Dollar General 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

additional 10% to 12% of the net orderly liquidation value of all of our eligible inventory and

that of each guarantor thereunder is made available to us in the form of a “last out” tranche under

which we may borrow up to a maximum amount of $125.0 million. Borrowings under the asset-

based credit facility will be incurred first under the last out tranche, and no borrowings will be

permitted under any other tranche until the last out tranche is fully utilized. Repayments of the

senior secured asset-based revolving credit facility will be applied to the last out tranche only

after all other tranches have been fully paid down.

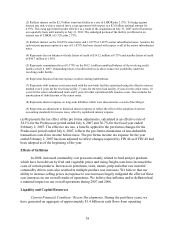

Interest Rates and Fees. Borrowings under the Credit Facilities bear interest at a rate

equal to an applicable margin plus, at our option, either (a) LIBOR or (b) a base rate (which is

usually equal to the prime rate). The applicable margin for borrowings is (i) under the term loan

facility, 2.75% for LIBOR borrowings and 1.75% for base-rate borrowings (ii) as of January 30,

2009 and February 1, 2008, respectively, under the asset-based revolving credit facility (except

in the last out tranche described above), 1.25% and 1.50% for LIBOR borrowings; 0.25% and

0.50% for base-rate borrowings and for any last out borrowings, 2.25% for LIBOR borrowings

and 1.25% for base-rate borrowings. The applicable margins for borrowings under the asset-

based revolving credit facility (except in the case of last out borrowings) are subject to

adjustment each quarter based on average daily excess availability under the asset-based

revolving credit facility. We are also required to pay a commitment fee to the lenders under the

asset-based revolving credit facility for any unutilized commitments at a rate of 0.375% per

annum. We also must pay customary letter of credit fees. See Item 7A. “Quantitative and

Qualitative Disclosures About Market Risk” below for a discussion of our use of interest rate

swaps to manage our interest rate risk.

Prepayments. The senior secured credit agreement for the term loan facility requires us to

prepay outstanding term loans, subject to certain exceptions, with:

• 50% of our annual excess cash flow (as defined in the credit agreement) which will

be reduced to 25% and 0% if we achieve and maintain a total net leverage ratio of 6.0

to 1.0 and 5.0 to 1.0, respectively;

• 100% of the net cash proceeds of all non-ordinary course asset sales or other

dispositions of property in excess of $25.0 million in the aggregate and subject to our

right to reinvest the proceeds; and

• 100% of the net cash proceeds of any incurrence of debt, other than proceeds from

debt permitted under the senior secured credit agreement.

The mandatory prepayments discussed above will be applied to the term loan facility as

directed by the senior secured credit agreement. Through January 30, 2009, no prepayments have

been required under the prepayment provisions listed above.

In addition, the senior secured credit agreement for the asset-based revolving credit

facility requires us to prepay the asset-based revolving credit facility, subject to certain

exceptions, with: