on the Company's review of the CVAs by counterparty portfolio, the

Company has determined that the CVAs are not significant to the overall portfolio valuations, as

the CVAs are deemed to be immaterial in terms of basis points and are a very small percentage

of the aggregate notional value. Although some of the CVAs as a percentage of termination

value appear to be more significant, primary emphasis was placed on a review of the CVA in

basis points and the percentage of the notional value. As a result, the Company has determined

that its derivative valuations in their entirety are classified in Level 2 of the fair value hierarchy.