Dollar General 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

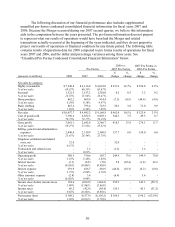

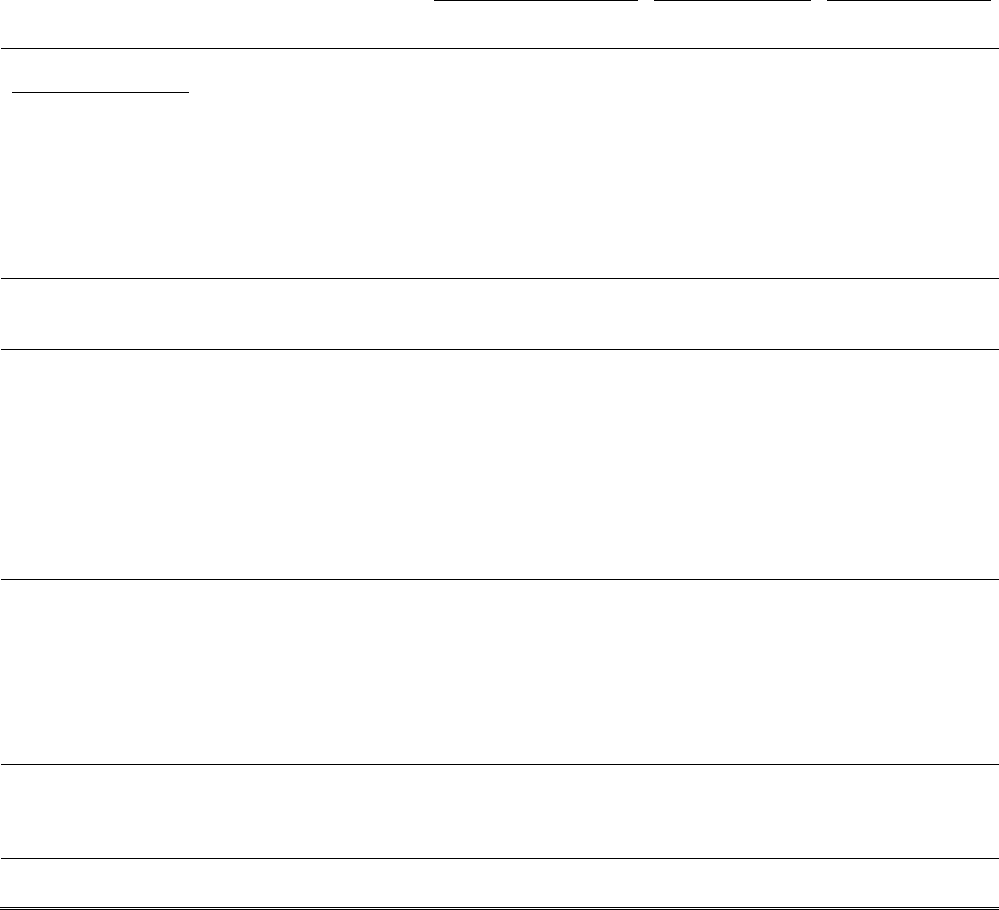

30

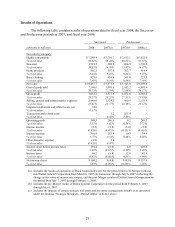

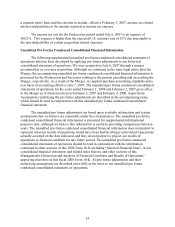

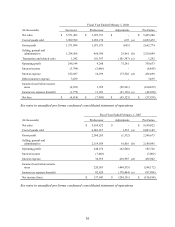

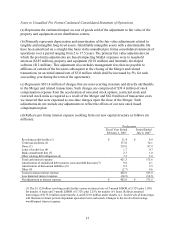

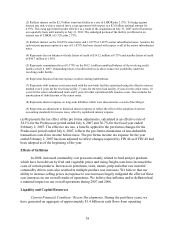

The following discussion of our financial performance also includes supplemental

unaudited pro forma condensed consolidated financial information for fiscal years 2007 and

2006. Because the Merger occurred during our 2007 second quarter, we believe this information

aids in the comparison between the years presented. The pro forma information does not purport

to represent what our results of operations would have been had the Merger and related

transactions actually occurred at the beginning of the years indicated, and they do not purport to

project our results of operations or financial condition for any future period. The following table

contains results of operations data for 2008 compared to pro forma results of operations for fiscal

years 2007 and 2006, and the dollar and percentage variances among those years. See

“Unaudited Pro Forma Condensed Consolidated Financial Information” below.

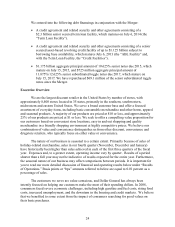

(amounts in millions)

2008

Pro Forma

2008 vs.

2007 Pro Forma

2007 Pro Forma vs.

2006 Pro Forma

2007

2006

$

change

%

change

$

change

%

change

Net sales by category:

Highly consumable

$ 7,248.4

$ 6,316.8

$ 6,022.0

$ 931.6

14.7%

$ 294.8

4.9%

% of net sales

69.31%

66.53%

65.67%

Seasonal

1,521.5

1,513.2

1,510.0

8.2

0.5

3.2

0.2

% of net sales

14.55%

15.94%

16.47%

Home products

862.2

869.8

914.4

(7.5)

(0.9)

(44.6)

(4.9)

% of net sales

8.24%

9.16%

9.97%

Basic clothing

825.6

795.4

723.5

30.2

3.8

72.0

9.9

% of net sales

7.89%

8.38%

7.89%

Net sales

$ 10,457.7

$ 9,495.2

$ 9,169.8

$ 962.4

10.1%

$ 325.4

3.5%

Cost of goods sold

7,396.6

6,852.5

6,803.1

544.1

7.9

49.3

0.7

% of net sales

70.73%

72.17%

74.19%

Gross profit

3,061.1

2,642.8

2,366.7

418.3

15.8

276.1

11.7

% of net sales

29.27%

27.83%

25.81%

Selling, general and administrative

expenses

2,448.6

2,310.9

2,180.9

137.7

6.0

130.0

6.0

% of net sales

23.41%

24.34%

23.78%

Litigation settlement and related

costs, net 32.0 - - 32.0 - - -

% of net sales

0.31%

-

-

-

-

Transaction and related costs

-

1.2

-

(1.2)

-

1.2

-

% of net sales

-

0.01%

-

Operating profit

580.5

330.6

185.7

249.9

75.6

144.9

78.0

% of net sales

5.55%

3.48%

2.03%

Interest income

(3.1)

(8.8)

(7.0)

5.8

(65.4)

(1.8)

26.3

% of net sales

(0.03)%

(0.09)%

(0.08)%

Interest expense

391.9

436.7

436.9

(44.8)

(10.3)

(0.2)

(0.0)

% of net sales

3.75%

4.60%

4.76%

Other (income) expense

(2.8)

3.6

-

(6.4)

-

3.6

-

% of net sales

(0.03)%

0.04%

-

Income (loss) before income taxes

194.4

(100.9)

(244.2)

295.3

-

143.3

(58.7)

% of net sales

1.86%

(1.06)%

(2.66)%

Income taxes

86.2

(42.9)

(88.0)

129.1

-

45.1

(51.2)

% of net sales

0.82%

(0.45)%

(0.96)%

Net income (loss)

$ 108.2

$ (57.9)

$ (156.2)

$ 166.1

-%

$ 98.2

(62.9)%

% of net sales

1.03%

(0.61)%

(1.70)%