Dollar General 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

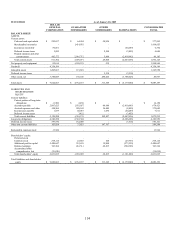

107

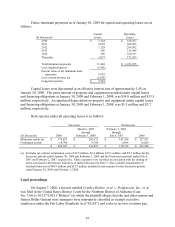

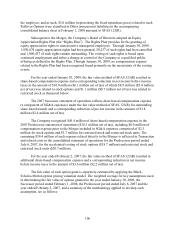

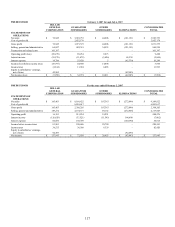

Successor Period Ended

Predecessor Period Ended

January 30,

2009

February 1,

2008

July 6,

2007

February 2,

2007

Expected dividend yield

0

%

0

%

0.91

%

0.82

%

Expected stock price volatility

40.2

%

41.9

%

18.5

%

28.8

%

Weighted average risk-free interest rate

2.8

%

4.6

%

4.5

%

4.7

%

Expected term of options (years)

7.4

7.5

5.7

5.7

Expected dividend yield - This is an estimate of the expected dividend yield on the

Company’ s stock. Prior to the Merger this estimate was based on historical dividend payment

trends. Subsequent to the Merger, the Company is subject to limitations on the payment of

dividends under its credit facilities as further discussed in Note 6. An increase in the dividend

yield will decrease compensation expense.

Expected stock price volatility - This is a measure of the amount by which the price of

the Company’ s common stock has fluctuated or is expected to fluctuate. Prior to the Merger, the

Company used actual historical changes in the market price of the Company’ s common stock

and implied volatility based upon traded options, weighted equally, to calculate the volatility

assumption, as it was the Company’ s belief that this methodology provided the best indicator of

future volatility. For historical volatility, the Company calculated daily market price changes

from the date of grant over a past period representative of the expected life of the options to

determine volatility. Subsequent to the Merger the expected volatilities have been based upon the

historical volatilities of a peer group of four companies, as the Company’ s common stock is not

publicly traded. An increase in the expected volatility will increase compensation expense.

Weighted average risk-free interest rate - This is the U.S. Treasury rate for the week of

the grant having a term approximating the expected life of the option. An increase in the risk-free

interest rate will increase compensation expense.

Expected term of options - This is the period of time over which the options granted are

expected to remain outstanding. For options issued prior to the Merger, the Company took into

consideration that its stock option grants prior to August 2002 were significantly different than

grants issued on and after that date, and therefore that the historical and post-vesting employee

behavior patterns for grants prior to that date were of little or no value in determining future

expectations. As a result, the Company excluded these pre-August 2002 grants from its analysis

of expected term. For pre-Merger options, the Company estimated expected term using a

computation based on an assumption that outstanding options would be exercised approximately

halfway through their contractual term, taking into consideration such factors as grant date,

expiration date, weighted-average time-to-vest, actual exercises and post-vesting cancellations.

Options granted have a maximum term of 10 years. Due to the absence of historical data for

grants issued subsequent to the Merger, the Company has estimated the expected term as the

mid-point between the vesting date and the contractual term of the option. An increase in the

expected term will increase compensation expense.

All nonvested restricted stock and restricted stock unit awards granted in the 2007

Successor and Predecessor periods had a purchase price of zero. The Company records

compensation expense on a straight-line basis over the restriction period based on the market

price of the underlying stock on the date of grant. The nonvested restricted stock and restricted