Dollar General 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.95

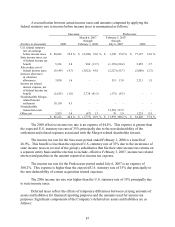

2009 and matures in February 2010. The December 2008 swap amortizes to a notional amount of

$300.0 million upon its maturity in January 2013.

As of January 30, 2009 and February 1, 2008, the fair value of the Company’ s interest

rate swaps of $(63.5) million and $(82.3) million was recorded in non-current Other liabilities on

the consolidated balance sheets. For the year ended January 30, 2009, the effective portion of the

change in fair value of the swaps of $14.2 million was recorded in Accumulated other

comprehensive loss, a separate component of equity, offset by related income taxes of $4.5

million. From the date the swaps were designated as hedges to February 1, 2008, the effective

portion of the change in fair value of the swaps of ($78.6) million was recorded in Accumulated

other comprehensive loss, offset by related income taxes of $29.5 million. The Company also

recorded expense in Other (income) expense in the consolidated statements of operations related

to hedge ineffectiveness of $1.0 million and $0.4 million during 2008 and the 2007 Successor

period, respectively.

In February 2009, the Company entered into a contract to hedge approximately 50% of

its anticipated 2009 fuel usage related to the transportation of merchandise. Such contract is not

expected to qualify for hedge accounting treatment, and as a result, gains or losses under this

contract will be recorded in Other (gains) losses in the consolidated statement of operations.

8. Commitments and contingencies

Leases

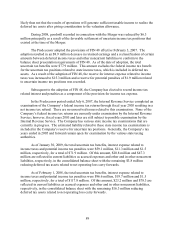

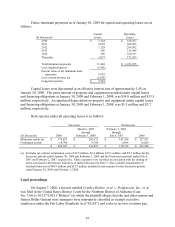

As of January 30, 2009, the Company was committed under capital and operating lease

agreements and financing obligations for most of its retail stores, three of its DCs, and certain of

its furniture, fixtures and equipment. The majority of the Company’ s stores are subject to short-

term leases (usually with initial or current terms of three to five years), often with multiple

renewal options. The Company also has stores subject to build-to-suit arrangements with

landlords, which typically carry a primary lease term of 10 years with multiple renewal options.

Approximately 42% of the stores have provisions for contingent rentals based upon a percentage

of defined sales volume. Certain leases contain restrictive covenants. As of January 30, 2009,

the Company is not aware of any material violations of such covenants.

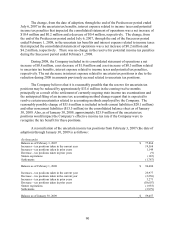

The Merger and certain of the related financing transactions may be interpreted as giving

rise to certain trigger events (which may include events of default) under leases for three of the

Company’ s distribution centers (“DCs”). The Company does not believe such an interpretation

would be appropriate under the terms of the leases. During the 2007 Successor period, the

Company concluded that a probable loss existed in connection with the restructurings and

accrued SG&A expenses totaling $12.0 million in the Successor statement of operations for the

period ended February 1, 2008. As of January 30, 2009, $7.0 million of such amount has been

paid. The Company believes that it has negotiated with the property owners proposed lease terms

that would be implemented if the owners were to refinance or sell the property and that the

resolution of these negotiations is primarily dependent on conditions in the real estate and

financial markets. The Company’ s current position is that any remaining potential loss on the

resolution of these matters would currently be properly characterized as reasonably possible

rather than probable and has therefore reversed the remaining $5.0 million of SG&A expenses