Dollar General 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

permitted to be measured at fair value under existing accounting pronouncements. Accordingly,

the standard does not require any new fair value measurements of reported balances.

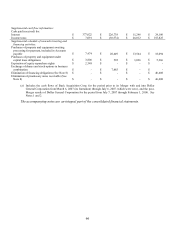

We adopted the provisions of FIN 48 effective February 3, 2007. The adoption resulted in

an $8.9 million decrease in retained earnings and a reclassification of certain amounts between

deferred income taxes and other noncurrent liabilities to conform to the balance sheet

presentation requirements of FIN 48. As of the date of adoption, the total reserve for uncertain

tax benefits was $77.9 million. This reserve excludes the federal income tax benefit for the

uncertain tax positions related to state income taxes which is now included in deferred tax assets.

As a result of the adoption of FIN 48, the reserve for interest expense related to income taxes

was increased to $15.3 million and a reserve for potential penalties of $1.9 million related to

uncertain income tax positions was recorded. As of the date of adoption, approximately $27.1

million of the reserve for uncertain tax positions would have impacted our effective income tax

rate subsequently if we were to recognize the tax benefit for these positions.

Subsequent to the adoption of FIN 48, we elected to record income tax related interest

and penalties as a component of the provision for income tax expense.

Accounting Pronouncements

In March 2008, the FASB issued Statement of Financial Accounting Standards (“SFAS”)

No. 161, “Disclosures about Derivative Instruments and Hedging Activities”, an amendment of

FASB Statement 133. SFAS 161 applies to all derivative instruments and nonderivative

instruments that are designated and qualify as hedging instruments pursuant to paragraphs 37 and

42 of SFAS 133 and related hedged items accounted for under SFAS 133. SFAS 161 requires

entities to provide greater transparency through additional disclosures about how and why an

entity uses derivative instruments, how derivative instruments and related hedged items are

accounted for under SFAS 133 and its related interpretations, and how derivative instruments

and related hedged items affect an entity’ s financial position, results of operations, and cash

flows. SFAS 161 is effective as of the beginning of an entity’ s first fiscal year that begins after

November 15, 2008. We plan to adopt SFAS 161 during the first quarter of our 2009 fiscal year

and its impact is expected to be limited to the additional disclosures discussed above.

In December 2007, the FASB issued SFAS No. 141(R), “Business Combinations”. The

new standard establishes the requirements for how an acquirer recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed, and any non-

controlling interest (formerly minority interest) in an acquiree; provides updated requirements

for recognition and measurement of goodwill acquired in the business combination or a gain

from a bargain purchase; and provides updated disclosure requirements to enable users of

financial statements to evaluate the nature and financial effects of the business combination. This

Statement applies prospectively to business combinations for which the acquisition date is on or

after the beginning of the first annual reporting period beginning on or after December 15, 2008.

Early adoption is not allowed. Unless a qualifying transaction is consummated subsequent to the

effective date, the adoption of this standard on our financial statements is expected to be limited

to any future Merger-related adjustments to uncertain tax positions that would, if subsequently

recognized, impact our results of operations rather than goodwill.