Dollar General 2008 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166

Our director compensation structure encompasses only cash compensation. Cash fees

payable to our non-employee directors consist solely of a $40,000 annual retainer fee, payable in

quarterly installments. We do not compensate for Board service any director who simultaneously

serves as a Dollar General employee. We will reimburse directors for certain fees and expenses

incurred in connection with continuing education seminars and for travel and related expenses

related to Dollar General business. We allow directors to travel on the Dollar General airplane

for those purposes.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

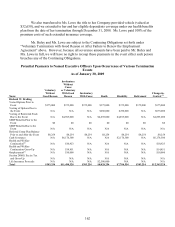

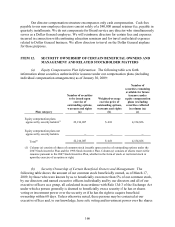

(a) Equity Compensation Plan Information. The following table sets forth

information about securities authorized for issuance under our compensation plans (including

individual compensation arrangements) as of January 30, 2009:

Plan category

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(a)

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

Number of

securities remaining

available for future

issuance under

equity compensation

plans (excluding

securities reflected

in column (a))

(c)

Equity compensation plans

approved by security holders(1) 22,216,087 $ 4.81 4,154,826

Equity compensation plans not

approved by security holders -- -- --

Total

(1)

22,216,087

$ 4.81

4,154,826

(1) Column (a) consists of shares of common stock issuable upon exercise of outstanding options under the

2007 Stock Incentive Plan and the 1998 Stock Incentive Plan. Column (c) consists of shares reserved for

issuance pursuant to the 2007 Stock Incentive Plan, whether in the form of stock or restricted stock or

upon the exercise of an option or right.

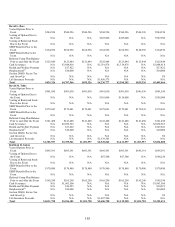

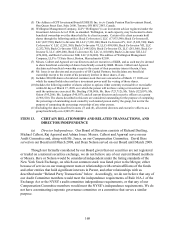

(b) Security Ownership of Certain Beneficial Owners and Management. The

following table shows the amount of our common stock beneficially owned, as of March 17,

2009, by those who were known by us to beneficially own more than 5% of our common stock,

by our directors and named executive officers individually and by our directors and all of our

executive officers as a group, all calculated in accordance with Rule 13d-3 of the Exchange Act

under which a person generally is deemed to beneficially own a security if he has or shares

voting or investment power over the security or if he has the right to acquire beneficial

ownership within 60 days. Unless otherwise noted, these persons may be contacted at our

executive offices and, to our knowledge, have sole voting and investment power over the shares