Dollar General 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

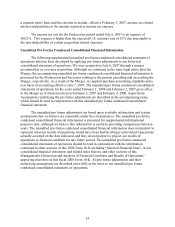

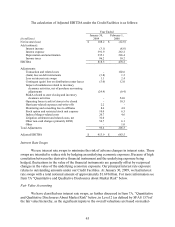

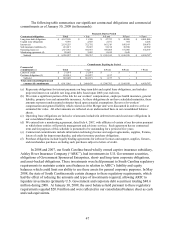

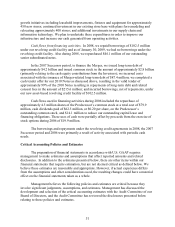

The calculation of Adjusted EBITDA under the Credit Facilities is as follows:

(in millions)

Year Ended

January 30,

2009

February 1,

2008

Net income (loss)

$

108.2

$

(12.8)

Add (subtract):

Interest income

(3.1)

(8.8)

Interest expense

391.9

263.2

Depreciation and amortization

235.1

226.4

Income taxes

86.2

10.2

EBITDA

818.3

478.2

Adjustments:

Transaction and related costs

-

102.6

(Gain) loss on debt retirements

(3.8)

1.2

Loss on interest rate swaps

1.1

2.4

Contingent (gain) loss on distribution center leases

(5.0)

12.0

Impact of markdowns related to inventory

clearance activities, net of purchase accounting

adjustments

(24.9)

(0.4)

SG&A related to store closing and inventory

clearance activities

-

54.0

Operating losses (cash) of stores to be closed

-

10.5

Hurricane-related expenses and write-offs

2.2

-

Monitoring and consulting fees to affiliates

8.6

4.8

Stock option and restricted stock unit expense

10.0

6.5

Indirect Merger-related costs

20.7

4.6

Litigation settlement and related costs, net

32.0

-

Other non-cash charges (primarily LIFO)

54.7

6.1

Other

-

1.0

Total Adjustments

95.6

205.3

Adjusted EBITDA

$

913.9

$

683.5

Interest Rate Swaps

We use interest rate swaps to minimize the risk of adverse changes in interest rates. These

swaps are intended to reduce risk by hedging an underlying economic exposure. Because of high

correlation between the derivative financial instrument and the underlying exposure being

hedged, fluctuations in the value of the financial instruments are generally offset by reciprocal

changes in the value of the underlying economic exposure. Our principal interest rate exposure

relates to outstanding amounts under our Credit Facilities. At January 30, 2009, we had interest

rate swaps with a total notional amount of approximately $1.69 billion. For more information see

Item 7A “Quantitative and Qualitative Disclosures about Market Risk” below.

Fair Value Accounting

We have classified our interest rate swaps, as further discussed in Item 7A. “Quantitative

and Qualitative Disclosures About Market Risk” below, in Level 2 (as defined by SFAS 157) of

the fair value hierarchy, as the significant inputs to the overall valuations are based on market-