Dollar General 2008 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.171

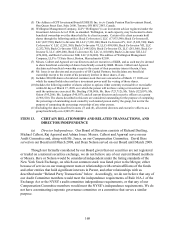

loan facility. The amount of principal outstanding under this term loan facility at all times

during fiscal 2008 and as of March 17, 2009 was $2.3 billion, and we paid no principal and

approximately $133.4 million of interest during fiscal 2008. We paid $200,000 to Citicorp North

America, Inc. for its services relating to this facility. For additional information regarding the

senior secured term loan facility, see the discussion under the heading “Credit Facilities” in the

Liquidity and Capital Resources portion of Management’ s Discussion and Analysis of Financial

Condition and Results of Operations in Item 7 above.

Goldman, Sachs & Co. is a counterparty to an amortizing interest rate swap totaling

$433.3 million as of January 30, 2009, entered into in connection with such senior secured term

loan facility. See Item 7A “Quantitative and Qualitative Disclosures About Market Risk” for

information regarding such interest rate swap. We paid Goldman, Sachs & Co. approximately

$9.5 million in fiscal 2008 pursuant to the interest rate swap.

Our Board members Mr. Calbert and Mr. Agrawal and our former Board member Mr.

Nelson serve as a Member, a Director and a Partner of KKR, respectively, while our Board

member Mr. Jones serves as a Managing Director of Goldman, Sachs & Co. KKR indirectly

owns approximately 52% of our common stock. Goldman, Sachs & Co. is an affiliate of GS

Capital Partners VI Fund, L.P. and affiliated funds. GS Capital Partners VI Fund, L.P. and

affiliated funds indirectly own approximately 22% of our common stock. Citicorp North

America Inc. is an affiliate of Citigroup Private Equity LP. Funds managed by Citigroup Private

Equity LP indirectly own approximately 7% of our common stock.

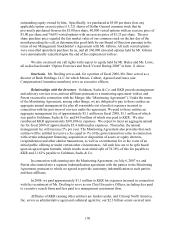

We use Capstone Consulting, LLC, a team of executives who work exclusively with

KKR portfolio companies providing certain consulting services. We pay Capstone a monthly fee,

currently $210,000, plus expense reimbursements. During fiscal 2008, the aggregate fees and

expenses we incurred for Capstone’ s services totaled approximately $3 million. Our former

Board member Mr. Nelson is the Chief Executive Officer of Capstone. Although neither KKR

nor any entity affiliated with KKR owns any of the equity of Capstone, KKR had provided

financing to Capstone prior to January 1, 2007.

(c) Related Party Transaction Approval Policy. On August 28, 2008, our Board

adopted a written policy for the review, approval or ratification of “related party” transactions.

For purposes of this policy, a “related party” includes our directors, executive officers, and

greater than 5% shareholders, as well as their immediate family members, and a “transaction”

includes one in which (1) the total amount may exceed $100,000, (2) Dollar General is a

participant, and (3) a related party will have a direct or indirect material interest (other than as a

director or a less than 10% owner of another entity, or both).

Pursuant to this policy and subject to certain exceptions, all known related party

transactions require prior Board approval. In addition, at least annually after receiving a list of

immediate family members and affiliates from our directors, executive officers and over 5%

shareholders, the Corporate Secretary will coordinate with relevant internal departments to

determine whether any transactions were unknowingly entered into with a related party and will

present a list of such transactions to the Board for review.